NINE MONTHS RESULTS ANNOUNCEMENT

International Consolidated Airlines Group (IAG) today (October 26, 2018) presented Group consolidated results for the nine months to September 30, 2018.

IAG period highlights on results:

Third quarter operating profit €1,460 million before exceptional items (2017 restated(1): €1,450 million)

Net foreign exchange operating profit impact for the quarter adverse €111 million

Passenger unit revenue for the quarter up 1.3 per cent, up 2.4 per cent at constant currency

Non-fuel unit costs before exceptional items for the quarter up 0.5 per cent, down 0.7 per cent at constant currency

Fuel unit costs for the quarter up 14.3 per cent, up 15.0 per cent at constant currency

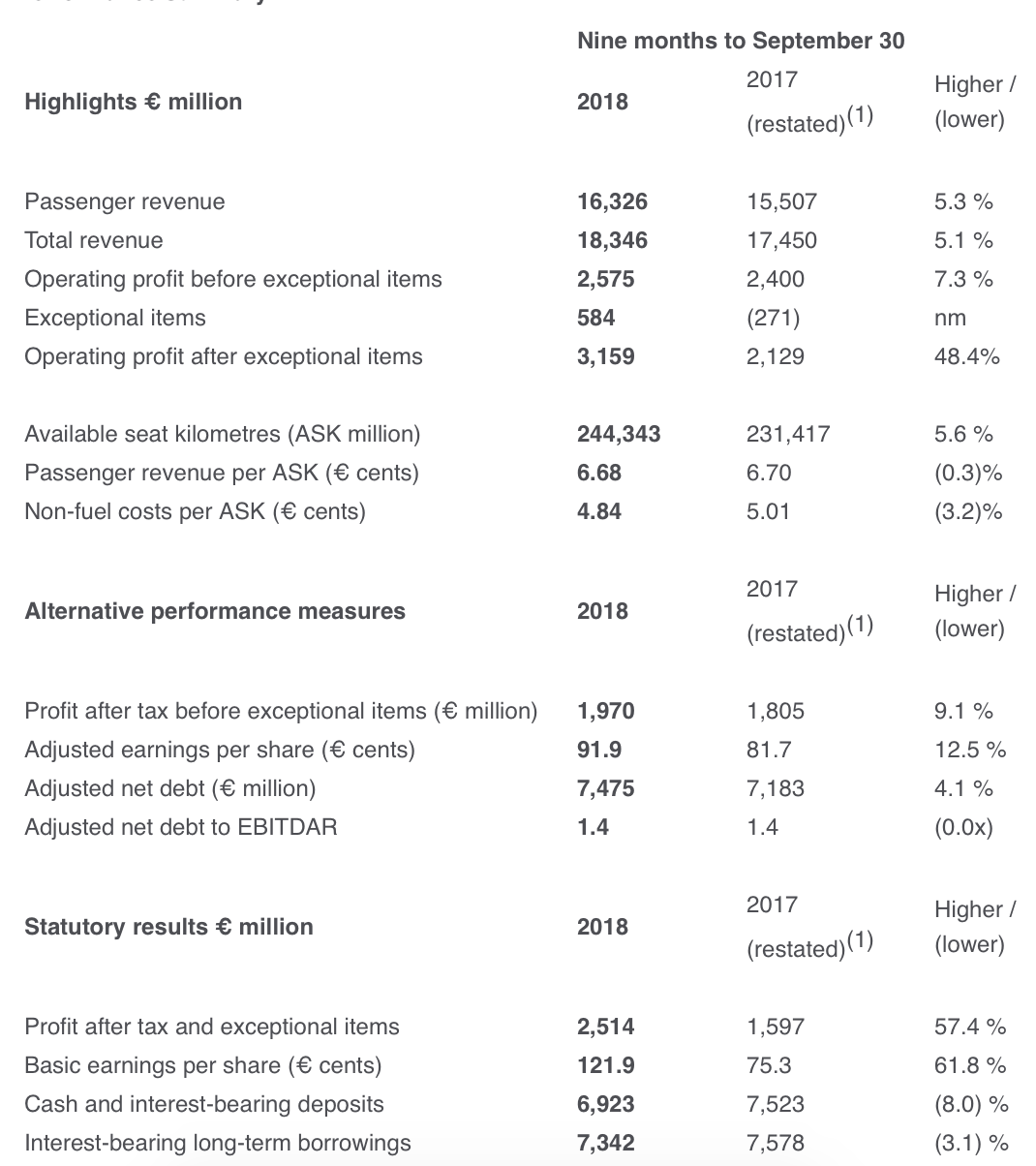

Operating profit before exceptional items for the nine months period €2,575 million (2017 restated(1): €2,400 million), up 7.3 per cent

Completion of second €500m share buyback programme on October 24

Interim dividend of 14.5 euro cents per share

Performance summary:

For definitions refer to the IAG Annual report and accounts 2017.

(1)Restated for new accounting standards IFRS 15 ‘Revenue from contracts with customers’ and IFRS 9 ‘Financial instruments’.

Willie Walsh, IAG Chief Executive Officer, said:

“We’re reporting a good quarter 3 performance with an operating profit of €1,460 million before exceptional items, up from €1,450 million last year.

“These were strong results despite significant fuel cost and foreign exchange headwinds. At constant currency, our passenger unit revenue increased by 2.4 per cent while non-fuel unit costs went down 0.7 per cent.

“We’re pleased to announce an interim dividend of 14.5 euro cents per share and this week we completed our second €500 million share buy-back programme”.

Trading outlook

At current fuel prices and exchange rates, IAG expects its operating profit before exceptional items for 2018 to show an increase of around €200m from a base of €2,950m in 2017. Both passenger unit revenue and non-fuel unit costs are expected to improve at constant currency for the full year.