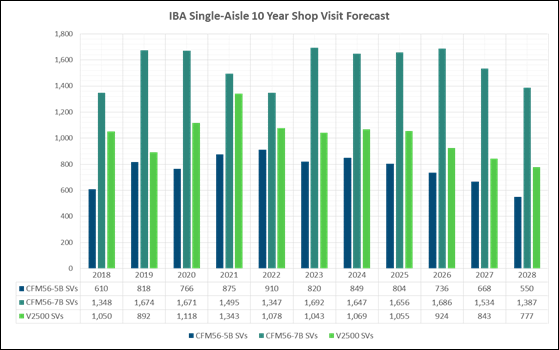

London/Dublin, May 9th 20I8: IBA, the leading aviation consultancy stimulated lively debate at last week’s Engine Leasing, Trading & Finance Conference in London. Operators and lessors alike were equally concerned by IBA’s prediction that the engine lease market will not be able to support the 25-35% increase in shop visit rates forecast for CFM56-7B and -5B engines and continuing strong demand for V2500’s in the period 2019-2024. There is currently very limited availability of spares and unless more spare engines are generated by retirements and aircraft teardowns, or airline held spare stock absorbs some of the demand, IBA expect engine inductions and longer TATs will create a log jam further intensified by the impact of compound shop visits i.e. first run, second run and third run overlapping.

The problem is exacerbated for MROs and operators because there are so many of this engine type flying. Strong performance on wing has delayed shop visits over the past years but now demand is out-stripping supply. Quality engine shops worldwide are edging towards full capacity, allowing little room for flexibility to cope with the unexpected, like new Airworthiness Directives.

IBA’s view on future scheduled shop visit induction has an aircraft/engine retirement forecast built in and considers intervals as predicated by the OEM including environmental impact. It also assumes a specific period of downtime for maintenance which varies according to engine type. The forecast has an allowance for green-time leasing of engines to defer shop visits, this is more notable as the years go by and more availability is expected. IBA is of the opinion that the forecast data predicts an increased requirement for spare engines and to ensure a stable demand.

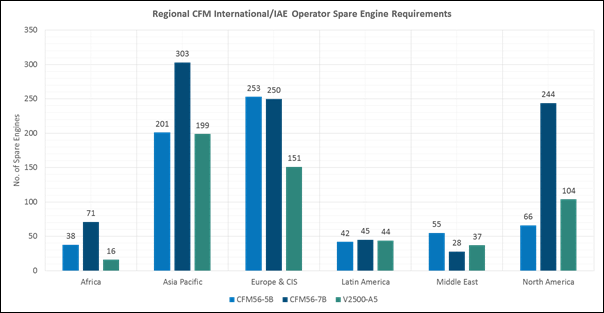

IBA also looked at the current engine fleet size and the number of spare engines required in circulation to support the fleet. It assumes regional intervals predicated by the OEM and the minimum requirements of spare engines across operating airlines. As expected, due to the number CFM56-5B/-7B and V2500 in those regions, Asia-Pacific, Europe and North America have greatest requirement for spare engines.

Limited availability of spare parts could mean longer downtime during maintenance compounded by a longer wait and higher pricing for those parts, plus possible increases in lease rates too. The problem eases by 2024 onwards says IBA when the numbers of A320ceo and B737NG aircraft retiring each year will release engines onto the market for part-out or redeployment.