London/Dublin/Tokyo/Paris - June 13th 2019: IBA Group, the specialist data intelligence provider and leading aviation consultancy, predicts that Paris Airshow orders could be as low as half of 2018’s yield. Dr Stuart Hatcher, Chief Operating Officer, MD-Aviation Services for IBA predicts that Firm and MoU orders combined could be as low as 450, Airbus will potentially launch the A321XLR, and Boeing will not launch the NMA but will set out the re-entry programme of the 737 MAX in more detail.

“To set the scene, 2019 is not shaping up to be a good year on the order front which is not particularly surprising given the headwinds,” comments Dr Hatcher. “Already, year to date, we have an unprecedented number of aircraft returning from failed operators as traffic growth slows, yields continue to soften from an historical low point, fuel costs increase across the medium term and forex is far from ideal. Aside from these economic points, 737 MAX grounding and the China-US Trade problems add to the woes.”

“Despite this doom and gloom, we must stress that the industry remains resilient as the numbers of consumers that can afford to travel continues to grow and all the facets required to support that (such as leasing) will grow and evolve with it. Potential risks are high, and with that comes a greater need to be diligent.”

To summarise IBA Group predicts general activity for this year as follows:

Airbus to potentially launch the A321XLR

Boeing to not launch the NMA quite yet

Boeing to set out the re-entry of the 737 MAX in more detail

Mitsubishi to launch the MRJ70 to optimise for scope clause compliance

DHC to make some noise on the purchase of the Q400 program

Sukhoi need to quash safety concerns and aftermarket support problems

For orders, we are expecting to see:

Airbus: New orders from the US majors for the A321XLR; a new order by Saudi Arabian Airlines for both A350s (to replace the 777-200ERs) and A320neos/A321neos; a potential large order from IndiGo for the XLR to take advantage of the vacuum left by Jet Airways; Air France surely must make an order for new narrowbody aircraft soon (along with a replacement for the ageing 777-200ERs and A330s)and Korean and Thai could be in the mix for some A330neos and A350s, as they need to look at ways to curtail operating costs.

Boeing: Strong focus on military orders, service contract wins, potentially a number of top-up 787 orders and some new 787 and 777X orders from legacy carriers in the Far East and Europe (like Air France, Thai & Korean). A potential 737 MAX order (Ryanair?) to top-up a previous order wouldn’t be a surprise either. Freighters were the big winner last year, and there is still some way to go before the backlog gets anywhere near replacement level, so we expect more orders here.

Mitsubishi: Conversion of some MRJ90 orders to the new “MRJ76, and some new wins from the US market looking to replace older technology.

ATR & DHC: We expect a very small number of new orders <20 for each program.

Embraer: Additional E175-E1 orders and some E195-E2 orders.

Comac, Irkut, Sukhoi: Nothing of note is expected.

Lessors: We expect to see no more than 20% of the firm Airbus A320 orderbook as yields remain challenging. ALC are the usual suspects to jump in early and get a launch order in.

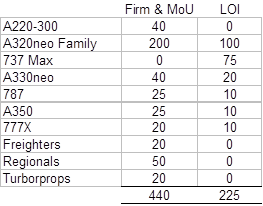

And finally, the order numbers….