Using our VesselsValue data, we review how OEMs (Original Equipment Manufacturers) have managed aircraft production during the Covid-19 pandemic, specifically looking at Widebody and Narrowbody Passenger aircraft.

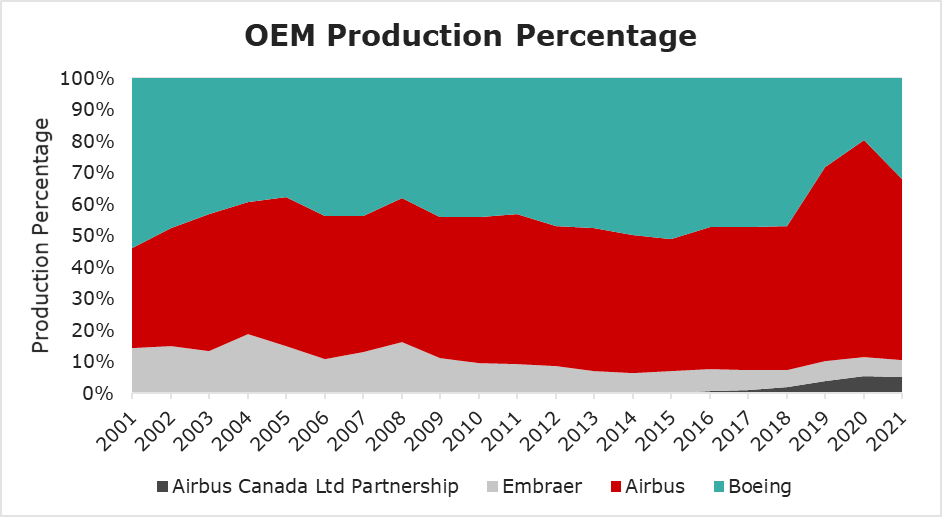

Production rates are based on the number of aircraft delivered. Historically, when comparing the percentage of total by OEM, Airbus and Boeing have the majority share with between 45-50% share of the production each.

This changed drastically when Boeing experienced the issues with the MAX being grounded and ultimately ended with a halt in production. Figure 1 shows a reduction of Boeing’s share of deliveries from 47% in 2018 to 28% in 2019, ultimately reaching a 20 year low of 19.7% before the recent recovery in Boeing production rates.

While Boeing deliveries declined, Airbus steamed ahead with a high rate of production of their A320 neo family range with nearly 550 deliveries in 2019.

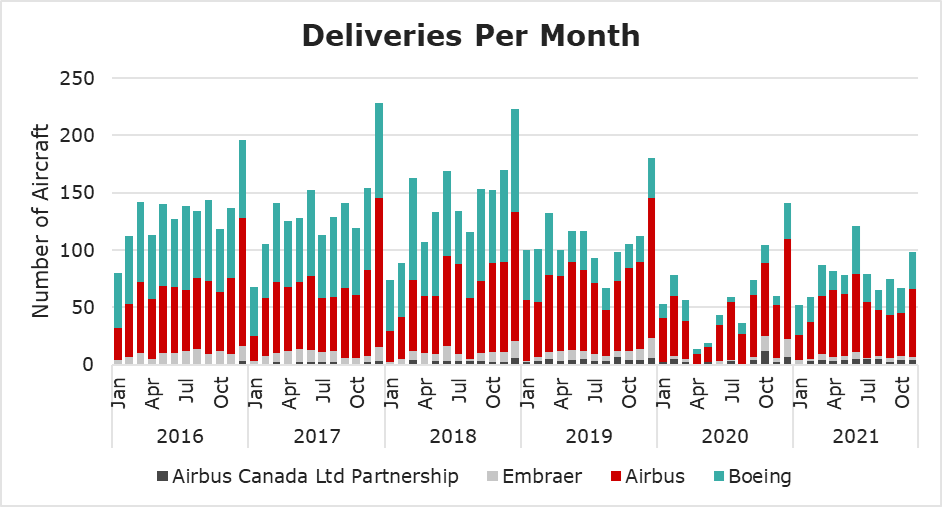

When Covid-19 hit, Boeing production rates declined further even more whilst Airbus ticked over. After having a slight pause in April and May of 2020, Airbus quickly recovered and was back to producing more than 50 aircraft across their product range and had a huge push of deliveries in December 2019, as seen in Figure 2.

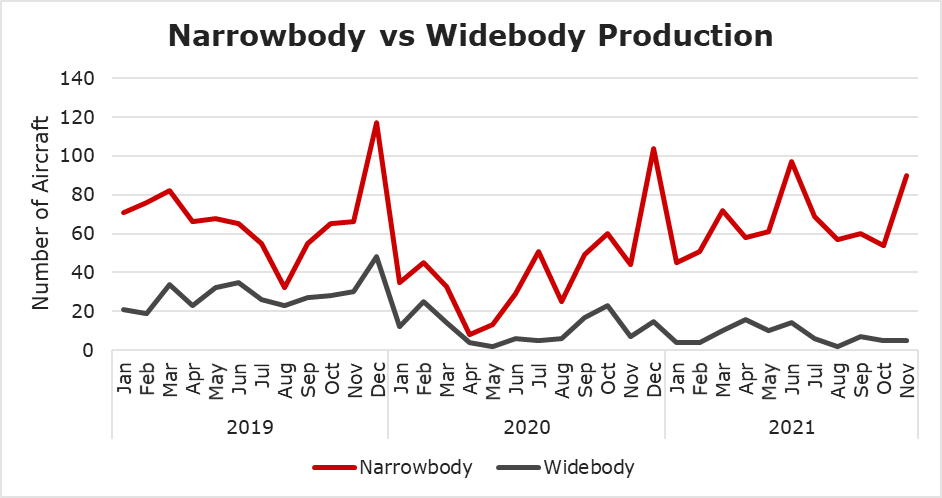

Understandably, with international travel restrictions in play, it was the Widebody production that dropped, followed by the Narrowbodies in April and May of 2020 during global travel uncertainties. However, whilst Widebodies continued to decline, Narrowbodies experienced sustained rates and even increased as they were, once again, used for regional flights and shorter distance travel around the US, China, India and Russia. This is summarised in Figure 3 with Narrowbody vs Widebody.

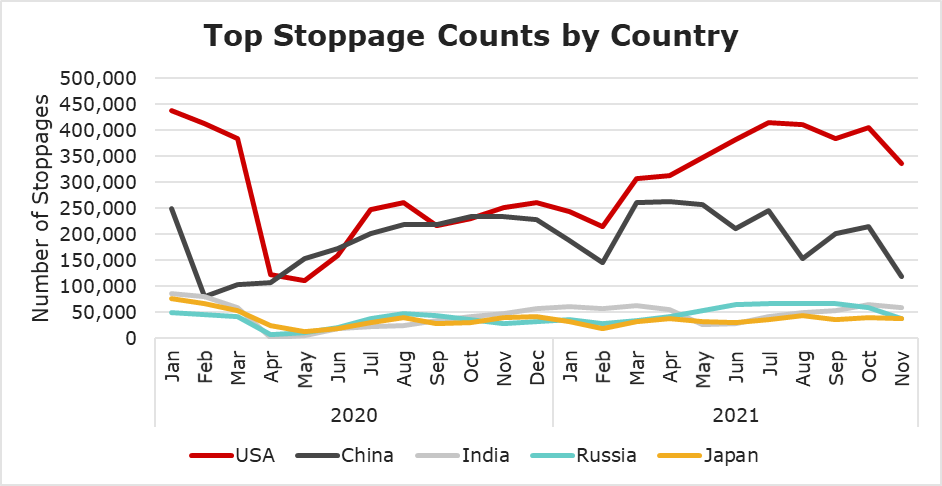

Figure 4 also shows the top five countries by the number of aircraft stoppages in them derived from ADS-B tracking data.

Conclusion

As international travel continues to normalise and with the US restrictions relaxed, we should begin to see Widebody production attempting to climb once again, but we expect this to be a very slow process and take several years before we see similar highs of December 2019. The Narrowbodies continue to grow in production, with the MAX issues resolved and China now allowing commercial flight. The continued success of the A320 neo family, the Airbus Canada Limited Partnership and Embraer all picking up in recent months, could imply that low production rates may soon be coming to an end.

Data as of end of November 2021.