Geneva, 24 May 2018: Wizz Air Holdings Plc ("Wizz Air" or the "Company"), the largest low-cost airline in Central and Eastern Europe1, today announces its audited results for the full year ended 31 March 2018 ("FY2018" or "FY18") for the Company as a whole, and separately for its airline ("Airline") and tour operator ("Wizz Tours") business units2.

1 Central and Eastern Europe, or CEE, is a region comprised of Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Estonia, Georgia, Hungary, Kosovo, Latvia, Lithuania, Macedonia, Moldova, Montenegro, Poland, Romania, Russia, Serbia, Slovakia, Slovenia and Ukraine.

2 The Group discloses revenues and expenses for its airline and tour operator business units separately. Where a measure is reported for a business unit then this is explicitly stated. All other measures and statements relate to the Group as a whole. See also Note 4 to the financial statements.

3 EBITDAR: profit (or loss) before net financing costs (or gain), income tax expense (or credit), depreciation, amortisation and aircraft rentals.

4 EBITDAR Margin: EBITDAR divided by total revenue.

5 In FY17 the Company presented two profit measures: the IFRS profit for the period and the 'underlying' profit for the period. The latter included adjustments for exceptional items. As explained in Note 5 to the consolidated financial statements, the adoption of IFRS 9 has removed the principal cause of such exceptional items and the Company is therefore not disclosing a separate underlying profit measure for FY18. The comparison in this table is made to the underlying profit in FY17 as this presents the best like for like measure. A reconciliation between underlying (non-GAAP) and IFRS profit for the year is set out in the Financial Review and also in Note 5 to the financial statements.

RECORD CAPACITY GROWTH AND PROFITABILITY BOTH AHEAD OF INITIAL GUIDANCE

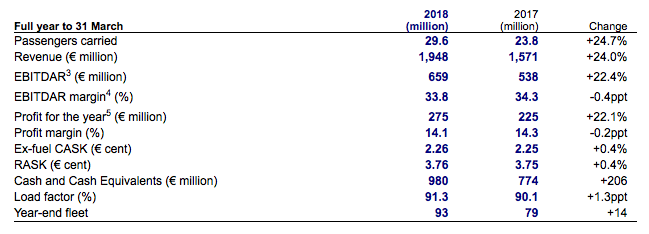

· Total revenue increase of 24.0% to €1,948 million.

o Ticket revenue up 23.7% to €1,132 million.

o Ancillary revenue up 24.4% to €816 million, representing 42% of total revenue.

· Net profit grew 22.1% to a record €275 million (compared to underlying profit in FY17).

· Net profit margin of 14.1% while delivering 25% passenger growth and 1.3ppt higher load factors of 91.3%.

· Total cash at the end of March 2018 was €1,142 million of which €980 million was free cash.

· Investment grade credit ratings received from both Moody's (Baa3) and Fitch (BBB).

SIGNIFICANT INVESTMENTS TO DRIVE COSTS EVEN LOWER

· Over 35% of seats now served by the more cost effective A321ceo aircraft with the addition of 10 brand new aircraft.

· Fleet expansion to 93 aircraft, a mix of 67 A320ceos and 26 A321ceos.

· Average aircraft age of 4.6 years, remains one of the youngest and most cost efficient fleets of any major European airline.

· Ordered 146 additional Airbus A320neo family aircraft securing an enviable pipeline of latest-technology, ultra-cost efficient aircraft deliveries until 2026.

· Launched the WIZZ Pilot Academy and started construction of a brand new state-of-the-art pilot and cabin crew training facility in Budapest supporting growth in a cost efficient way.

AIRLINE AND WIZZ TOURS

The segmented reporting illustrates the financial performance of the Airline and Wizz Tours business units separately:

· Airline: FY18 performance:

o Total unit revenue improved by 0.4% to 3.76 euro cents per available seat kilometre (ASK).

o Total unit costs increased by 1.3% to 3.19 euro cents per ASK.

o Fuel unit costs increased by 3.5% to 0.93 euro cents per ASK.

o Ex-fuel unit costs increased by 0.4% to 2.26 euro cents per ASK.

o Ancillary revenue per passenger unchanged at €27.2 per passenger.

§ Value added services +€2.0 per passenger.

§ Baggage fees -€2.0 per passenger.

· Wizz Tours: FY18 package holiday revenues of €18.0 million.

INCREASING MARKET LEADING POSITION AND CUSTOMER OFFERING

· Passengers carried +24.7% to 29.6 million increasing Wizz Air's position as CEE's leading low cost carrier.

· Number one market share position in CEE increased by 3ppt to 42% in terms of seats.

· 95 new routes commenced in FY18, building our core CEE markets and expanding our customer offering outside the CEE.

· Launched a brand new UK airline, Wizz Air UK Limited, confirming our commitment to the UK market and significant investment in Luton starting with 8 based aircraft.

· New base announced in Vienna with five based aircraft committed.

· Wizz Discount Club membership continued to increase reaching already over 1.1 million by year end.

Commenting on the results, József Váradi, Wizz Air's Chief Executive Officer said:

The 2018 financial year was another year of investment and driving efficiencies in Wizz Air's operations as we continue to our mission to become Europe's undisputed airline cost leader. This relentless focus on cost means we continue to stimulate the market through the lowest fares, resulting in record passenger numbers of almost 30 million up 25% year on year. A backdrop of high economic growth rates across the CEE and the opportunities created by Wizz Air's ultra-low fares underpins our business which has seen revenues increase by 24% and net profit of a record €275m an increase of 22% year on year. Our cost focus, market leading position in CEE, pipeline of truly game changing Airbus A320neo family technology and balance sheet strength, as reflected in our recently awarded investment grade credit ratings, are the strongest of foundations for Wizz Air to continue to drive profitable growth and achieve one of the best profit margins of all European airlines, ensuring Wizz Air remains one of the most exciting airline businesses in the world.

As FY 2019 financial year begins we remain very optimistic for the coming twelve months. Higher fuel prices are supporting a stronger fare environment and we expect these macro conditions to provide Wizz Air with market share opportunities as weaker carriers withdraw unprofitable capacity. Our ability to drive cost advantage further and offer lower fares across our ever expanding network will lead to an expected 20% increase in passenger numbers to 36 million in FY 2019.

The Company recorded a solid start to FY 2019 with RASK forecast at broadly flat in Q1 year on year, a good performance given the absence of Easter traffic which fell into the last financial year, and although still at an early stage of the financial year, the Group net profit is expected to be in a range of between €310 million and €340 million in FY 2019. As usual, this guidance is dependent on the revenue performance for the all-important summer period as well as the second half of FY 2019, a period for which the Company, like most airlines, currently has limited visibility."