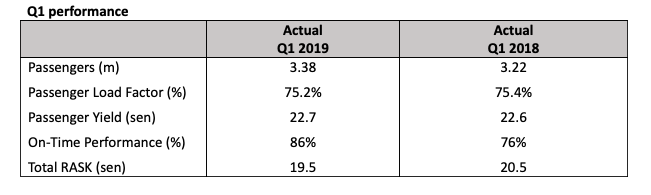

· 2% revenue improvement YoY

· Load factor remained steady at 75.2% attributed to aggressive sales initiatives on the back of much softer market

· Excellent on-time performance (OTP) for the quarter at 86%, an improvement of 10 percentage points YoY

· Customer Satisfaction Index up 2 percentage points YoY and Net Promoter Score up 14 points from a year ago

KLIA, 14 June 2019: Malaysia Airlines Berhad (MAB) reported a year-on-year (YoY) revenue improvement of 2% in the first quarter ended 31 March 2019 on the back of increased available seat kilometres driven by a 8% increase in domestic and international capacity.

Load factor was unchanged at 75.2% as the airline matched increase in capacity with market demand. The airline saw a marginal growth in yield on the back of the added capacity and a positive passenger growth of 5%.

The quarter saw improvement in ancillary revenue following initiatives that allow passengers greater choice and flexibility. This, coupled with competitive pricing for products such as prepaid baggage and seat selection and other ancillary products, saw an increase in ancillary revenue by 23% YoY. The airline also noted a large increase in passengers accessing the three Golden Lounges in KLIA following refurbishments and improvements in offerings.

The airline achieved an excellent On-time Performance (OTP) of 86% compared to 76% the previous year, a result of improved operational efficiencies overall including network realignment as well as improved technical dispatch reliability and ground handling process.

The uptrend in Customer Satisfaction Index (CSI) and Net Promoter Score (NPS) continues following significant improvements in cabin, boarding and check-in services as well as website and mobile app experience.

Group CEO Izham Ismail said: “Notwithstanding an improvement in our Q1 operational performance in comparison to last year, we expect 2019 to remain extremely challenging. The competitive environment is expected to continue to tighten in 2019 given, driven by overcapacity in the region as well as domestic. This is largely driven by the price-sensitive leisure market which directly impacts yield. While the airline has hedged against fuel and forex, we will continue to be impacted by such external volatilities including the ongoing trade war between the US and China, and does not foresee to breakeven this year.

Our key focus remains to continue driving revenue improvements through enhanced product and service offerings focusing on what our passengers value, while driving cost optimisation. The efforts in improving customer experience is reflected in our CSI and NPS. We also achieved solid operational stability with OTP, disruption management and mishandled baggage which have shown significant improvements.

Looking ahead, our forward booking looks much stronger compared to last year as the airline continues to strengthen our sales channels including the travel trade partners and build on existing products such as MHexplorer. The rest of the year will also see the airline looking to build revenue via other methods beyond traditional ticket sales which will include deeper collaborations with our partners.”

Early in the year, Malaysia Airlines launched Amal, a pilgrim-centric service dedicated for Hajj and Umrah, in a ceremony graced by Malaysia’s Minister of Economic Affairs, Yang Berhormat Dato’ Seri Mohamed Azmin Ali. Amal by Malaysia Airlines commenced its first service in October 2018 and operates up to three daily flights to Jeddah and Madinah on the A380-800 aircraft.

The national airline was made official airline partner of Team MAS and the Footbal Association of Malaysia (FAM), to fly national athletes and football teams Harimau Malaya and Harimau Muda to and from their competitions on the world stage. The partnerships also include marketing and promotional activities.

Malaysia Airlines reinstated its daily service to Kochi on the Boeing 737-800 aircraft at the end of the quarter. Kochi is the sixth Indian city the airline flies to besides New Delhi, Mumbai, Chennai, Bengalore and Hyderabad.