International Consolidated Airlines Group (IAG) today (October 27, 2017) presented Group consolidated results for the nine months to September 30, 2017.

IAG period highlights on results:

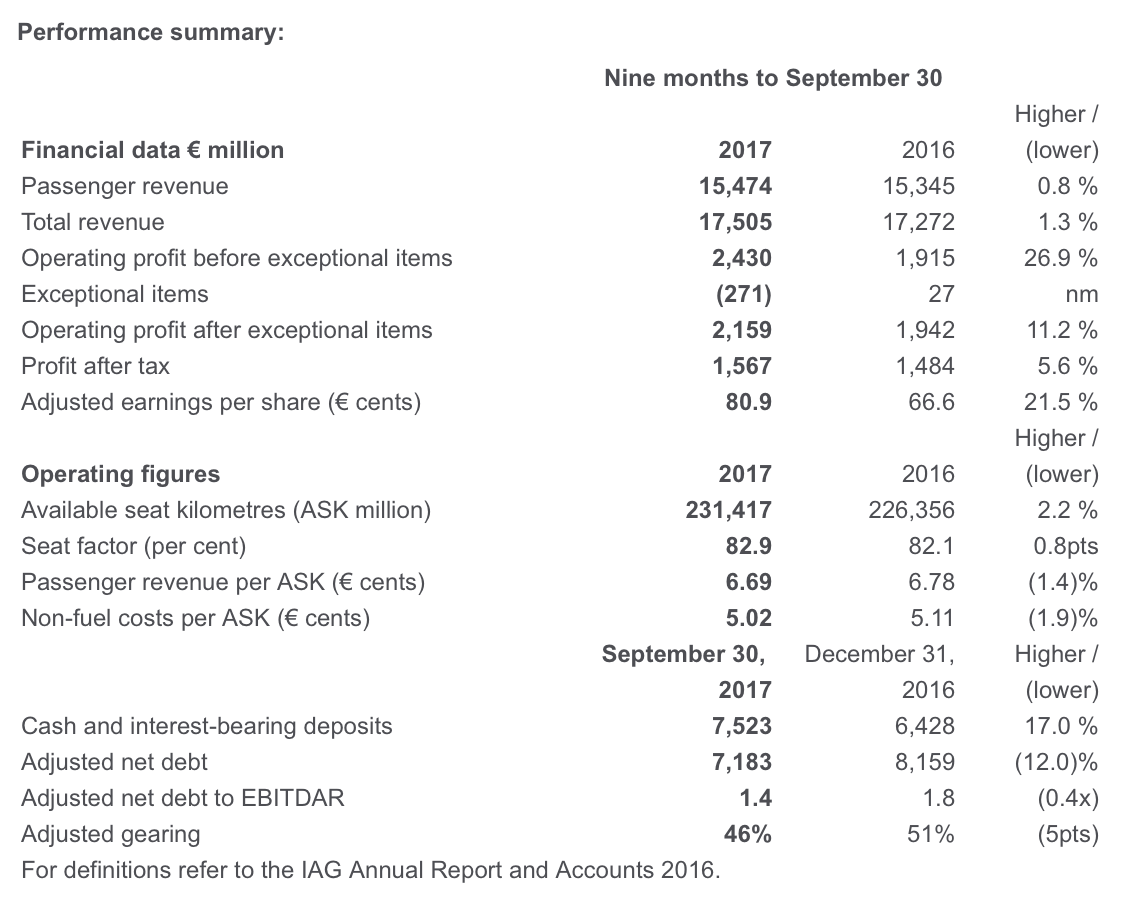

- Third quarter operating profit €1,455 million before exceptional items (2016: €1,205 million)

- Passenger unit revenue for the quarter up 0.7 per cent, up 2.2 per cent at constant currency

- Non-fuel unit costs before exceptional items for the quarter down 1.7 per cent, up 2.5 per cent at constant currency

- Fuel unit costs before exceptional items for the quarter down 7.5 per cent, down 8.4 per cent at constant currency

- Operating profit before exceptional items for the period of nine months to September 30, 2017 €2,430 million (2016: €1,915 million), up 26.9 per cent

- Cash of €7,523 million at September 30, 2017 was up €1,095 million on 2016 year end

- Adjusted net debt to EBITDAR improved by 0.4 to 1.4 times

Willie Walsh, IAG Chief Executive Officer, said:

“We’re reporting another strong quarter with an operating profit up 20.7 per cent to €1,455 million before exceptional items.

“All our companies performed well. Passenger unit revenue was up 2.2 per cent at constant currency boosted by improvements in the Spanish and Latin American markets. Our commercial performance was good despite underlying disruption from severe weather and terrorism. IAG Cargo improved in the quarter due to stronger Asia Pacific demand compared to last year.

“We’re pleased to announce an interim dividend of 12.5 euro cents per share.”

Trading outlook

At current fuel prices and exchange rates, IAG expects its operating profit for 2017 to be around €3 billion before exceptional items.

This announcement contains inside information and is disclosed in accordance with the Company’s obligations under the Market Abuse Regulation (EU) No 596/2014.

Enrique Dupuy, Chief Financial Officer