Fitch Ratings-Chicago-12 March 2020: Coronavirus' rapidly increasing effect on air travel is placing downward pressure on global airline credit profiles, especially as there are risks that demand takes materially longer than previous shocks to recover, says Fitch Ratings. Most Fitch-rated US airlines should be able to absorb a temporary drop in demand, while maintaining sufficient liquidity and credit metrics within current rating levels. However, this is becoming less likely as the virus spreads and the US ban on travel from Europe significantly raises pressure on international carriers in the near term.

Stress case scenarios under consideration include a protracted increase in confirmed cases that cause a sharp and sustained decline in global demand. The drop in demand would be steeper than during the Severe Acute Respiratory Syndrome (SARS) outbreak but would follow a similar or modestly slower trajectory for recovery. Larger rated airlines would likely experience rating pressure, due to greater than expected reduction in demand draining liquidity and pressuring credit metrics. Financial distress is likely among smaller regional carriers or those already under pressure but widespread bankruptcies among rated carriers would not be anticipated.

Fitch is focusing on downside rating sensitivities outlined in our Rating Action Commentaries and monitoring stress scenarios and liquidity. Key credit factors include the duration of the outbreak, lower fuel costs and actions, such as reductions in capacity and labor costs, taken to mitigate pressure. A temporary drop in demand will be partly offset by lower fuel prices. However, relief could be deferred to 2021 due to high fuel hedging positions.

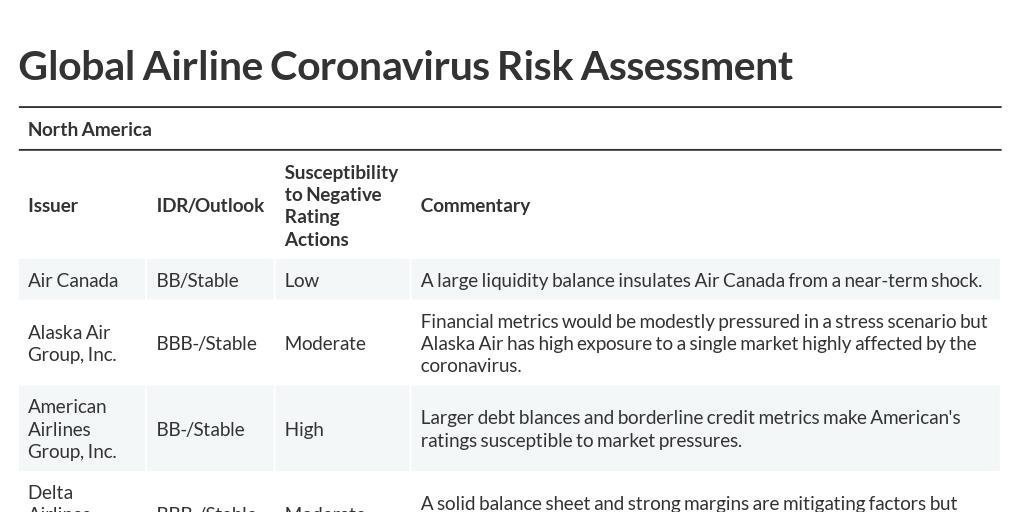

Within North America, American Airlines, Hawaiian Airlines and Spirit Airlines are most at risk for negative action. American has large debt balances, which drove credit metrics to levels Fitch considered borderline prior to coronavirus. Hawaiian has limited geographic diversification and large exposure to Asia. Spirit's low cost structure and good liquidity provide some downside protection. However, the rating is already on Negative Outlook due largely to leverage metrics being high for the rating.

Alaska Air faces risk from geographic concentration, particularly since its home market of Seattle, WA is heavily affected by the virus. United Airlines has the most international exposure of any issuer in North America and the greatest revenue exposure in the Atlantic, which is a greater risk following the US's European travel ban announcement. Southwest Airlines and Delta Air Lines are less of a concern. WestJet's Positive Outlook could be revised, as coronavirus may delay planned de-leveraging following its leveraged buyout last year.

Within EMEA, we view Vista Global as most exposed to a negative rating action. PJSC Aeroflot has limited headroom in credit metrics. Ryanair and Wizz Air have a fairly large exposure to Italy and other European countries substantially affected by the outbreak but strong balance sheets and solid liquidity partially mitigate risk.

Most Latin American airlines should be able to manage over the short term. However, the scope of the effects from the virus is unclear and could lead to negative rating actions. Rating headroom is limited for LATAM Airlines Group and Azul while GOL Linhas Aereas Inteligentes and Avianca have relatively more headroom. Currency depreciation could affect cash flow and liquidity. Fitch is monitoring issuer strategies to mitigate risk and implications for financial flexibility and access to credit lines.

In APAC, North Asian airlines from China, Hong Kong, South Korea and Japan will be most affected by coronavirus, followed by Southeast Asian airlines, which derive significant revenue from North Asian tourists. Airlines in India and Australia, which bank on domestic traffic, have been relatively insulated so far. However, further spread of coronavirus within these countries is a risk.