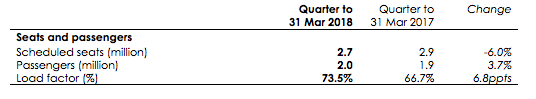

Flybe continues to drive load factors as capacity reduces

Flybe's turnaround continues with a further improvement in load factors as we reduce capacity1. In Q4, load factors2 were up by 6.8 ppts to 73.5%, a strong performance for the winter season. As a result, estimated passenger revenue4 per seat was up by 9.0% to £50.84. Passenger numbers3 rose by 3.7%, even though capacity was reduced by 6.0%.

The extremely poor weather in February and March however led to airport closures and flight cancellations across the UK and near continent. This particularly affected Flybe as all our flying is within this area. We had to cancel 994 flights due to weather in Q4 compared to 372 in Q4 last year. As a result, we anticipate this to have an impact of around £4m from lost revenue and additional care and assistance costs on cancelled and delayed flights. Coming so late in the financial year means that this added loss will be reflected in our full year financial results.

At 31 March 2018, Flybe has returned five of the planned six end-of-lease aircraft with the final one to be returned in early April. At the year end, Flybe will have a total fleet size of 80 aircraft (31 March 2017: 83) which will fall to 79 once the final handback is completed.

We expect net debt at 31 March 2018 to be broadly flat year on year.

Early Indications of summer UK (H1 2018/19) trading

Our strategy to reduce capacity to focus on profitable flying will continue into the new financial year. Very early indications of our summer trading are encouraging with an estimated 7.5% increase in passenger revenue per seat offsetting an expected 7.9% decrease in capacity. So far, we have sold 21% of our H1 capacity, against 20% sold at the same time last year.

Christine Ourmieres-Widener, Chief Executive, said:

"The Flybe strategy as set out in our business plan to reduce the fleet size is delivering higher load factors and revenue per seat. The drive to reduce costs is continuing, given added impetus by the rise in fuel prices and lower value of sterling. Despite these headwinds, the foundations are being put in place to strengthen the business and we remain confident that our strategy will continue to improve performance as we go into the new financial year."

Hedging

Flybe UK's current hedge books5 at 31 March 2018 are summarised below (all hedges are forward swaps).

Jet fuel

· H1 2018/19 - 76% hedged at $519 per tonne

· H2 2018/19 -43% hedged at $517 per tonne

· H1 2019/20 -3% hedged at $584 per tonne

US Dollar

· H1 2018/19 - 76% hedged at $1.3260

· H2 2018/19 - 67% hedged at $1.3466

· H1 2019/20 - 32% hedged at $1.3724

Flybe UK currently has a broadly neutral position in Euro income and expenditure.

Carbon

· Calendar year 2017 - 85% acquired at €2.57 per tonne with the shortfall due to additional requirements identified in a recent emissions audit. Given recent high price rises, the fully costed final acquisition price is estimated to be c €3.80 per tonne.

· Calendar year 2018 - 39% hedged following the issue of free EU allowances. No additional allowances have been acquired to date.