Dublin, Ireland, August 23, 2018 – Fly Leasing Limited (NYSE: FLY) (“FLY”), a global leader in aircraft leasing, today announced its financial results for the second quarter of 2018.

Highlights

· Net income of $24.3 million, $0.87 per share

· Adjusted Net Income of $25.2 million, $0.90 per share

· 10% increase in operating lease rental revenue

· Sold two aircraft for an economic gain of $15.6 million

· Book value per share of $21.02

· Completed a new $574.5 million term loan facility

“FLY is reporting a very strong second quarter based on a substantial increase in operating lease rental revenue and a combination of end of lease income and gains resulting from our aircraft trading,” said Colm Barrington, Chief Executive Officer of FLY. “Our quarterly net income of $24.3 million is as a result of the positive fleet activities of FLY over the previous quarters. Our earnings per share of $0.87 are a substantial increase from the same quarter last year, reflecting improvements in our business and share repurchases undertaken over the last few years.”

“The acquisition of the 55 aircraft portfolio that we announced in February is proceeding as planned,” added Barrington. “We have started transferring aircraft to FLY and expect that the initial stage of the transaction, comprising the acquisition of 34 Airbus A320 aircraft and seven CFM engines, will be completed in the third quarter. As contemplated in connection with the portfolio acquisition, after quarter end we completed the sale of approximately 1.3 million shares at $15.00 per share to affiliates of Onex Corporation and the management of BBAM, demonstrating their continued support of FLY. As we acquire these aircraft and deploy our capital over the course of the year, we expect to see FLY generate stronger shareholder returns.”

Financial Results

FLY is reporting net income of $24.3 million, or $0.87 per share, for the second quarter of 2018. This compares to net income of $2.9 million, or $0.09 per share, for the same period in 2017.

Net income for the six months ended June 30, 2018 was $34.0 million, or $1.21 per share, compared to net income of $7.9 million, or $0.25 per share, for the six months ended June 30, 2017.

Adjusted Net Income

Adjusted Net Income was $25.2 million for the second quarter of 2018, compared to $5.1 million for the same period in the previous year. On a per share basis, Adjusted Net Income was $0.90 in the second quarter of 2018, compared to $0.16 for the second quarter of 2017. For the six months ended June 30, 2018, Adjusted Net Income was $37.6 million, or $1.34 per share, compared to $11.0 million, or $0.34 per share, for the same period last year.

A reconciliation of Adjusted Net Income to net income determined in accordance with GAAP is shown below.

Portfolio Acquisition Update

Subsequent to June 30, 2018, FLY completed the transfers of 12 Airbus A320 aircraft pursuant to definitive agreements dated February 28, 2018 with AirAsia Group Berhad, as successor to AirAsia Berhad ("AirAsia"), and its subsidiary, Asia Aviation Capital Limited ("AACL") for a total of 13 Airbus A320 aircraft from the initial portfolio. FLY expects to complete the transfers of the remaining 20 Airbus A320 aircraft and seven engines on operating leases to AirAsia and its affiliated airlines, and one Airbus A320 aircraft on operating lease to a third-party airline, by the end of the third quarter of 2018.

Financing

On June 15, 2018, FLY entered into a $574.5 million term loan facility with a consortium of lenders to partially finance the acquisition of 30 Airbus A320 aircraft from AACL. As of August 23, 2018, FLY has drawn down $213.4 million under the facility in conjunction with the aircraft transferred from AACL as described above.

Share Issuance and Sale

In contemplation of the initial transfer of aircraft from AirAsia, on July 13, 2018, FLY issued and sold approximately 1.3 million of its common shares to affiliates of Onex Corporation ("Onex") and the management team of BBAM Limited Partnership and its subsidiaries ("BBAM") at a purchase price of $15.00 per share. All FLY common shares held by Onex, and the newly issued FLY common shares held by members of the BBAM management team, are subject to a 180-day lock-up from the date of issuance.

Financial Position

At June 30, 2018, FLY’s total assets were $3.6 billion, including investment in flight equipment totaling $3.0 billion. Total cash at June 30, 2018 was $466.1 million, of which $406.5 million was unrestricted. FLY's book value per share at June 30, 2018 was $21.02.

Aircraft Portfolio

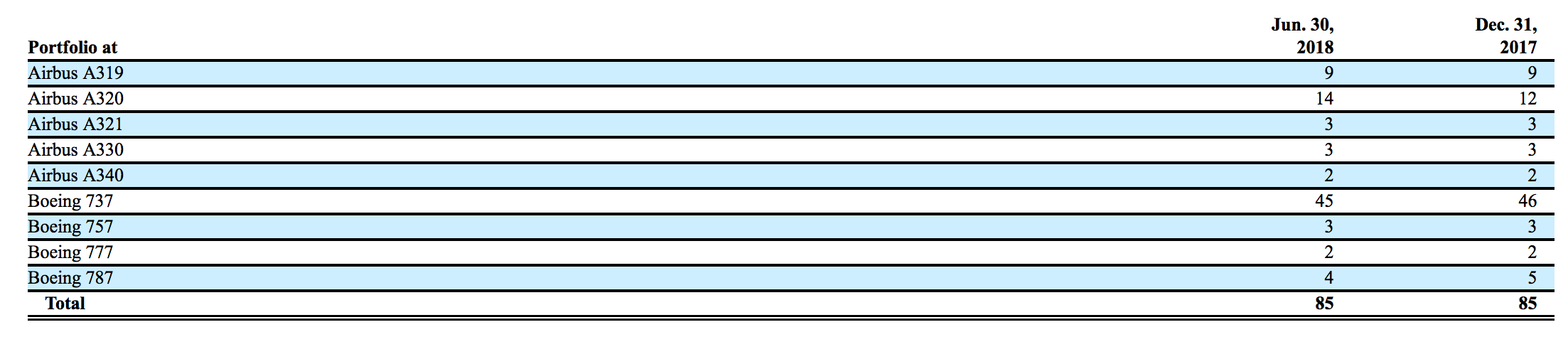

At June 30, 2018, FLY had 85 aircraft on lease to 45 airlines in 27 countries. The table below does not include the two B767 aircraft owned by a joint venture in which FLY has a 57% interest.

At June 30, 2018, the average age of the portfolio, weighted by net book value of each aircraft, was 6.8 years. The average remaining lease term was 6.2 years, also weighted by net book value. At June 30, 2018, FLY's 85 aircraft on lease were generating annualized rental revenue of approximately $367.1 million. FLY’s lease utilization factor was 99.7% for the second quarter of 2018 and 99.2% for the six months ended June 30, 2018.