São Paulo, December 7, 2017 - GOL Linhas Aéreas Inteligentes S.A. (“GOL” or “Company”), (NYSE: GOL and B3: GOLL4), Brazil’s #1 airline, today provides general outlook and guidance for full year 2017 (revised) and 2018 (preliminary).

The Company’s guidance highlights key metrics which impact financial results and drive long-term shareholder value. GOL provides forward-looking information that is focused on the main metrics the Company uses to measure business performance.

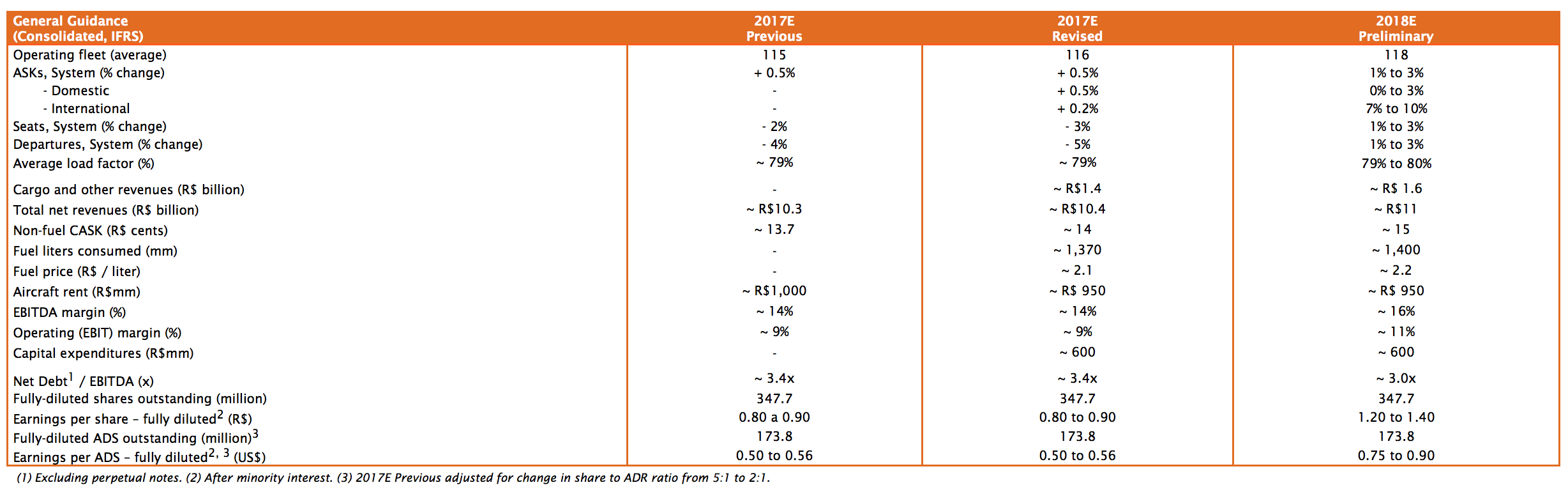

For full year 2017, GOL has adjusted its fuel and currency assumptions. The Company’s full year 2017 and 2018 general guidance is presented below. These indicators are useful for analysts and investors who project GOL’s results.

In comparison with 4Q16, the Company expects an available seat capacity sequential increase in 4Q17 of approximately 2% in the domestic market and 9% in the international market. For the 4Q17, GOL expects consolidated load factors in the range of 81% with consolidated passenger yields in the range of R$26 cents (up 5% versus 3Q17). For the fourth quarter, the Company expects consolidated non-fuel CASK to be in the range of R$14.5 cents (down 4.5% versus 4Q16). GOL expects that its hedging program will partially offset eventual increases in fuel prices due to higher oil prices; the Company has hedged approximately 40% of its fourth quarter fuel consumption and over 15% of its 2018 needs.

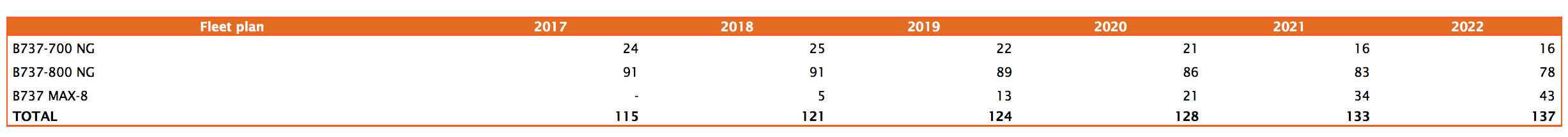

In the third quarter of 2018, the Company will receive its first Boeing 737 MAX, part of an order of 120 aircraft destined to replace GOL’s existing fleet over time. The 737 MAX allows longer non-stop flights and reduces fuel consumption by up to 15%, which will allow GOL to reduce its costs and fly to more destinations. GOL’s fleet modernization plan ensures that GOL’s fleet will maintain its status as one of the youngest and most modern in the world. By the end of 2022, over 30% of the fleet will be comprised of Boeing 737 MAXs, reducing average fleet age to below 7 years. The table below details the fleet plan through 2022:

The current guidance for 2018 may be adjusted in order to incorporate the evolution of GOL’s operating and financial performance and any eventual changes to the Brazilian economy and GOL’s broader economic environment, including variations in such variables as GDP growth, interest rate, exchange rate, and WTI and Brent oil price trends.