Geneva, 8 November 2017: Wizz Air Holdings Plc ("Wizz Air" or "the Company"), the largest low-cost airline in Central and Eastern Europe ("CEE"), today issues unaudited results for the six months to 30 September 2017 ("first half" or "H1") for the Company as a whole, and separately for its airline ("Airline") and tour operator ("Wizz Tours") business units1.

RECORD H1 PROFITABILITY AND STRONG BALANCE SHEET

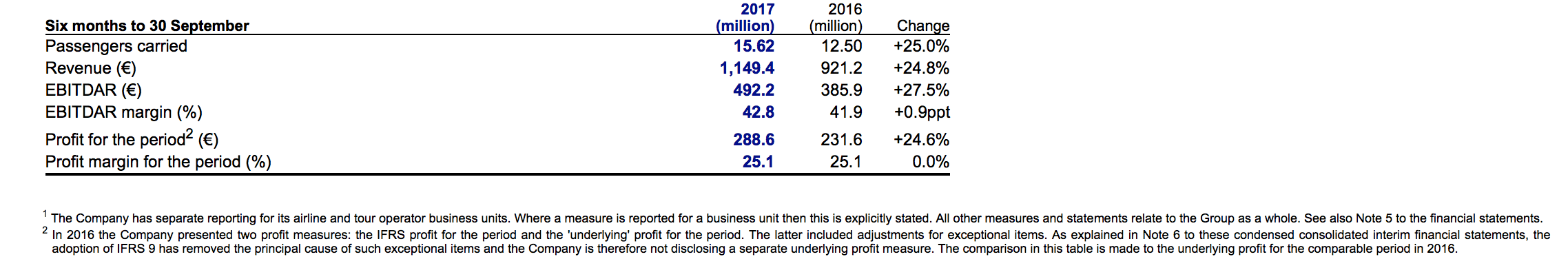

· Total revenue increased 24.8% to €1,149.4 million:

o Ticket revenues increased 20.8% to €685.1 million.

o Ancillary revenues grew 31.1% to €464.3 million.

· Profit for the period was a record €288.6 million in H1, a year-on-year increase of 24.6%.

· Total cash at the end of September 2017 was €1,193.4 million, of which €1,029.8 million was free cash.

AIRLINE AND WIZZ TOURS

The segmented reporting details the financial performance of the Airline and Wizz Tours business units separately:

· Airline: First half KPI performance:

o Total unit revenue increased 0.7% to 4.27 Euro cents per available seat kilometre (ASK).

o Total unit costs increased by 1.9% to 3.13 Euro cents per ASK.

o Ex-fuel unit costs increased by 1.7% to 2.22 Euro cents per ASK.

o Fuel unit costs increased by 2.2% to 0.91 Euro cents per ASK.

o Load factors increased by 1.7 ppt to 92.8%.

· Wizz Tours: First six months package holiday revenues of €12.1 million.

LEADING POSITION IN CENTRAL AND EASTERN EUROPE

· Passengers carried increased 25.0% to 15.62 million, securing Wizz Air's position as CEE's leading low cost carrier.

· Network has continued to grow with the opening of two new bases in London Luton (UK) and Varna (Bulgaria).

· Wizz Air started 57 new routes in H1 and now offers more than 550 routes to 43 countries from 28 bases.

· Fleet expansion with six Airbus A321 and one Airbus A320 aircraft added during H1 taking the fleet to 86 aircraft, a mix of 64 A320s and 22 A321s.

· Average aircraft age of 4.5 years, one of the youngest fleets of any major European airline.

· Wizz Discount Club membership of over 1,000,000 at the end of H1.

BUSINESS DEVELOPMENTS AND INNOVATION

· Fleet delivery stream strengthened through an order of additional ten Airbus A321ceo aircraft powered by Pratt & Whitney V2500 engines to be delivered in 2018 and 2019.

· Customer satisfaction enhanced with the removal of the 'paid-for' cabin bag policy.

· Ancillary product innovation continued with a new 'fare lock' feature enabling customers to lock in Wizz Air's low fares for 48 hours before payment and a new 'Flexible Partner' feature allowing customers to book up to 10 tickets and name their travel partner(s) at the time of check-in.

· New subsidiary incorporated in the UK that in October filed an application for the grant of aviation licences with the UK Civil Aviation Authority - further signalling the Group's commitment to the important UK market.

· Enhanced leadership capacity by the promotion of Mr. Bela Szegedi to take the role of Chief Flight Operations Officer.

József Váradi, Wizz Air Chief Executive said:

Our results for the first half of the current financial year ending 31 March 2018 ("FY18") have been ahead of expectations with robust trading across all of our markets. We carried 15.6m passengers, 25% more than in the same period last year, generating 25% higher revenues. Our record first half net profits were also 25% higher compared to the first half of last year, maintaining a 25% net profit margin. In light of this strong performance and encouraging third quarter bookings the Company today raised its net profit guidance for the full year to a range of between €265 million to €280million.

Our network, routes and bases continued to expand rapidly to meet the demand from our core Central and Eastern European markets, highlighting the continued significant growth opportunity for the Company in the region. In the first half of FY18, we announced 57 new routes taking our network to over 550 routes to/from 28 bases in 43 countries, further securing our position as Central and Eastern Europe's leading low cost carrier. We have continued to grow our fleet, with the addition of six Airbus A321ceo and one A320ceo aircraft as well as strengthening our delivery stream with an additional order for 10 A321ceo to be delivered in 2018 and 2019.

Customer satisfaction and innovation remains at the forefront of our strategy and in the first half we announced the removal of our 'paid for' cabin bag policy and introduced the 'fare-lock' and 'Flexible Partner' products.

We also continue to prepare the Company for the significant planned growth ahead. As part of that planning, we have further strengthened our management team with the appointment of Stephen Jones to the new position of Executive Vice President and Deputy Chief Executive Officer, along with the internal promotions of Iain Wetherall to Chief Financial Officer and Heiko Holm to Chief Technical Officer, enhancing management depth and experience and bringing new innovative thinking to Wizz Air.

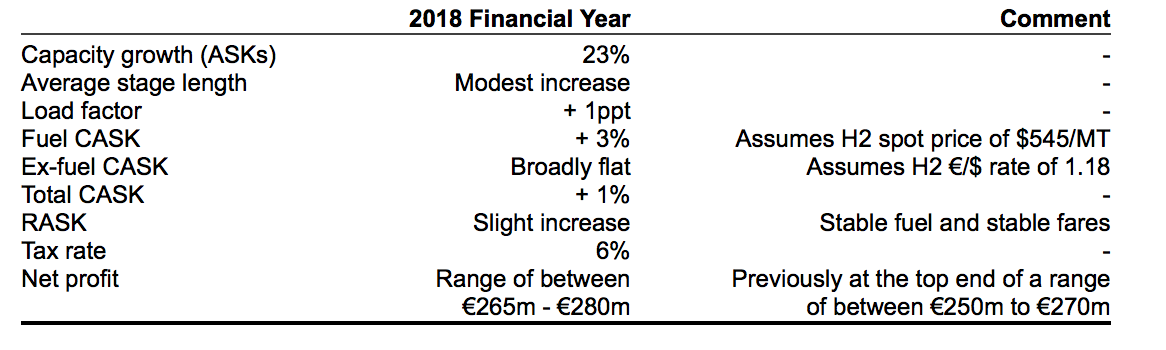

FULL-YEAR OUTLOOK

With the continued expansion of its network, Wizz Air estimates that it will grow capacity in terms of ASKs by around 23% in the 2018 financial year. Wizz Air's current expectations for full year performance are summarised below.