Hawaiian Holdings, Inc. (NASDAQ: HA) (the "Company"), parent company of Hawaiian Airlines, Inc. ("Hawaiian"), today reported its financial results for the first quarter of 2018.

"2018 is off to a great start," said Peter Ingram, Hawaiian Airlines president and CEO. "Despite an uptick in competitive capacity in the first quarter, we generated more revenue and carried more guests than any first quarter in our history. No one should be surprised that Hawaiian rose to the challenge. My colleagues on the ground and in the air are without peer - delivering operational excellence coupled with authentic Hawaiian hospitality. Our outstanding first quarter results would not have been possible without the passion and excellence they bring to this airline. It is an honor to serve with them."

"We are excited for the year ahead, and look forward to continuing to demonstrate that Hawaiian is now, and will remain, the carrier of choice to Hawai'i."

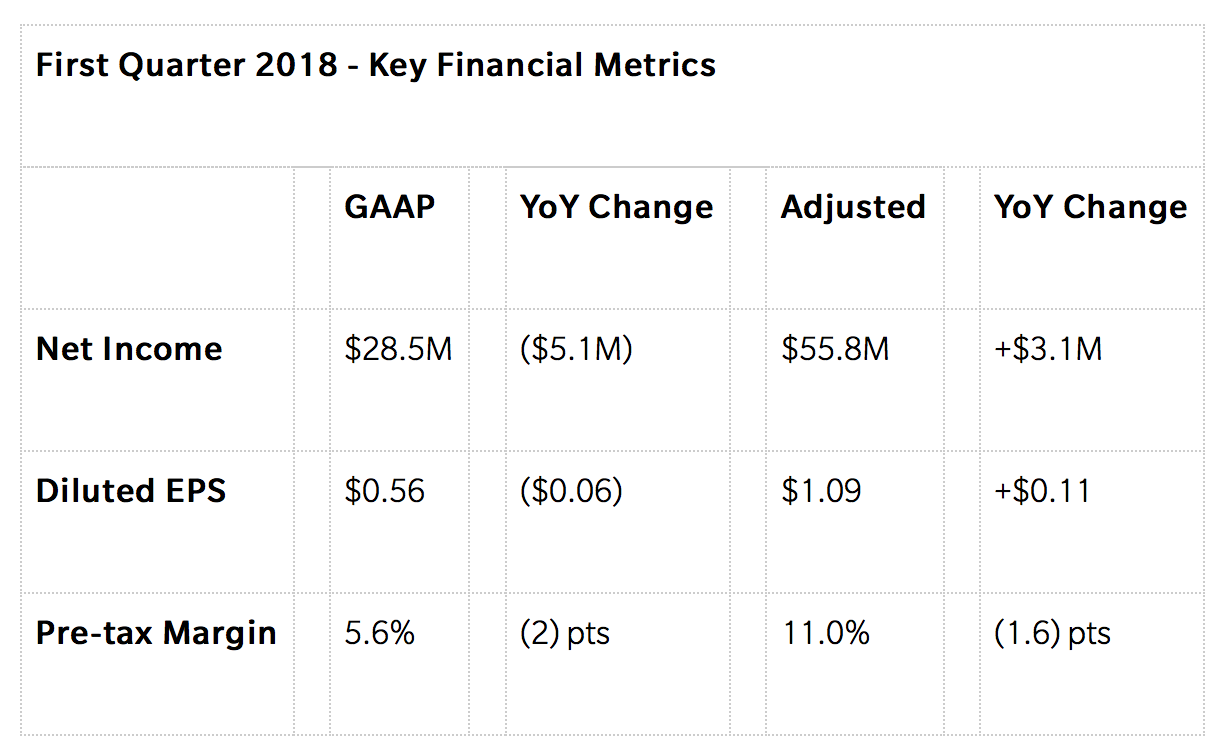

Statistical information, as well as a reconciliation of the non-GAAP financial measures, can be found in the accompanying tables.

Liquidity and Capital Resources

The Company's Board of Directors declared a quarterly cash dividend of 12 cents per share to be paid on May 25, 2018, to all shareholders of record as of May 11, 2018.

The Company repurchased approximately 549,000 shares of its common stock for approximately $20 million in the first quarter, which leaves approximately $80 million remaining under its share repurchase program.

As of March 31, 2018, the Company had:

Unrestricted cash, cash equivalents and short-term investments of $524 million

Outstanding debt and capital lease obligations of $558 million

First Quarter 2018 Highlights

Awards and Recognition

Recognized as a winner in the 2018 TripAdvisor Travelers' Choice™ awards for Airlines across three categories for the North America region, including Travelers' Choice - North America, Travelers' Choice Business Class - North America, and Travelers' Choice Economy Class - North America.

Leadership and People

Effective March 1, 2018, welcomed Peter Ingram as its new president and chief executive officer (CEO) following the retirement of former president and CEO Mark Dunkerley.

Strengthened its senior leadership team with the promotions of John Jacobi to Senior Vice President, Information Technology; Jim Landers to Senior Vice President, Technical Operations; and Brent Overbeek to Senior Vice President, Revenue Management and Network Planning.

Celebrated record-setting results in 2017 by rewarding its more than 6,700 employees with $23.8 million in profit sharing, the largest annual payment in Hawaiian's history.

Operational

Carried nearly 2.9 million guests across its network, a record for the first quarter.

Partnerships

Deepened its reach into Japan by commencing code-share operations with Japan Airlines (JAL) under a new comprehensive partnership between the two airlines.

New Routes

Expanded its routes to the Pacific Northwest with the launch of new daily non-stop service between Portland International Airport (PDX) and Maui's Kahului Airport (OGG).

Expanded its routes to Southern California with the announcement of new daily non-stop flights between Long Beach Airport (LGB) and Honolulu's Daniel K. Inouye International Airport (HNL) beginning May 2018.

Product and Loyalty

Extended its partnership with Barclaycard US, Hawaiian's co-branded credit card partner, under a new agreement through 2024 that includes improved economics for Hawaiian and enhanced product offerings for cardholders.

Fleet and Financing

Selected its wide-body aircraft of the future by executing a non-binding letter of intent with Boeing for the purchase of 10 new 787-9 "Dreamliner" aircraft for delivery starting 2021, with purchase rights for an additional 10 aircraft.

Second Quarter and Full Year 2018 Outlook

The table below summarizes the Company's expectations for the second quarter ending June 30, 2018, and the full year ending December 31, 2018, expressed as an expected percentage change compared to the results for the quarter ended June 30, 2017, or the full year ended December 31, 2017, as applicable.

For the full year ending December 31, 2018, the Company expects its effective tax rate to be in the range of 24% to 26%.