The Russia / Ukraine conflict sent shock waves through the world and the commercial Aviation industry.

Western sanctions, and the Russian response to them, have raised important questions on the validity of some assumptions underpinning appraised Market Values of affected aircraft. In March 2022 we outlined our approach, which was to use an end of life, part out value as a reasonably consistent proxy for the hypothetical Market Value of an intact sanctioned aircraft.

One year on, has anything in VV Aviation’s stance changed? What is our view on Forecast Values for Russian sanctioned aircraft?

Russian sanctioned fleet: an overview

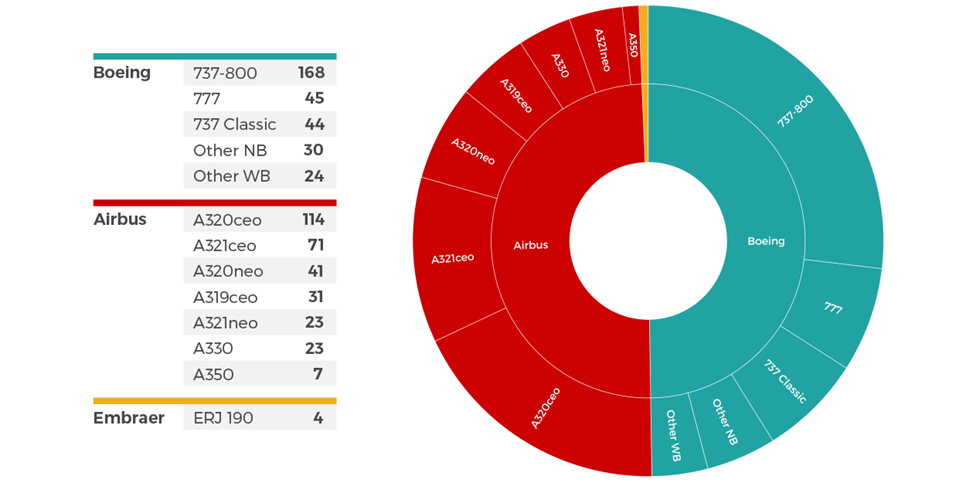

VV Aviation counts over 600 passenger Narrowbody and Widebody aircraft (defined as Embraer E190 and larger) as subject to Western sanctions, due to their connection (owned or operated) by Russian entities. The sanctioned fleet is evenly split between Airbus and Boeing, with a few Embraer E190s completing the total.

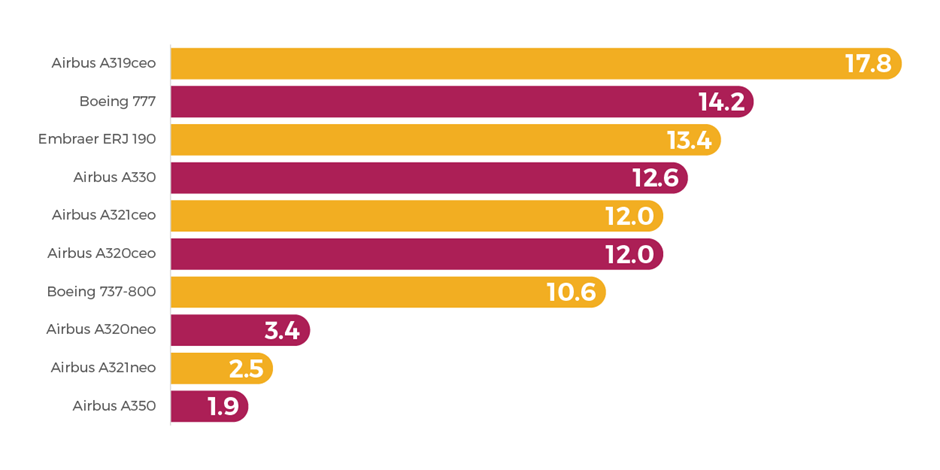

The majority of the fleet is comprised of Narrowbodies, with the Boeing 737-800 and A320ceo most heavily represented. There is a significant number of Airbus “new technology” A320neos, A321neos and A350s. The average age of the sanctioned fleet is just over 13 years, with the new technology types on average just under 3 years old.

Recap:

- Sanctions imposed restrictions on aircraft connected to Russian entities and persons, or for use inside Russia.

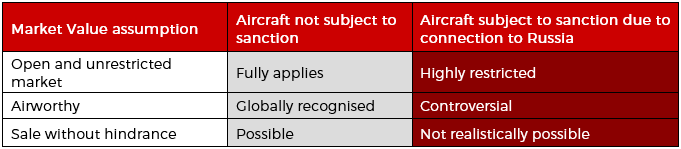

- Market Values typically assume, among other considerations, an open and unrestricted market, with the aircraft in an airworthy state and in a condition that permits sale without hindrance.

- To account for the restrictions on the market for sanctioned aircraft, VV Aviation uses their equivalent part out value (assuming serviceability) at the end of their economic useful life as a proxy measure. This effectively discounts up to 90% of the ‘normal’ Market Value depending on aircraft type and age.

One year later, has our stance changed?

In summary, it has not. If anything, the idea of the Market Value under sanctions of the aircraft being non zero, but a fraction of their unrestricted Market Value, appears to be borne out by anecdotal evidence. There is increasing interest for opportunistic investors to buy insurance claims currently progressing through the court system at pennies on the dollar.

Looking ahead, how likely is it that values will rebound?

VV Aviation hopes that there will be a resolution leading to the end of the conflict resulting in the lifting of sanctions.

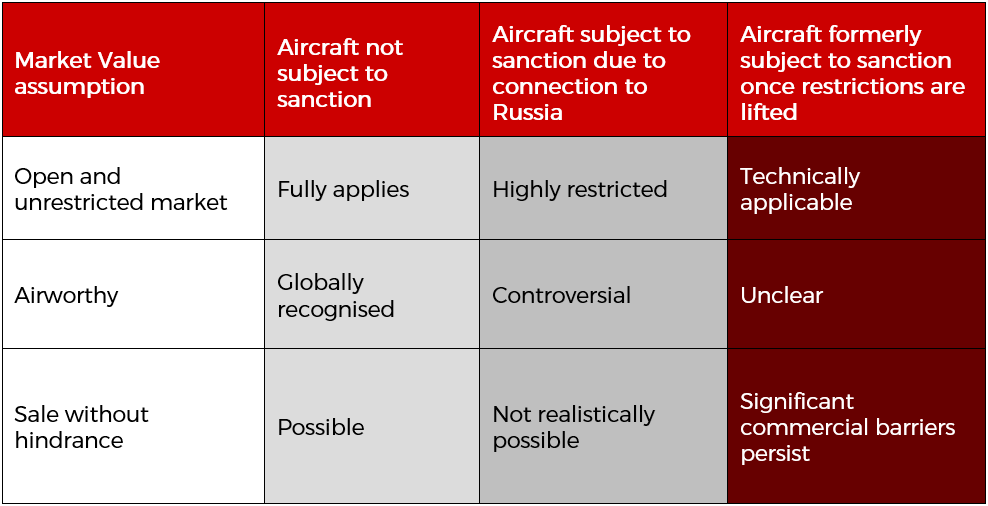

However, we believe a ‘snap back’ to pre sanction market conditions for currently sanctioned aircraft is unrealistic. In fact, it is quite possible that the diminution in value due to sanctions is permanent. This likelihood increases the longer the isolation from the global aircraft maintenance, registration, insurance, finance and trading ecosystem continues.

The reason is that, while there may technically be an open and unrestricted market, it is unclear how airworthiness would be handled in a post sanction environment, and it is highly unlikely that aircraft would be accepted for sale without significant difficulty.

Significant barriers are expected to persist post sanction, and trust will take time to rebuild.

The key issues here are the part’s traceability and component certifiability. Aircraft in Russia have now been operating for nearly a year, without any outside scrutiny or manufacturer support. News articles are rife with speculation that serviceable original parts are being reused and swapped to keep aircraft flying or being used beyond their approved limits. Rosaviatsiya (the Russian civil aviation authority, or CAA) has indicated it will allow Russian made substitute parts to be installed.

Even before the conflict began, the market had made its preference clear. This is even seen with Russia for aircraft built to Western, rather than Russian, standards. Post conflict, aircraft suspected of carrying Russian substituted parts would likely face an uphill battle to convince buyers that these parts were of equal or better quality.

Furthermore, even if sanctions were lifted tomorrow and buyers did queue up clamouring for those aircraft, their ability to re-register, insure and finance those aircraft would almost certainly be subject to significant friction. It must be borne in mind that, to Western CAAs (Civil Aviation Authority) at least, the Russian authorities have breached two major international treaties for Aviation: the Chicago Convention and the Cape Town Convention. This is extremely important because the Chicago Convention has governed since 1944, among other things, the process of transferring registration from one country to another. More recently, Russia ratified the Cape Town Convention, which was developed to facilitate financing by reducing repossession risks to lenders and lessors.

In a post sanction world, it is extremely doubtful that other major CAAs would simply revert to business as usual as far as Russia is concerned. Accepting an export certificate of airworthiness from Rosaviatsiya with the same regularity as they do, for example, between the FAA and EASA.

Rather, it is likely to be a painful process in which every single component on any aircraft trading out of Russia would be treated with scepticism. This scepticism will stem from a safety standpoint, however, there is also a political context that cannot be discounted, and which could endure for quite some time.

Even if the aircraft were traded within Russia only, the violation of the Cape Town Convention would severely curtail buyers’ ability to attract finance from outside Russia. Lessors and their insurers are currently exposed to billions of dollars in potential losses and would be understandably wary for the foreseeable future.

It all boils down to this: reversal of sanctions if they occur, will only remove the formal hurdles to tradability that aircraft in Russia currently face. However, in a post sanction environment, we believe significant commercial barriers would still endure. This market reality is what VV Aviation’s values reflect.

Of course, we will continue to monitor the situation and adjust accordingly.

VV Aviation data as of end March 2023.