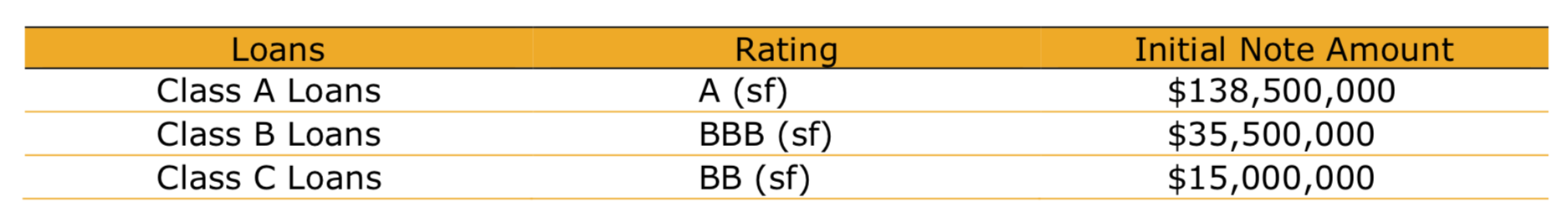

NEW YORK, NY (December 4, 2018) – Kroll Bond Rating Agency (KBRA) assigns final ratings to three classes of loans (the “Loans”) issued by Vx Cargo 2018-1 Trust (“CARGO 2018-1” or the “Borrower”).

CARGO 2018-1 represent Vx Capital Partners, LLC’s (“Vx”, the “Servicer” or the “Company”) inaugural securitization. KBRA notes that Vx will service CARGO 2018-1 via an affiliate, Vx Freighter Investment Management, LLC (the “Servicer”) and will be retaining the equity in the transaction, also via an affiliate.

Proceeds from the Loans will be used to acquire 35 freighter aircraft, including 33 737-400SF and two 737-300SF (the “Portfolio”), which is the first aircraft ABS transaction consisting 100% of narrowbody freighter aircraft. The Portfolio is on lease to 12 lessees located in 10 countries and currently has three aircraft not subject to a lease agreement, including two aircraft each subject to LOI for lease and one aircraft being marketed for lease. As of October26, 2018, the Portfolio had a weighted average remaining lease term of approximately 4.3 years, with approximately 9.5% of the Portfolio initially not subject to a lease. As of Q3 2018, the Portfolio has an initial value of approximately $249.9 million, based on the average of the half-life base values provided by three appraisers as of August 2018, with adjustments for maintenance condition provided by ICF as of September 2018. The Portfolio has an aggregate current market value of approximately $283.6 million, which is 13.5% greater than the maintenance adjusted base value.