São Paulo, November 9, 2017 - GOL Linhas Aéreas Inteligentes S.A. ("GOL" or "Company"), (NYSE: GOL and B3: GOLL4), Brazil's #1 airline, announces an increase in its guidance for the full year 2017. The revision is based on 3Q17 financial results and the air traffic figures for 9M17, improved operating and financial performance, and the Company's commitment to capacity discipline.

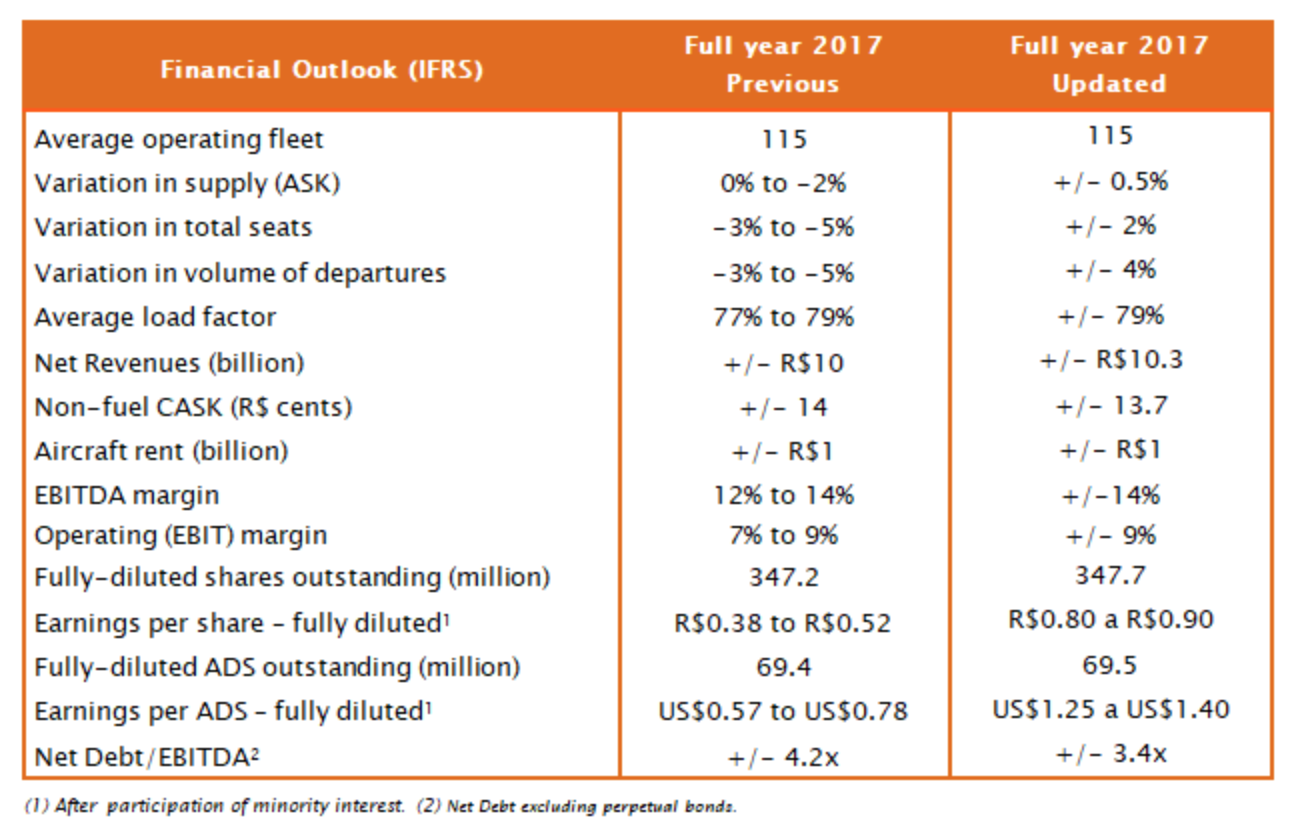

GOL believes it has matched the Company's supply of seats with demand for its air transportation services, as indicated by GOL's consistently high load factors. The 2017 revised guidance (table below) reflects the continuity of this strategy.

The Company's guidance for the full year 2017 is: a variation in ASK of approximately 0.5%, a variation in total seats of 2% and an average load factor of 79%. Full-year CASK ex-fuel is expected to be around R$13.70 cents. GOL expects EBITDA margin near 14%, operating margin of approximately 9%, earnings per share of R$0.80 to R$0.90 and earnings per ADS between R$1.25 and R$1.40. The Company's leverage (Net Debt/EBITDA) is expected to be around 3.4x.

GOL believes that its leadership in rational capacity and yield management, combined with its lowest cost operations and a highest quality passenger service, will enable the Company to increase its competitive advantages and effectively manage passenger demand.