• Tough competition, rising fuel costs and unfavourable currency conditions continue

• Quarter 3 impacted by crew shortage

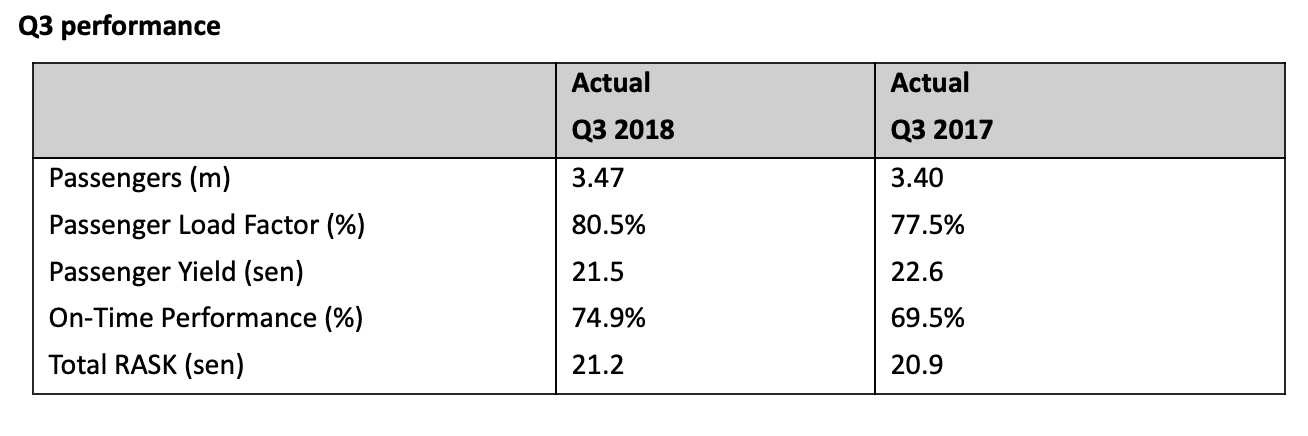

• RASK remained steady, increasing 1.4% YoY

• Passenger Load Factors saw healthy increase at 80.5%

• On-time performance continues to improve at 74.9% up 8% YoY

• Customer satisfaction index up 7% YoY

KLIA, 14 December 2018: Malaysia Airlines experienced a challenging third quarter with stiff competition, rising fuel prices and adverse foreign exchange movements, further exacerbated by crew shortages, especially in July and August.

Yield came under pressure in quarter three. This was in part due to the inability to deploy planned peak up-grading of aircraft to a widebody during the period, as a result of crew shortages which impacted revenue. The airline has since activated an extensive recruitment exercise, supported by an aggressive cadet enlistment and training programme to build a strong pipeline of crew and is confident that the situation will be stabilised by early 2019.

Notwithstanding the challenging operating environment, total Revenue Average Seat per Kilometer (RASK) remained resilient with an increase of 1.4% year-on-year (YoY). This was mainly driven by higher cargo revenue, up 29% YoY. On-time performance (OTP) also increased during the quarter, up by 8% YoY, as a result of improved operational efficiencies in engineering and ground handling.

Continued focus on improving customer experience and enhancing the product offering has seen an overall improvement in Customer Satisfaction Index (CSI), which was up 7% YoY, with the airline’s Net Promoter Score (NPS) increasing by a significant 21 points in the period. This was, in part, driven by improvements to the airline’s call centre which introduced an ‘After-Call Survey’ to obtain immediate customer feedback. Call centre satisfaction ratings are up 7% to 74%.

Malaysia Airlines became the first airline in Malaysia, and amongst only a small number globally, to launch on WhatsApp. Customers can now receive their booking confirmation and flight status via the messaging app, with a view to expand the range of notifications delivered in 2019. The airline also launched MHchat, a new feature designed to help travellers book flights, retrieve bookings and ask questions round the clock via Facebook Messenger.

Passenger load factors also increased in the quarter up by 3% with Malaysia Airlines. Recovery in international business continued in the quarter with a load factor of 81.7% in 2018 versus 78.4% in 2017.

Fleet developments during the period include the addition of the airline’s sixth A330-200 to its fleet of 21 A330s deployed on higher density regional routes across Asia Pacific. The B737-800s continue to provide domestic and regional connectivity while the airline prepares for delivery of 10 B737 MAX8 in 2020.

Malaysia Airlines’ A380-800s continue to service Project Amal, a division within Malaysia Airlines dedicated to Hajj and Umrah traffic. The division successfully transported more than 15,000 pilgrims during Hajj on over 80 flights between Kuala Lumpur, Jeddah and Madinah throughout July and September 2018. The airline’s A380s are also deployed to key markets, such as Sydney and Seoul, during peak times.

Group CEO Izham Ismail said: “The third quarter continued to be challenging with volatile fuel prices, unfavourable foreign exchange movements, as well as overcapacity in key markets compounded by the pilot shortage. Nevertheless, in line with our emphasis on customer experience, I believe our efforts in that area continue to show positive traction as evidenced by the improvements in our CSI and NPS ratings.

We are maintaining a strong focus on cost management and will continue to invest in aspects of the customer experience that deliver a competitive edge. Our pioneering digital initiatives, including the recently launched WhatsApp Business solution, exemplify this.

We have seen good quarterly traction in the year and we are expecting to finish 2018 by reducing the losses of the previous year. Moving forward, 2019 looks similarly challenging but we remain committed to improving performance and reducing costs whilst managing external factors beyond our control.”