The Board of Directors of AirAsia Group Berhad ("AAGB" or "the Company") (“Board”) wishes to announce that AirAsia Berhad (“AAB”), a wholly-owned subsidiary of the Company, has on 10 November 2019, entered into a Profit Sharing Agreement (“Agreement”) with AirAsia X Berhad (“AAX”) in connection with the transfer two (2) of its existing slots (equivalent of 14x weekly) of its Kuala Lumpur - Singapore route (“KUL-SIN Route”) (“Transaction”).

Pursuant to the Agreement, AAX will share 50% of the net operating profit of the route with AAB on a monthly basis throughout the term of the Agreement. The Agreement shall be effective on the date of the Agreement, for a period of one (1) year, and may be renewed for another one (1) year by mutual agreement in writing by both AAX and AAB. Unless otherwise agreed in writing and subject to regulatory approval, in the event AAX’s performance of the KUL-SIN Route does not meet the mutually agreed expectations or the Agreement is not extended or that AAX ceases or intends to cease operation of the KUL-SIN Route, the airport slots shall be returned to AAB.

The Transaction will provide an opportunity for AAB to heighten the fly-thru market which has remained stagnant since 2017 and benefit from the additional capacity which doubles up to AAB’s current capacity.

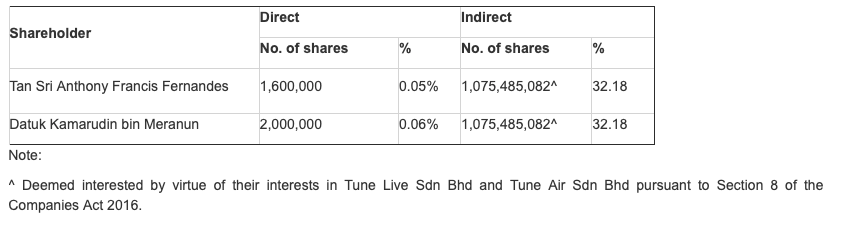

Tan Sri Anthony Francis Fernandes and Datuk Kamarudin bin Meranun are deemed interested in the Transaction (“Related Parties”) and they have abstained from all management and Board deliberations and voting in respect of the Transaction. The Related Parties’ direct and indirect shareholdings in AAGB as at the date of this Announcement are as set out in the table below:

Save as disclosed, no other directors and/or major shareholders of the Company and/or persons connected with them have any interest, whether directly or indirectly, in the Transaction.

The highest percentage ratio applicable to this Transaction is 0.08% and the highest aggregated percentage ratio for all transactions between the Company and the Related Parties and/or persons connected with them pursuant to Paragraph 10.12(1) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad is 0.12%.

The Agreement is not subject to the approval of the shareholders of the Company or any government authorities.

The Transaction will not have any material financial impact in the current financial year nor will it have any effect on the issued and paid-up share capital or substantial shareholders’ shareholding of AAGB. The Transaction is also not expected to have any material effect on the net assets per share, earnings per share and gearing of AAGB for the financial year ending 31 December 2019.