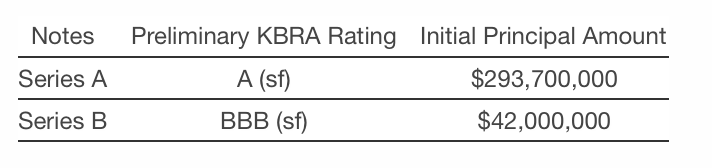

Kroll Bond Rating Agency (KBRA) assigns preliminary ratings to two classes of notes (the “Notes”) issued by Willis Engine Structured Trust III.

Proceeds from the Notes will be used to acquire 56 engines (the “Portfolio”), 51 of which are on lease to 27 lessees located in 20 countries, along with 5 engines currently not subject to a lease agreement. The Portfolio has an initial value of approximately $419.6 million, based on the average of the half-life base values provided by three appraisers as of May 31, 2017 and adjusted for maintenance conditions as determined by ICF SH&E, Inc. as of April 2017. This is the Company’s first transaction rated by KBRA.

Willis is engaged in the leasing and management of its own aircraft engines and aircraft under operating leases. As of May 31, 2017, Willis owned 216 aircraft engines and related equipment (including the initial Portfolio), 13 aircraft and 5 spare parts packages. In addition to its owned portfolio, as of May 31, 2017, Willis and its affiliates managed a total lease portfolio of 437 additional aircraft engines and related equipment for third parties, which includes Willis Engine Securitization Trust II, a securitization issued in 2012.

The transaction benefits from sufficient credit enhancement and liquidity, as well as a dynamic structure that accelerates principal payments on the Notes in the event of weak performance.

KBRA analyzed the transaction using the Aviation ABS Methodology published on October 26, 2016.

For complete details on the analysis, please see KBRA’s Pre-Sale Report, Willis Engine Structured Trust III, which was published today at www.kbra.com.

The preliminary ratings are based on information known to KBRA at the time of this publication. Information received subsequent to this release could result in the assignment of final ratings that differ from the preliminary ratings.