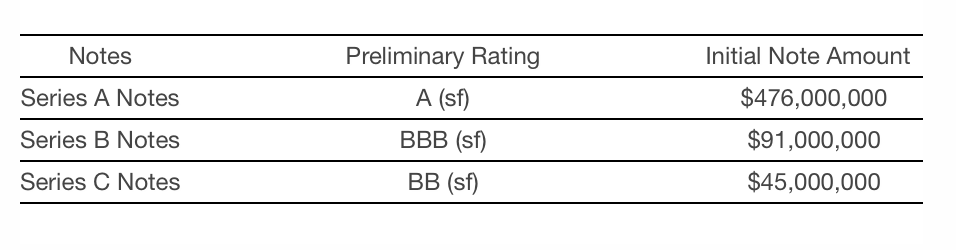

Kroll Bond Rating Agency (KBRA) assigns preliminary ratings to three series of notes (the “Notes”) issued by Horizon Aircraft Finance I Limited (“Horizon Cayman”) and Horizon Aircraft Finance I LLC (“Horizon USA”, and, together with Horizon Cayman, “Horizon”, or the “Issuers”).

This transaction represents the second term securitization of aircraft managed by BBAM Aviation Services Limited (“BBAM”) and the first rated by KBRA. BBAM was founded in 1989 and has grown from 30 to over 150 full time staff members with an established infrastructure, including teams focused on technical asset management, origination and remarketing, legal, finance/accounting and capital markets. BBAM is owned by the management team (35%), Onex Partners (35%) and GIC (30%). BBAM has managed a diversified portfolio for third party clients, and created the third largest managed aircraft fleet globally with more than 500 aircraft. BBAM and BBAM US LP (the “Servicers”) will act as servicers for the transaction.

Proceeds from the sale of the Notes, together with the equity proceeds, will be used to acquire 29 aircraft (the “Portfolio”) on lease to 21 lessees located in 19 countries. As of September 30, 2018, the initial weighted average aircraft age of the Portfolio is approximately 9.8 years with a weighted average remaining lease term of approximately 3.4 years. The Portfolio consists 100% of narrowbody aircraft and has an initial value of approximately $737.7 million.

The transaction benefits from sufficient credit enhancement and liquidity, as well as a dynamic structure that accelerates principal payments on the Notes in the event of weak performance. The preliminary ratings are based on information known to KBRA at the time of this publication. Information received subsequent to this release could result in the assignment of final ratings that differ from the preliminary ratings.