Geneva, 5 November 2020: Wizz Air Holdings Plc (“Wizz Air”, “the Company” or “the Group”), the fastest-growing European airline today issues unaudited results for the six months to 30 September 2020 (“first half” or “H1”).

This interim financial report does not include all the notes of the type normally included in an annual financial report. Accordingly, this report should be read in conjunction with the annual report for the year ended 31 March 2020 and any public announcements made by Wizz Air Holdings Plc during the interim reporting period.

József Váradi, Wizz Air Chief Executive commented on the results:

“Wizz Air distinctly outperformed the industry in the second quarter of the current financial year: we carried 5.8 million passengers at 66% load factor and 72% of our 2019 capacity against an ever-shifting backdrop of travel restrictions across all of our markets. Our ancillary revenues continue to increase on a per passenger basis, driven by a resilient performance of our core products. At the same time, our disciplined cost management allowed us to sustain our investment graded balance sheet with a total cash balance of €1.6bn.”

Commenting on business developments, Mr Váradi added:

“During the first half of the financial year, we demonstrated outstanding agility and invested in long-term market opportunities: we announced 13 new bases since the beginning of the fiscal year, and added more than 260 new routes, including domestic routes, thereby significantly expanding the company’s geographical footprint and enhancing our strategic positioning to capture demand. In addition to this, our new Abu Dhabi airline has received its Air Operator Certificate and is ready for take-off once restrictions allow. We continue to pursue opportunities as they arise and to create a unique competitive advantage for the future.

These achievements would not have been possible without the relentless effort of our people, who continue to deliver outstanding performance in these difficult times and I would like to thank them for their dedication and resilience. As the first ever ultra-low cost carrier, Wizz Air was named “Airline of the Year” in 2020 by Air Transport World, which is a meaningful external recognition of the unrivalled performance of the entire team of Wizz Air during these unprecedented times.”

On current trading and the outlook for the full year, Mr Váradi said:

“During the winter period, we expect conditions to be particularly challenging with ongoing travel restrictions due to COVID-19 as well as the seasonal drop in demand for travel. We will continue to focus on cost management and strive to maintain cash-positive flying with a disciplined approach towards capacity.

Notwithstanding the challenges that lie ahead of us during the remainder of this fiscal year, we have laid the foundation for a swift recovery: in addition to expanding into new markets, we intend to retain all our current staff base and thereby generate a head start for when demand returns.

We are confident we will emerge as a structural winner, enabling Wizz Air to grow profitably in the years to come.”

FINANCIAL RESULTS IN H1

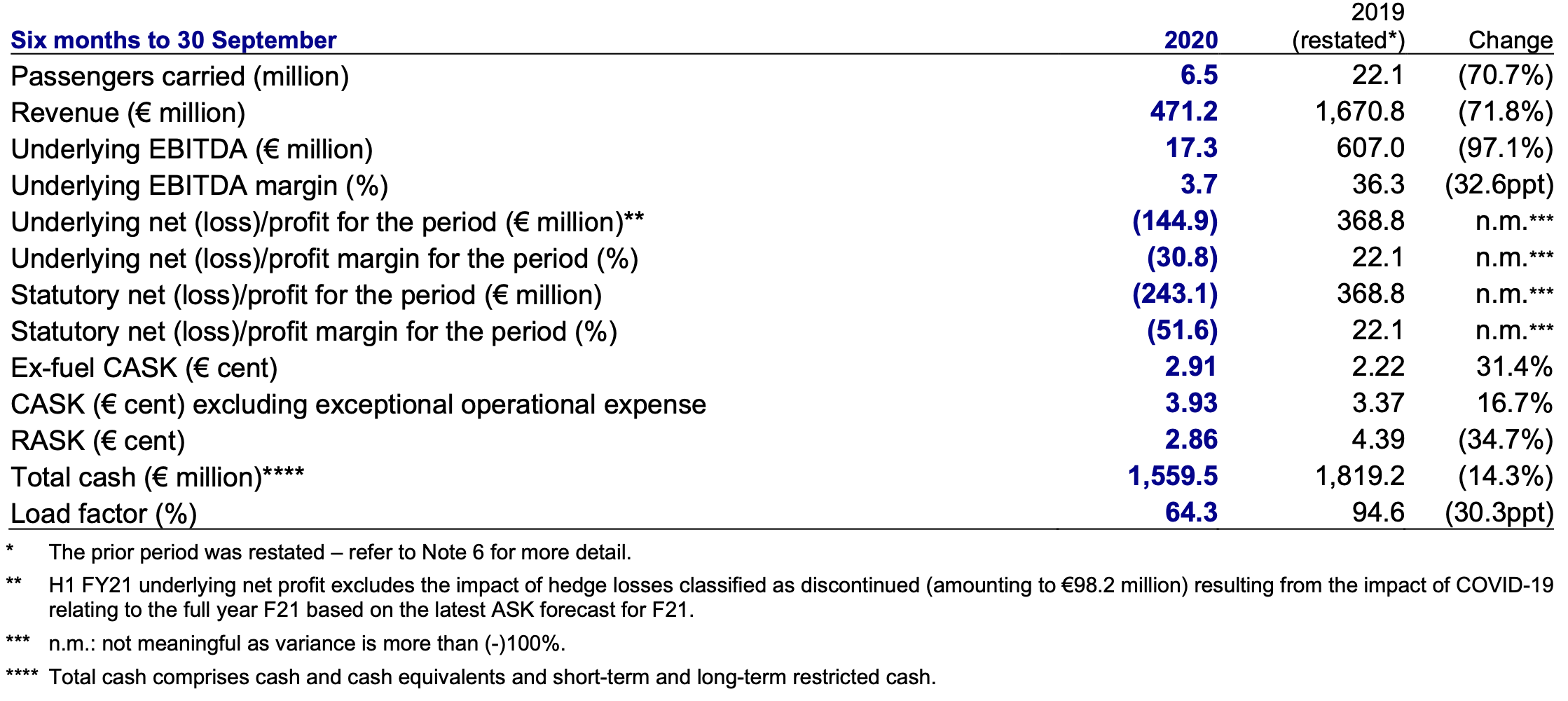

• Total revenue decreased by 71.8% to €471.2 million:

o Ticket revenues decreased by 78.9% to €201.8 million

o Ancillary revenues decreased by 62.3% to €269.4 million

o Totalunitrevenuedecreasedby3.8%to72.7Eurocentsperavailableseatperkilometre(ASK) o Ancillaryrevenueperpassengerincreasedby28.6%to41.6Eurocents

• Total operating expenses (including discontinued fuel hedges) decreased by 43% to €716.8 million: o Totalunitcostsincreasedby34.4%year-on-yearto4.52EurocentsperASK

o Ex-fuel unit costs increased by 31.1% year-on-year to 2.91 Euro cents per ASK

o Fuel unit costs increased by 40.8% year-on-year to 1.61 Euro cents per ASK

- Statutory loss for the period was €243.1 million

- Statutory loss for the second quarter was €135.1 million

Total cash (including restricted cash balances) at the end of September 2020 was €1,559.5 million

SEIZING SIGNIFICANT LONG-TERM MARKET OPPORTUNITIES

Significant expansion with the announcement of 13 new bases and the allocation of 29 aircraft: o Doncaster,UnitedKingdom:2basedaircraftand13newroutes

o LondonGatwick,UnitedKingdom:1basedaircraftand4newroutes

o Catania,Italy:2basedaircraftand5newroutes

o MilanMalpensa,Italy:5basedaircraft,29newroutes o Larnaca,Cyprus:3basedaircraft,16newroutes

o Lviv,Ukraine:1basedaircraft,10newroutes

o Tirana,Albania:3basedaircraft,15newroutes

o Bacău,Romania:2basedaircraft,12newroutes

o Dortmund, Germany: 3 based aircraft, 20 new routes

o St.Petersburg,Russia:2basedaircraft,10newroutes o Oslo, Norway: 2 based aircraft, 3 new routes

o Trondheim, Norway: 2 based aircraft, 7 new routes

o Bari,Italy:1basedaircraft,3newroutes

- Wizz Air entered the domestic air travel market in Italy and Norway.

- Wizz Air Abu Dhabi, a national airline of the United Arab Emirates has received its Air Operator Certificate in October 2020.

- Wizz Air improved optionality in its fleet delivery plan and delayed eight aircraft deliveries for the next three years which allows the company to react to the demand environment accordingly.

- Wizz Air remains investment grade rated with Moody’s and Fitch.

- The fleet continued to grow with 11 new Airbus A320neo family aircraft during the period taking the fleet to 132 aircraft at the end of the first half: 72 A320ceo, 41 A321ceo, 14 A321neo and 5 A320neo aircraft. These game-changing aircraft are powered by Pratt & Whitney GTF engines and deliver close to 50% reduction in noise footprint compared to previous generation aircraft. In addition, Pratt and Whitney's GTF engine reduces fuel burn by 16% and nitrogen oxide emissions by 50%.

- Average aircraft age of 5.4 years as at 30 September 2020, one of the youngest fleets of any major European airline.

Wizz Air continuously operates at the lowest CO2 emissions per passenger/km among all competitor airlines, with 62.5 grams per passenger/km for the rolling 12 months to 30 September 2020.

RECENT TRADING UPDATE AND GUIDANCE

The demand environment is still largely shaped by various travel restrictions across Wizz Air’s markets, which adds to the usual seasonality in air travel demand seen throughout the winter months. Wizz Air targets to only fly cash contribution positive whilst retaining flexibility to swiftly adjust capacity according to market conditions.

We reiterate our guidance on cash burn of €70 million per month in the case of a full grounding until the end of F21. This includes the cost of the operation, the cost of our leases, and the cash payments linked to hedges. Should current restrictions and lockdowns persist over winter, we believe that cash positive flying could be minimal. We will continue to invest in the renewal of our fleet during H2 2020 and CY2021 in order to further increase our competitive position and our edge on cost and sustainability.

The protection of the Company’s liquidity position is our top priority and we expect, despite the projection of a difficult winter for the industry, to end the FY at a solid liquidity position with an ability to respond to surging demand within weeks as a result of a strongly diversified network and a full integrity of its supply chain.

Due to the ongoing uncertainty caused by COVID-19, the Company is not in a position to provide guidance on net profit for the financial year 2021.