WestJet Airlines Ltd. (TSX: WJA) ("WestJet") today announced that at a special meeting held today (the "Meeting"), its shareholders and optionholders overwhelmingly voted to approve its previously announced proposed transaction with Onex Corporation ("Onex") (TSX: Onex). Of the votes cast at the Meeting, more than 92.5 per cent of shareholders and optionholders who voted were in favour of the proposed transaction.

WestJet and Onex entered into a definitive agreement on May 12, 2019 (the "Arrangement Agreement"), for the proposed acquisition of WestJet by Onex under a plan of arrangement, pursuant to which each outstanding share of WestJet will be exchanged for $31.00 in cash subject to the terms and conditions of the Arrangement Agreement (the "Arrangement"), following which WestJet will operate as a privately-held company.

Ed Sims, WestJet's President and Chief Executive Officer, said, "We are very pleased to obtain overwhelming support from our securityholders at today's special meeting. Receiving this support is an important step on our path to closing the transaction, and we continue to engage with the necessary authorities on the remaining approvals."

The total number of shares represented by shareholders present in person and by proxy at the Meeting was 69.2 million, representing approximately 60 per cent of WestJet's issued and outstanding Common Voting Shares and Variable Voting Shares. The total number of stock options represented by optionholders present in person and by proxy at the Meeting was 3.3 million, representing approximately 54 per cent of WestJet's issued and outstanding stock options.

Given that the total number of votes cast by or on behalf of holders of WestJet's Variable Voting Shares at the Meeting exceeded 25 per cent of the total number of votes cast at the Meeting, the results below reflect the fact that the vote attached to each Variable Voting Share has been automatically decreased to equal the maximum vote permitted per Variable Voting Share under WestJet's amended and restated articles of incorporation, which, in these circumstances was 0.48960, 0.45108 and 0.45272 of a vote per Variable Voting Share for each approval of the Arrangement Resolution (as defined below) noted below, respectively.

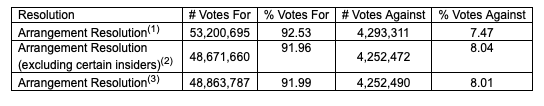

Holders of the requisite majorities of shares and options voted in favour of the special resolution to approve the Arrangement (the "Arrangement Resolution"), as follows:

(1)

More than 66 2/3 per cent of votes cast by shareholders and optionholders of WestJet, voting together as a single class, present in person or represented by proxy at the Meeting, voted in favour of the Arrangement Resolution, as required by the interim order of the Court of Queen's Bench of Alberta (the "Court").

(2)

More than 50 per cent of votes cast by shareholders of WestJet, voting together as a single class, present in person or represented by proxy at the Meeting, excluding those shareholders whose votes are required to be excluded pursuant to Section 8.1(2) of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, voted in favour of the Arrangement Resolution, as required by the interim order of the Court.

(3)

More than 50 per cent of votes cast by shareholders of WestJet, voting together as a single class, present in person or represented by proxy at the Meeting, voted in favour of the Arrangement Resolution, as required by the TSX.

Detailed voting results for the meeting are available under WestJet's profile on SEDAR at sedar.com.

The Arrangement is still subject to other conditions to closing, including remaining regulatory approvals, and final approval of the Arrangement by the Court of Queen's Bench of Alberta.

Further information regarding the Arrangement is provided in WestJet's management information circular dated June 19, 2019 in respect of the Meeting. Assuming the timely receipt of the remaining regulatory approvals and Court approval, the transaction is expected to close in the latter part of 2019.