Singapore Airlines (SIA) has completed sale-and-leaseback transactions for 11

aircraft, comprising seven Airbus A350-900s and four Boeing 787-10s, raising

approximately S$2.0 billion in total.

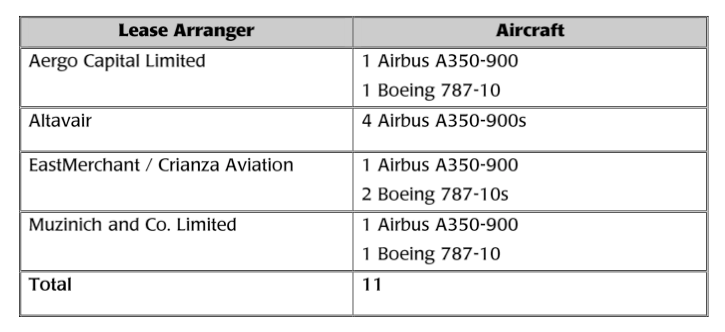

The transactions were arranged by four different parties, as follows:

SIA has successfully raised approximately S$15.4 billion in fresh liquidity since 1

April 2020, including these sale-and-leaseback transactions. The amount also

includes S$8.8 billion from SIA’s successful rights issue, S$2.1 billion from secured financing, S$2.0 billion via the issuance of convertible bonds and notes, as well as more than S$500 million through new committed lines of credit and a short-term unsecured loan.

SIA continues to have access to more than S$2.1 billion in committed credit lines,

along with the option to raise up to S$6.2 billion in additional mandatory

convertible bonds before the Annual General Meeting in July 2021.

During this period of high uncertainty, as the airline industry continues to navigate

the unprecedented challenges caused by the Covid-19 pandemic, the SIA Group will continue to explore additional means to raise liquidity as necessary.

Mr Goh Choon Phong, Singapore Airlines Chief Executive Officer, said: “The

additional liquidity from these sale-and-leaseback transactions reinforces our ability to navigate the impact of the Covid-19 pandemic from a position of strength. We will continue to respond nimbly to the evolving marketing conditions, and be ready to capture all possible growth opportunities as we recover from this crisis.’