São Paulo, June 19, 2017 - GOL Linhas Aéreas Inteligentes S.A. ("GOL" or "Company"), (NYSE: GOL and B3: GOLL4), Brazil's #1 airline, today announced an increase in its guidance for full year 2017. Such revision is based on 1Q17 financial results and the preliminary air traffic figures for the first five months of the year, improved operating and financial performance, and the Company's commitment to capacity discipline.

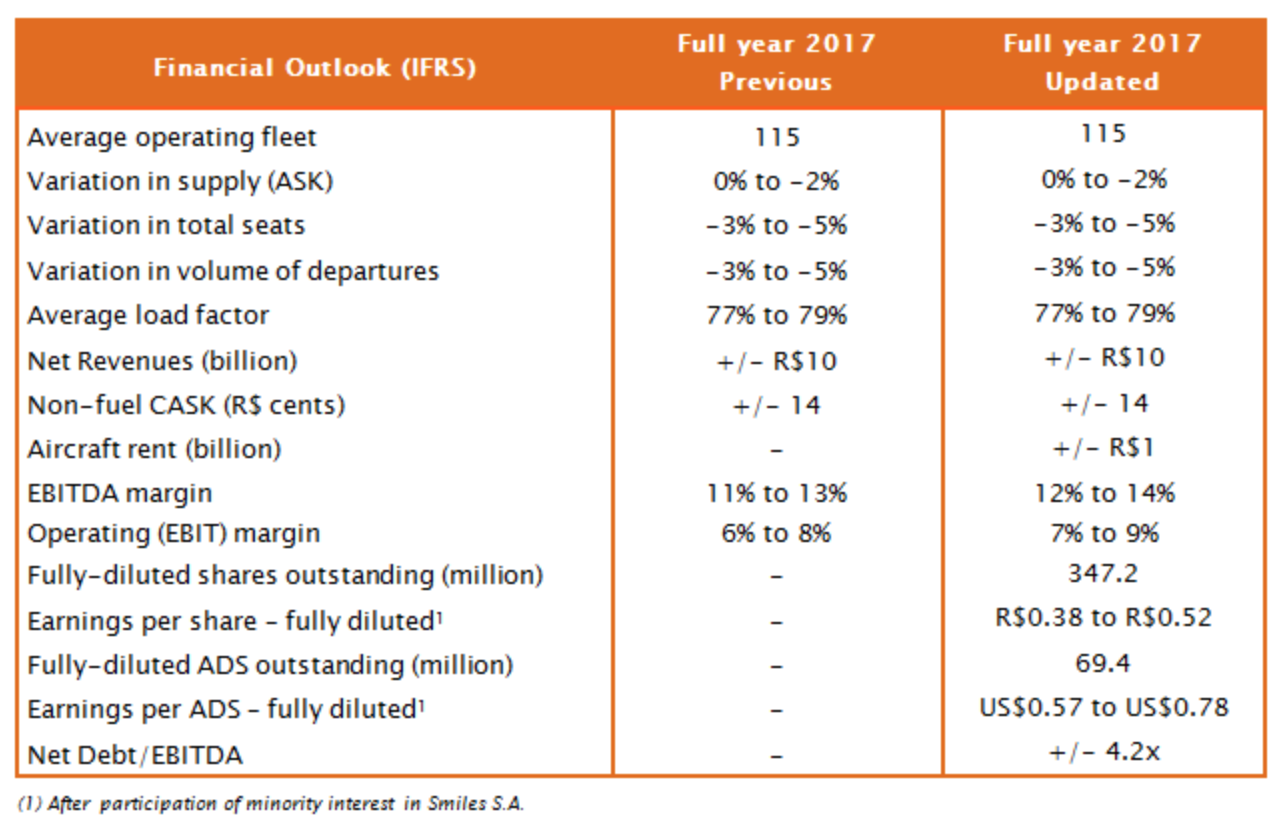

GOL has been diligent in adjusting the size of its fleet to Brazilian GDP and believes that it has matched the Company's supply of seats with demand for its air transportation services, as indicated by GOL's consistently high load factors. The 2017 revised guidance (table below) reflects the continuity of this rational strategy.

The Company's guidance for full year 2017 is: variation in supply (ASK) between 0% and -2%, variation in total seats between -3% and -5%, and average load factor between 77% and 79%. Yields are expected to increase primarily due GOL's capacity discipline. Full-year non-fuel CASK is expected to be in the R$0.14 range, flat versus 2016. Fuel cost per ASK should grow less than expected due to lower projected increases in oil prices. GOL expects EBITDA margin in the range of 12% to 14%, operating margin in the range of 7% to 9% and earnings per ADS between R$0.57 and R$0.78. The Company's leverage (Net Debt/EBITDA) is expected to be around 4.2x.

GOL believes that its leadership in rational capacity and yield management, combined with its lowest cost operations and a highest quality passenger service, will enable the Company to increase its competitive advantages and effectively manage passenger demand.