São Paulo, September 17, 2021 - GOL Linhas Aéreas Inteligentes S.A. (NYSE: GOL and B3: GOLL4), (“GOL” or “Company”), Brazil’s largest airline, announces that it has finalized the terms and conditions for the refinancing by GLA Linhas Aéreas S.A., an operating unit of the Company, of R$1.2 billion, with a final maturity in 2024. The participating syndicate is comprised of local banks in Brazil, and the transaction is subject to final approvals and execution of the relevant documents.

The refinancing will conclude GOL’s liability management program and return the Company to its lowest level of short-term debt since 2014 (approximately R$0.5 billion at the end of 3Q21). Through its liability management program, GOL utilized assets on its balance sheet to reduce short-term debt by R$2.1 billion over the 12-month period ended in June 2021. In partnership with its aircraft lease providers, the Company has maintained its aircraft lease liability at approximately 45% of total indebtedness during the same period, with a stable IFRS16 discount rate.

The refinancing of GOL’s short-term debt will extend the average tenor of its liabilities to 3.3 years – an increase of more than two years. The use of proceeds of the refinancing includes: R$592 million applied to the remaining balance of the 7th issue of debentures, R$528 million of export financing lines (Finimps), and R$165 million of working capital credit lines.

“With this transaction, the Company has concluded the largest balance sheet deleveraging among its peers, making it the airline with the lowest liabilities. We can now focus the vast majority of our operating cash flow on sustainable operational growth,” said Richard Lark, CFO.

The transaction will also improve GOL’s credit metrics by better matching future assets and liabilities and reducing the Company’s average cost of debt. Richard Lark added: “We are optimistic that this will be a critical catalyst to restoring GOL’s credit rating to its pre-pandemic level of B/B+ by the three major corporate credit ratings agencies.”

The Company’s disciplined financial management throughout the pandemic strengthened its balance sheet and reduced short-term indebtedness, preserving liquidity to maintain operations. GOL also concluded several other important initiatives to rebalance its capital structure, such as the amortization of its US$300 million Term Loan B, the issuance of US$500 million of Senior Secured Notes due 2026, a R$423 million equity capital increase led by its controlling shareholder, and the acquisition of the minority interest in its Smiles loyalty program.

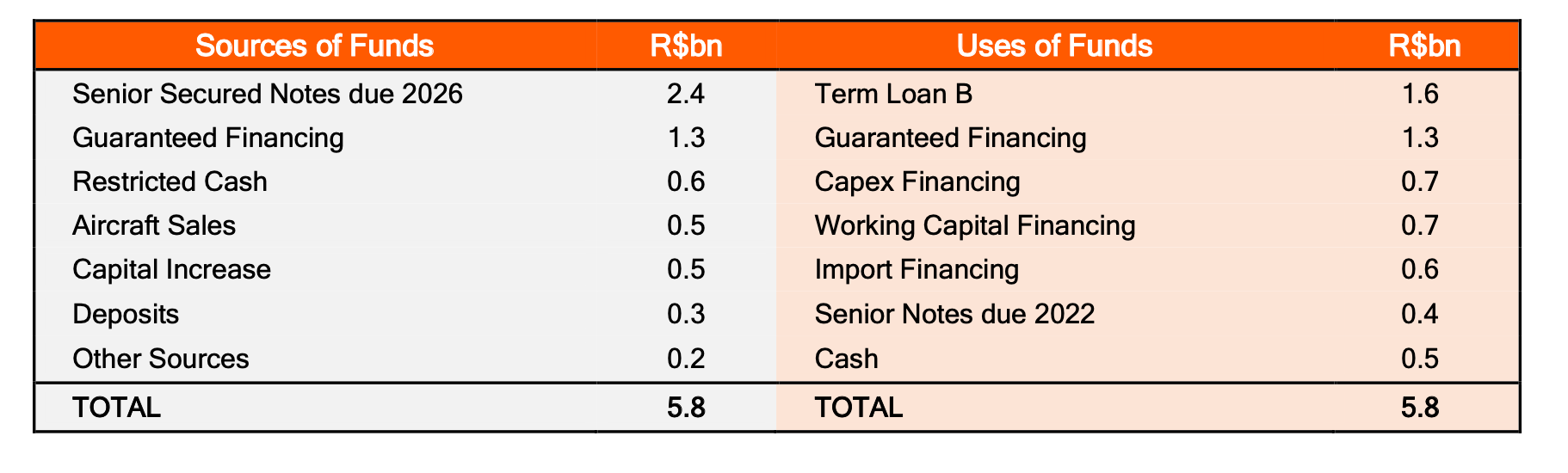

The table below shows the main sources and uses in GOL’s liability management since January 2020.