- Tough first half with heightened competition and unfavourable currency conditions

- Passenger Load Factors up 16.9% YoY

- Passenger revenue saw an increase of 8% YoY

- Successful cutover to new Amadeus Reservation System went live on 10 June

- Renews safety audit accreditation for 7th time since 2005

- Launch of the Negaraku livery in the presence of the Prime Minister of Malaysia, YAB Dato’ Sri Mohd Najib Tun Abdul Razak

- Malaysia Airlines is on track to be profitable in second half of 2018

KLIA, 8 September 2017: Malaysia Airlines experienced a tough second quarter with heightened competition and adverse forex movement. Load factors continued to be strong and passenger revenue saw positive year on year (YoY) growth amidst the tough operating environment.

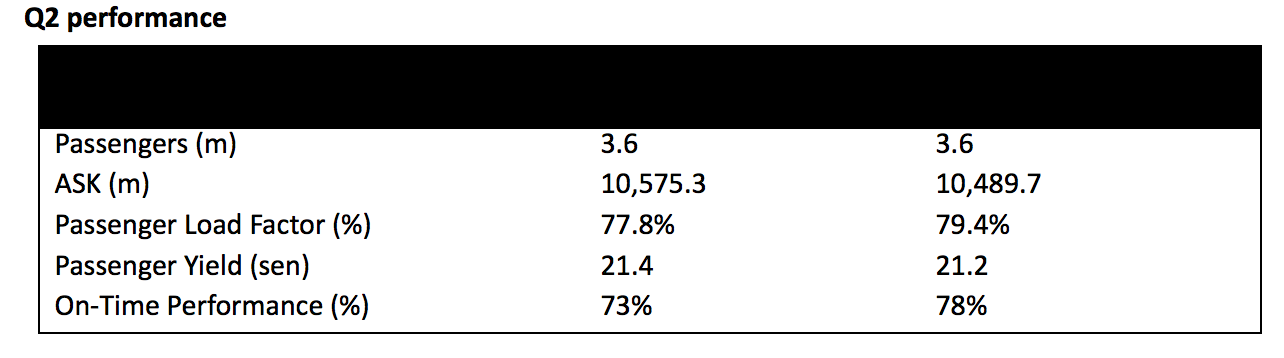

Group CEO Peter Bellew said, “The second quarter passenger revenue saw an increase of 8%, on the back of 1.8% higher capacity (ASK) compared to same period last year.”

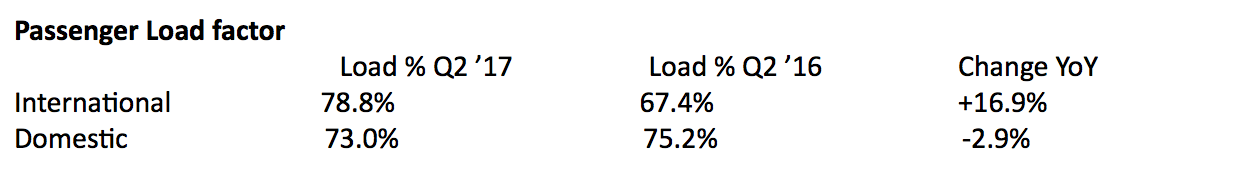

Load factor remained stable at 77.8%, a marginal reduction from 79.4% in the first quarter this year. The lean travel period during Ramadhan presented challenges, but these were offset by the Hari Raya peak period. Malaysia Airlines managed to increase international loads compared to Q2 2016 by a significant 16.9%, whilst only sacrificing a reduction of 4.5% in average fare.

“However, we continue to see a challenging environment in the domestic sector due to overcapacity and relentless competition, which led to a small reduction in domestic loads to 73% from 75.2% in Q2 2016. Moving forward we remain focused on improving services with a better steer on pricing. We have already seen progress on this front via a 2.6% increase in domestic average fare,” said Bellew.

Technical issues, severe weather, air traffic control delays and operational constraints led to a 5% reduction in on time performance (OTP). These issues have been addressed, and the improvements put in place have seen a steady improvement in OTP, to 78.4%, in the month of June.

“I am extremely pleased to see forward booking showing healthy YoY growth on both the Business and Economy class, despite the tight discipline we have put on pricing to avoid irrational competition. We continue to focus on China, which has tremendous growth potential. The airline’s new routes, Fuzhou, Nanjing, and Wuhan, which were launched in the month of June, are already showing encouraging figures in their early months. We will continue to focus on improving the customer experience, develop a stronger and broader alliance network, and increase our focus on the world’s fastest growing aviation region, Asia,” he said.

Bellew also noted that Malaysia Airlines continues to be the only airline in the country to be certified continuously since 2005, by the International Air Transportation Association’s Operational Safety Audit (IOSA) certification after successfully undergoing stringent checks by the world body’s safety audit standards.

“We have been IOSA certified, a benchmark for global safety management in airlines, since 2005. Maintaining safety standards has always been at the core of our existence at Malaysia Airlines. We remain committed to ensure Malaysia Airlines provides a safe and secure operational environment for our customers, staff and other stakeholders,” he said.

Malaysia Airlines Berhad

Bookings

Passenger load factors remained steady for Q2 2017 with Malaysia Airlines maintaining fare discipline despite competitor fares dropping significantly. Recovery in international business continued in the quarter with a load factor of 78.8% in 2017 versus 67.4% in 2016. Domestic business load factor did marginally decline due to overcapacity. The airline is expecting the ongoing price war in Malaysia to suppress average fares for the remainder of 2017.

Fleet

The airlines is still exploring various options for widebodies, for possible delivery in 2018 and 2019, to address the rapid growth in international sales which requires additional widebody aircraft. Discussions are continuing with a range of lessors, other airlines and aircraft manufacturers to acquire good quality aircraft with lie flat beds and high quality inflight entertainment systems.

The airline is looking forward to the delivery of the six leased new Airbus 350 aircraft from Air Lease Corporation (ALC), with the first A350 aircraft planned to arrive at the end of 2017. The A350s will operate Malaysia Airlines’ flagship service to London Heathrow from Q1 2018 and are expected to result in a more efficient operating cost on the route.

The A350 is a technologically advanced aircraft and to assist a smooth introduction of this fleet, Malaysia Airlines has entered into a detailed maintenance agreement with Airbus in which the majority of the parts and components for the A350 and A330 will be maintained directly by Airbus in Kuala Lumpur. Malaysia Airlines will in future pay a fixed price per hour of usage of the aircraft for this comprehensive parts and components support. Airbus will be setting up and staffing a dedicated manufacturer team in Kuala Lumpur to support Malaysia Airlines, which is expected to minimise the future risks of AOG (aircraft on ground) and greatly simplify the procurement of parts for the Airbus fleet.

Malaysia Airlines in June announced an option to convert 10 of its 737 MAX 8s on order to the newest version of the 737 MAX family, the MAX 10s. The airline will be a launch customer for the new Boeing 737 Max 10 aircraft, and will fit the aircraft with 16 innovative lie flat business seats and 166 economy seats. The first deliveries will be in January 2021. The current plan is for delivery of the MAX 8 to commence in 2019 and the MAX 10 in 2021.

The airline is currently assessing the feasibility of a dedicated A380 charter airline, as early as Q4 2018, to service the growing global traffic on the Hajj and Umrah to Saudi Arabia.

The quarter also saw the unveiling of the ‘Negaraku’ livery on the airline’s B737-800 aircraft in the presence of the Prime Minister of Malaysia, YAB Dato’ Sri Mohd Najib Tun Abdul Razak. The livery is part of the ‘Negaraku’ initiative, a nationwide movement driven by Malaysians for all Malaysians with the objective of fostering unity among all and inspiring the spirit of patriotism. The B737 aircraft, the first of several to display the national flag, will be flown and visible all across the world on flights below seven hours, from Shanghai to Perth.

Cost control

Given the adverse impact on foreign exchange and a challenging competitive environment, reducing costs will remain a focus for 2017. The quarter saw continued cost management initiatives to generate more savings in several areas across the various divisions. This included a total of 77 Operations initiatives registered and tracked for FY2017. To date, the programme has registered a 48% completion rate with estimated savings of nearly RM14 million for the quarter and a total savings of RM16 million for the first half of 2017.

Operational improvements continue

Punctuality dipped in 2Q 2017, which recorded a lower OTP of 73.3% mainly due to aircraft constraints which resulted in tight operations and aircraft swap or changes. Other factors affecting OTP included the high consequential delays due to late arrivals of aircraft impacted by external factors (weather in Kuala Lumpur and air traffic control at international stations). Some of the issues have been addressed which has led to steady improvement of OTP to 78.4% in June 2017. Aircraft utilisation also improved in the quarter with all fleet registering a higher than planned daily average aircraft utilisation.

There are currently 15 fuel initiatives registered for the year with 10 currently running in the quarter. Actual burn off registered better than budget for Q2 2017, with a variance of 1.38 million kg against budget. However, fuel cost registered higher than budget due to forex.

Investing in the Customer

Customer satisfaction and experience continue to be a key priority for the airline. Malaysia Airlines has returned to the Skytrax quality auditing scheme this year and aims to restore its previous high ratings by the end of 2019. Customer experience areas of particular focus for the airline include soft skills training for frontliners and on-board offerings such as seats, food and in-flight entertainment. Engagement with Skytrax commenced in June 2017 with a final audit expected to be completed in late 2018.

Malaysia Airlines has continued investing in aircraft, products, service and technology as a core principle of its transformation programme. One of the initiatives rolled out in quarter two has been new menus on the domestic and regional sectors with more emphasis on Malaysian and Asian dishes, which have received encouraging response thus far. To ensure that Malaysian Hospitality begins on board, the airline has introduced classic Malaysian dishes to its menu such as Hainanese Chicken Rice, Nyonya Fish Curry and Yong Tow Foo. For the Hari Raya celebrations, Malaysia Airlines also offered satay to its Economy Class passengers on all domestic flights which offer hot meals. Other recent F&B improvements include menus with seasonal influences on the airline’s Kuala Lumpur- London flights.

The airline has also commenced work on the upgrading of the domestic and regional lounges in Kuala Lumpur International Airport (KLIA), which are expected to be completed by the Q4 2017. These upgrades will be progressively rolled out to cover the international lounge in the satellite terminal at KLIA, as well as the Malaysia Airlines lounge in London Heathrow.

Technology driven company

The successful implementation of Information Technology is key to the turnaround with IT being an important tool in improving the airline’s customer experience and overall operational efficiency. The airline has almost completed 70% of its overall planned IT transformation, which began in March 2016.

MAG has now entered into the third phase of its digital transformation with the launch of its first innovation lab, known as iSpace. The lab, which was launched by the Minister of Science, Technology and Innovation, Datuk Seri Panglima Wilfred Madius Tangau, will serve as a testing ground for staff to incorporate multifaceted aspects of digital solutions, which will benefit the airline’s guests.

Already there have been a number of impressive prototypes and apps being developed by the winning teams of the MAB Hackathon, a competition held in February 2017 to promote innovation in technology. Collaboratively, the winning solutions, generated by the MAB Hackathon, include the tracking of unaccompanied minors, an interactive social media app that offers passengers personalized content, an app that provides key destination information on tours and trips, as well as an upgrade bidding app which can be used on mobile devices. These apps have the potential to add tremendous value to the airline’s product offerings.

The quarter also saw the successful migration of the airline’s new passenger sales system (PSS) to the Amadeus system. The PSS cutover was completed in record time of less than 12 months compared to approximately 2 years for other carriers. The new PSS is now stabilized, with minimal issues encountered during weeks that followed and without the expected dip in bookings that typically follows any major systems cutover.

The new system will enable the airline to offer customers enhanced speed and convenience, a more intuitive web booking experience, state-of-the-art mobile applications and offers to suit individual needs.

Expansion in Asia

Throughout 2017, the airline will commence its expansion of 11 new routes to China. The quarter saw new services to Wuhan, Fuzhou and Nanjing. Services from Kuala Lumpur to Chengdu and Chongqing are targeted to be launched by the Q4 2017.

The airline will also be introducing three extra flights to Seoul, bringing the route frequency up to ten flights a week from seven. Other planned improvements will include a service upgrade, for the night Kuala Lumpur-Mumbai sector, with the widebody Airbus 330 replacing the Boeing 737.

Enhancing corporate governance

The Business Integrity unit achieved several milestones in the quarter towards a more transparent and accountable Group. Over 3,000 employees have now been trained by the Knowledge Management Unit, set up to ensure understanding by staff on all policies within the group including fraud and wildlife trafficking. This has seen significant improvements towards a culture of compliance with over 2000 declarations made in the past six months against 97 in January of this year. Warning letters have also been issued for Procurement non-compliance matters, a first for the Group, stressing the zero tolerance stance of the Group.

Investing in a talent pipeline and local succession planning

As part of an initiative to institutionalise the Group’s performance management system (PMS), a series of workshops and clinics were conducted for all employees. To date, approximately 2,500 employees, from executives to general managers, have been trained on KPIs and target setting.

In addition, as part of the Group’s focus on leadership development and succession planning, 389 leaders within MAG have been trained on building and strengthening their leadership skills and capabilities. Plans are underway to roll out the initiative to the middle management group, executives, senior executives and assistant managers.

The Group is continuously sourcing and identifying talent to join the organization to ensure a strong talent pipeline. In this second quarter of the year, the Group participated in the Malaysian career fair Aspire, which over 5,000 potential candidates attended. A university outreach programme was also held with Sunway University, Kolej Kemahiran Tinggi Mara (KKTM), and UNITEN.

The first Works Council Conference of the year took place in April. The session served as a platform to share information about the business as well as raise awareness on employee issues. The council has enabled the airline to implement change more rapidly and efficiently with a closure rate of 82% on issues raised as of May 2017.

Outlook

The Group maintains its cautious outlook in fiscal year 2017. The aggressive price war on the domestic market is expected to continue with a weak Ringgit and increased fuel prices adding to an already challenging cost environment. Advance bookings are far stronger in 2017 than 2016, but the airline is seeing yield pressure across all routes as low fares are available from many legacy carriers as well as the traditional low cost carriers. For Malaysia Airlines, the market is diverging with consistent growth and improvement on international services, but a loss of market share domestically where fares are increasingly low. The Group will continue to be prudent in controlling capacity and has already scaled back on domestic route frequencies allocating the Group’s aircraft where MAG sees the best potential returns. The airline is still on track to be profitable in 2018.