Hawaiian Holdings, Inc. (NASDAQ: HA) (the "Company"), parent company of Hawaiian Airlines, Inc. ("Hawaiian"), today reported its financial results for the second quarter of 2018.

"Our second quarter performance reflects our continued position as the carrier of choice for Hawai'i," said Peter Ingram, Hawaiian Airlines president and CEO. "The Hawaiian team showed their mettle yet again, producing solid financial and operational results in a quarter marked by rising fuel prices, elevated industry capacity, and headline-grabbing volcanic activity on the Big Island of Hawai'i. We generated more revenue and carried more guests than in any second quarter in our history by executing our plan and running a safe and reliable airline. I couldn't be more proud of my colleagues."

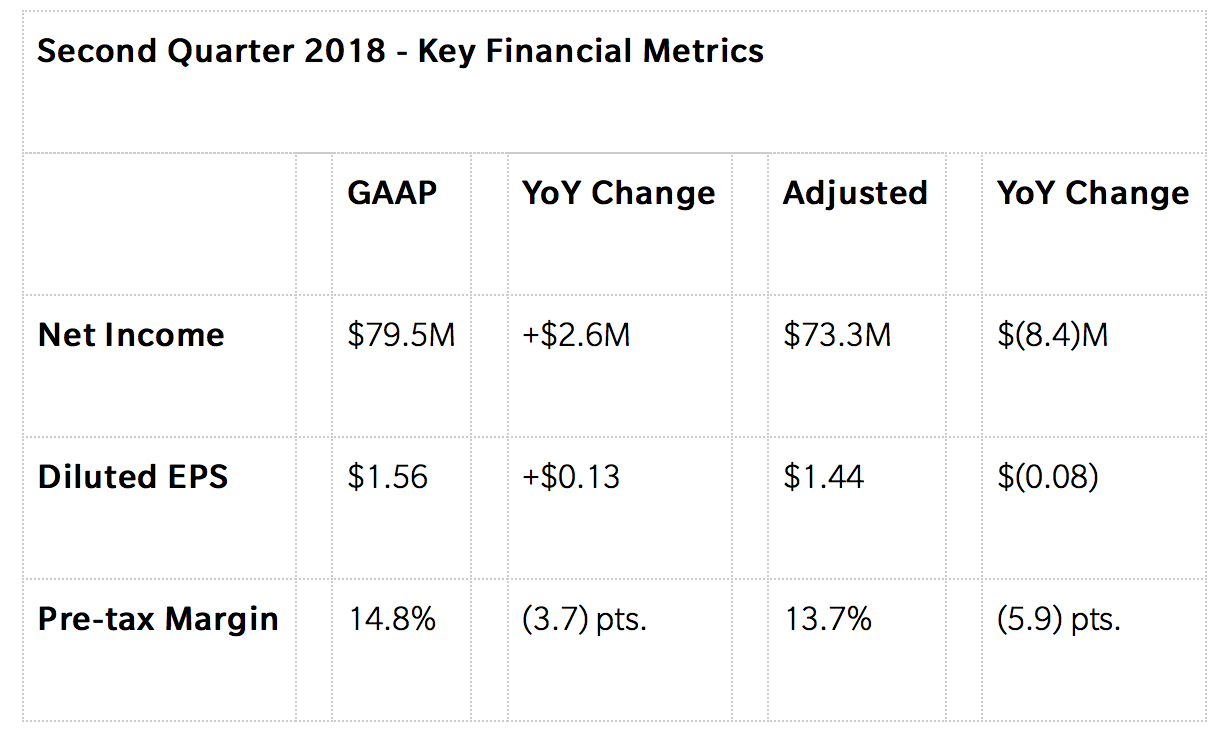

Statistical information, as well as a reconciliation of the non-GAAP financial measures, can be found in the accompanying tables.

Shareholder Returns, Liquidity and Capital Resources

As of June 30, 2018, the Company had:

Unrestricted cash, cash equivalents and short-term investments of $593 million

Outstanding debt and capital lease obligations of $692 million

The Company returned $8.6 million to shareholders in the second quarter through $6.1 million in dividends and $2.5 million in share repurchases.

On July 20, 2018, the Company's Board of Directors declared a quarterly cash dividend of 12 cents per share to be paid on August 31, 2018, to all shareholders of record as of August 17, 2018.

Second Quarter 2018 Highlights

Leadership and People

Welcomed Jim Lynde as Senior Vice President, Human Resources, and Rob Sorenson as Vice President, Marketing and E-Commerce. Promoted Beau Tatsumura to Vice President, Maintenance and Engineering.

Operational

Carried more than 3 million guests across its network, a record for the second quarter.

Partnerships

Together with Japan Airlines, filed an application with the U.S. Department of Transportation (DOT) and Japan's Ministry of Land, Infrastructure, Transport and Tourism (MLIT) seeking antitrust immunity to create a joint venture that promises significant consumer benefits and the opportunity for service expansion. The antitrust immunized joint venture will build upon the broad codeshare partnership the two carriers initiated in March 2018.

New Routes and increased frequencies

Expanded its routes to Southern California with the launch of new daily non-stop service between Long Beach Airport (LGB) and Honolulu's Daniel K. Inouye International Airport (HNL).

Announced expanded seasonal winter service to International destinations, including:

increasing non-stop service between Seoul's Incheon International Airport (ICN) and Honolulu (HNL) to daily flights between mid-January and early-February 2019; and

increasing non-stop service between Sapporo's New Chitose Airport (CTS) and Honolulu (HNL) with up to five weekly flights during the first half of February 2019.

Announced expanded service to Northern California with new daily non-stop flights between Sacramento International Airport (SMF) and Maui's Kahului Airport (OGG) beginning April 2019.

Product and Loyalty

Completed remodeling its Airbus A330 fleet with lie-flat premium seats and increased Extra Comfort capacity.

Together with Barclays, Mastercard, and Bank of Hawai'i, launched an enhanced Hawaiian Airlines World Elite Mastercard and Hawaiian Airlines Business Mastercard that allow cardmembers to earn more miles faster and embark on their next vacation sooner through a refreshed rewards structure.

Fleet and Financing

Subsequent to quarter end, secured its next long-haul aircraft with the signing of a definitive purchase agreement with Boeing for the purchase of 10 Boeing 787-9 aircraft, including purchase rights for an additional 10 aircraft.

Took delivery of four Airbus A321neo aircraft between May and June, increasing the size of its Airbus A321neo fleet to six aircraft.

Took delivery of one ATR-42 turboprop aircraft in June, increasing the size of its passenger turboprop fleet to four aircraft.

Entered into two Japanese Yen-denominated debt financings, each collateralized by an Airbus A321neo aircraft.

Third Quarter and Full Year 2018 Outlook

The table below summarizes the Company's expectations for the third quarter ending September 30, 2018, and the full year ending December 31, 2018, expressed as an expected percentage change compared to the recast results for the quarter ended September 30, 2017, or the full year ended December 31, 2017, as applicable.

For the full year ending December 31, 2018, the Company expects its effective tax rate to be in the range of 24% to 26%.

New Revenue Recognition Accounting Standard

As of January 1, 2018, the Company adopted Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers, which affects the Company's accounting for frequent flyer mileage sales, passenger revenue, other operating revenue, and selling costs. The prior periods presented have been recast to reflect adoption of these new standards.

For additional details on the impact of the adoption of the new standards, see the Company's Annual Report on Form 10-K for the year ended December 31, 2017, and the Company's subsequent periodic filings beginning with its Quarterly Report on Form 10-Q for the quarter ended March 31, 2018.