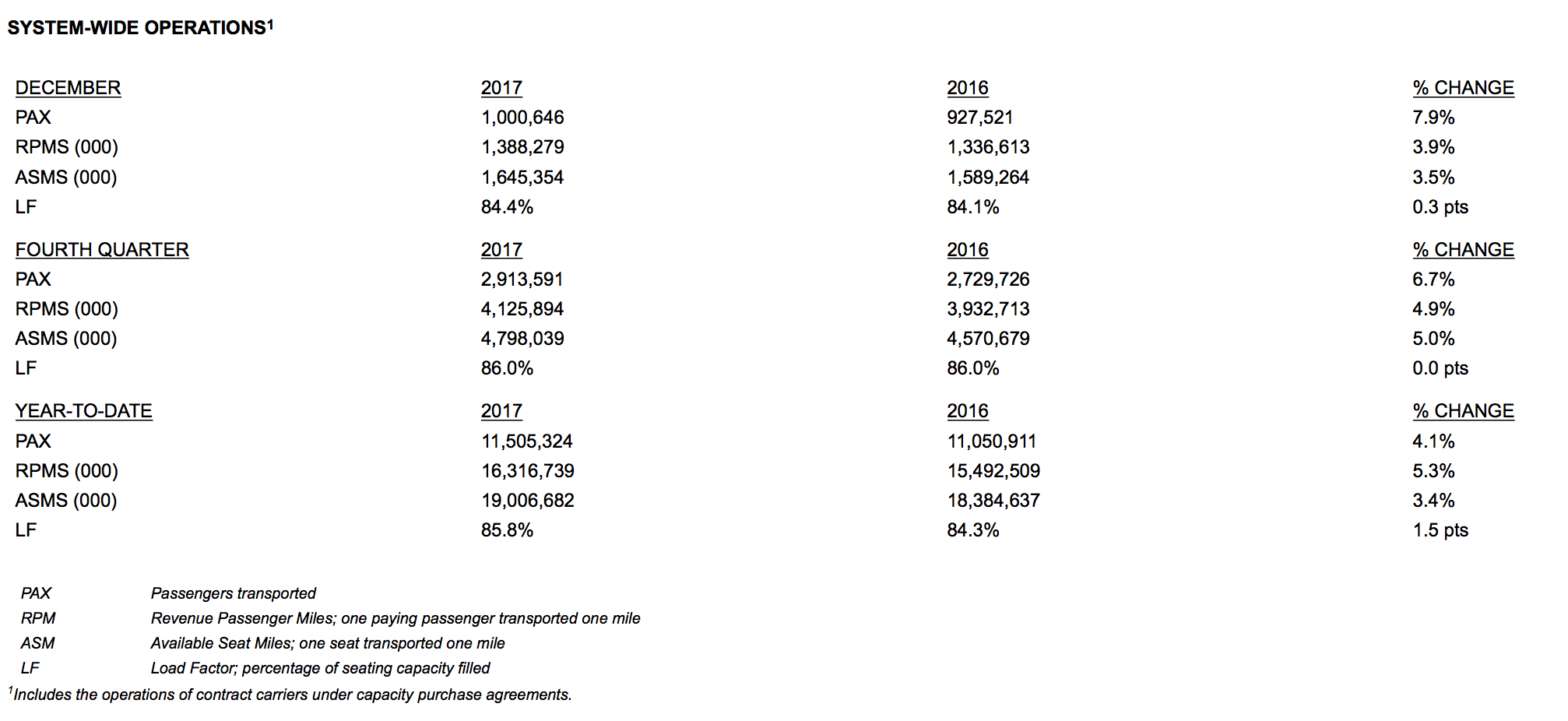

HONOLULU – Hawaiian Airlines, Inc., a subsidiary of Hawaiian Holdings, Inc. (NASDAQ: HA) (“Hawaiian” or the "Company"), welcomed a record 11,505,324 guests in 2017, a 4.1 percent increase over the previous year. Hawai’i’s largest and longest-serving airline today announced its system-wide traffic statistics for the month, quarter, and full year ended December 31, 2017. The Company also updated its expectations for certain fourth quarter and full year 2017 financial metrics.

The record number of passengers in 2017 marks 13 straight years of growth as the Company continues to expand its network and fleet, providing travelers with more options to fly to, and within, the Hawaiian Islands than any other carrier.

Hawaiian took delivery of its first of 18 A321neo aircraft in November, and its second in December. The A321neo aircraft will help the airline to build upon its already strong U.S. West Coast presence, highlighted by recent announcements that included new daily non-stop service to Maui’s Kahului Airport from San Diego and Portland international airports as well as to Honolulu's Daniel K. Inouye Airport from Long Beach Airport. Hawaiian will also expand its summer seasonal service with four additional daily summer flights in 2018, including its first international seasonal service between Narita and Honolulu international airports. Additionally, Hawaiian added its 24th A330-200 aircraft in October and its first of three expected ATR 72 turboprop aircraft in an all-cargo configuration in December.

Fourth Quarter & Full Year 2017 Outlook

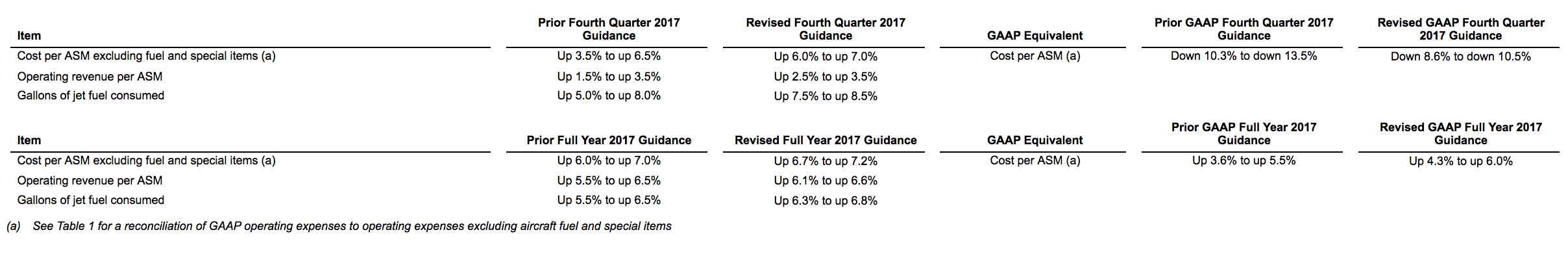

The Company has revised certain of its expectations for the quarter and year ended December 31, 2017, that were previously provided in its Third Quarter 2017 Earnings Release on October 19, 2017 and updated on December 5, 2017.

Specifically, for the quarter and year ended December 31, 2017, the Company:

• expects its operating revenue per ASM to be at the favorable end of the prior guidance range due to stronger than expected close in bookings;

• is raising its estimates for gallons of jet fuel consumed due to higher than expected payloads; and

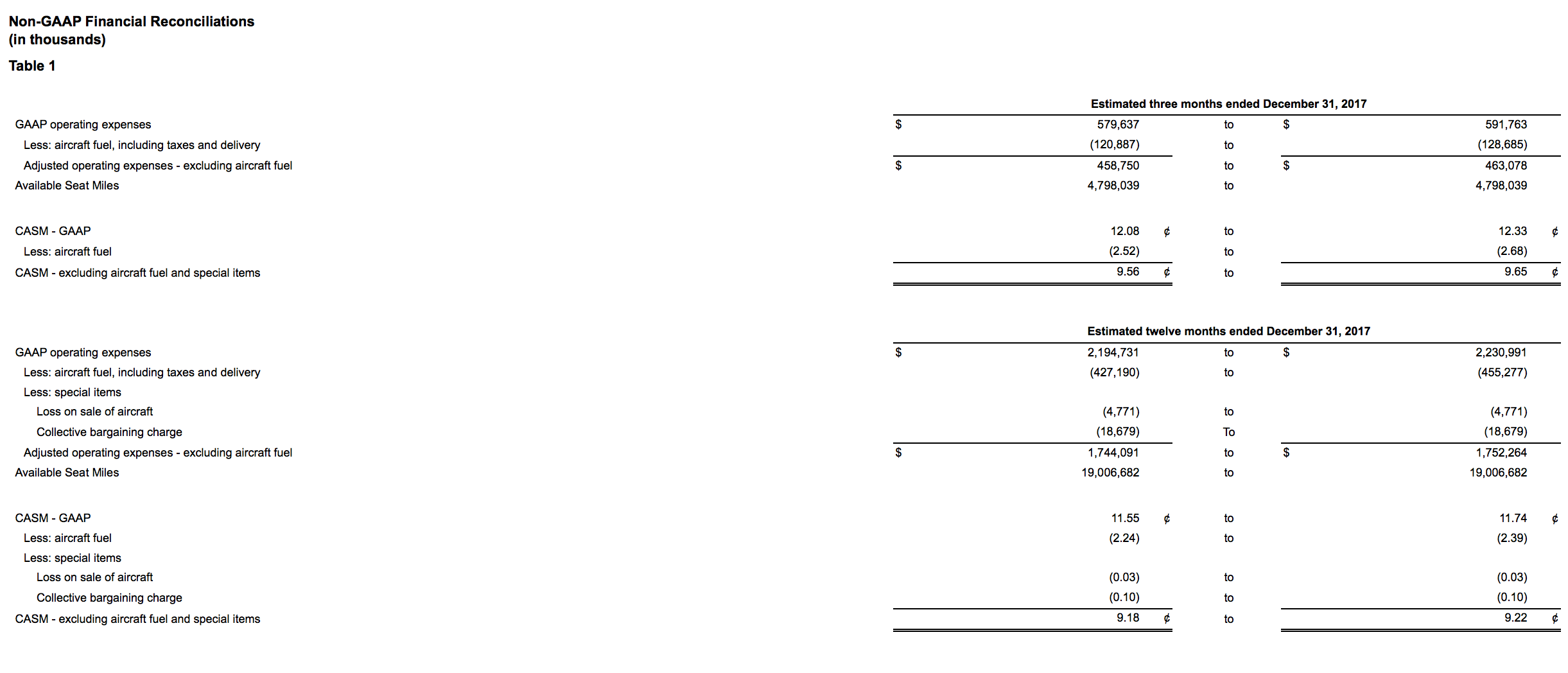

• is raising its estimates for operating costs per ASM (CASM) excluding fuel and special items due to higher than expected revenue related expenses and the shift of certain operating expenses into 2017 that were originally expected in 2018. Excluding the impact of these items, the Company's expectations of CASM excluding fuel and special items would be roughly in line with the prior fourth quarter and full year 2017 guidance.

The Company believes that CASM excluding fuel and special items provides useful information about the underlying cost structure of the Company and is consistent with the metrics used by management to measure and monitor the Company's costs.

Tax Reform Impact

For the quarter ended December 31, 2017, the Company expects to record a one-time reduction to income tax expense in the range of $90 - $140 million due to the expected effect of the Tax Cuts and Jobs Act of 2017. This reduction is a result of the difference between rates in effect when income tax expense was accrued, and the rates expected to be in effect when the income taxes will likely be paid. This estimated impact is a non-cash item and is expected to be treated as a special item.