Dublin, Ireland, November 9, 2017 – Fly Leasing Limited (NYSE: FLY) (“FLY”), a global leader in aircraft leasing, today announced its financial results for the third quarter of 2017.

Third Quarter 2017 Highlights

· Net loss of $12.5 million, $0.43 per share

· Adjusted Net Income of $14.9 million, $0.51 per share

· Acquired three aircraft for $114 million

· Repurchased 1.5 million shares

· Priced $300 million of unsecured 5.25% senior notes due 2024

“We were active on several fronts this quarter as we acquired three aircraft, including another new 737 MAX 8, repurchased a further 1.5 million shares and refinanced our unsecured notes that were due 2020,” said Colm Barrington, CEO of FLY. “We have acquired eight aircraft in the first nine months of 2017 for a total of $403 million, growing the fleet to 84 aircraft. Our growth capacity remains strong with the ability to acquire over $2 billion worth of new aircraft without the need to raise additional funds.”

“FLY has repurchased a total of 3.6 million shares so far this year, and we ended the quarter with a net book value per share of $18.95,” added Barrington. “We see great value in our shares and will continue to repurchase stock under our current buyback program.”

“We also remain focused on driving down our cost of debt,” said Barrington. “The refinancing of our unsecured notes will result in substantial savings, reducing our borrowing costs by nearly $10 million per year starting in 2018. Further, following quarter end, we repriced our term loan, which will result in an additional $1 million of annual interest cost savings.”

Financial Results

FLY is reporting a net loss of $12.5 million, or $0.43 per share, for the third quarter of 2017, primarily driven by a $22.0 million non-cash impairment charge. This compares to net income of $22.9 million, or $0.70 per share, for the same period in 2016.

Net loss for the nine months ended September 30, 2017 was $4.6 million, or $0.15 per share. For the same nine-month period in 2016, net income was $34.7 million, or $1.03 per share.

Adjusted Net Income

Adjusted Net Income was $14.9 million for the third quarter of 2017, compared to $17.3 million for the same period in the previous year. On a per share basis, Adjusted Net Income was $0.51 in the third quarter of 2017, compared to $0.53 for the third quarter of 2016. For the nine months ended September 30, 2017, Adjusted Net Income was $35.7 million, or $1.15 per share, compared to $48.7 million, or $1.45 per share, for the same nine-month period in 2016.

A reconciliation of Adjusted Net Income to net income (loss) determined in accordance with GAAP is shown below.

Aircraft Impairment

As a result of a lessee’s insolvency filing during the third quarter, FLY recorded an impairment charge of $22.0 million on a 2001 vintage Airbus A330-200 to write the aircraft down to its estimated current market value.

Share Repurchases

During the nine months ended September 30, 2017, FLY repurchased 3.6 million shares for $47.3 million at an average price of $13.29 per share. At September 30, 2017, $19.3 million remained under the share repurchase authorization. Subsequent to quarter end, FLY repurchased 159,462 shares at an average price of $13.90 per share through November 3, 2017. As of November 3, 2017, $17.1 million remained under the share repurchase authorization.

Senior Unsecured Notes Due 2024

On October 16, 2017, FLY completed its offering of $300 million of unsecured 5.25% Senior Notes due 2024. The net proceeds were approximately $294.2 million, which FLY has used, together with cash on hand, to discharge its outstanding 6.75% Senior Notes due 2020.

Financial Position

At September 30, 2017, FLY’s total assets were $3.5 billion, including investment in flight equipment totaling $3.1 billion. Total cash at September 30, 2017 was $394.2 million, of which $272.1 was unrestricted. The book value per share at September 30, 2017 was $18.95.

Aircraft Portfolio

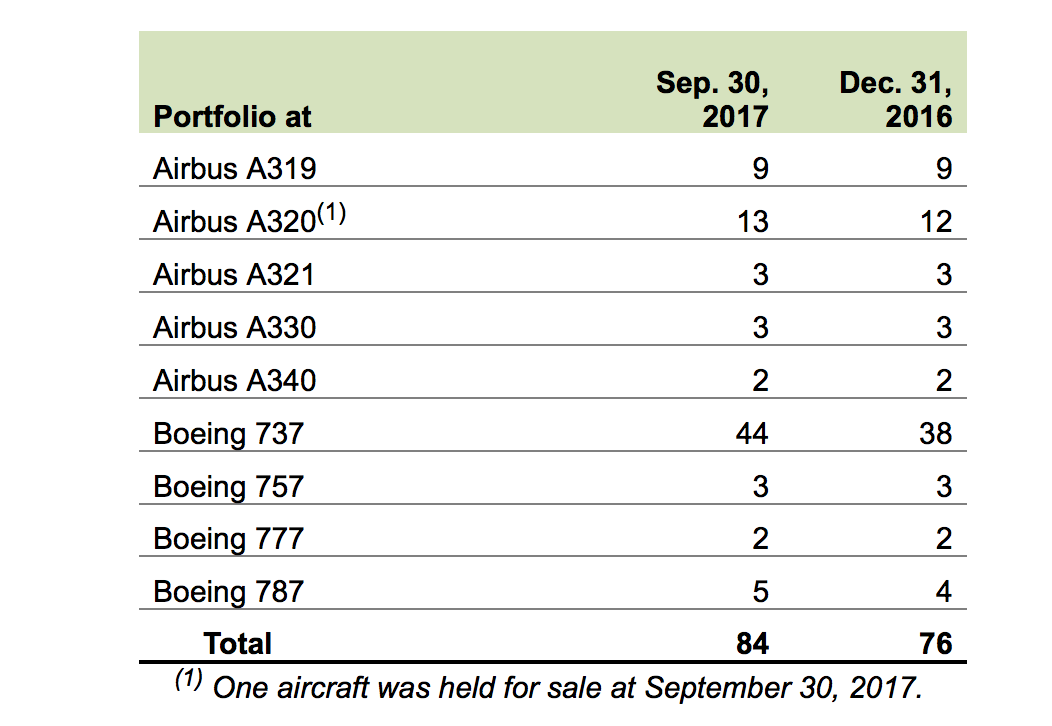

At September 30, 2017, FLY’s 84 aircraft were on lease to 45 airlines in 29 countries. The table below does not include the two B767 aircraft owned by a joint venture in which FLY has a 57% interest.

At September 30, 2017, the average age of the portfolio, weighted by net book value of each aircraft, was 6.2 years. The average remaining lease term was 6.5 years, also weighted by net book value. At September 30, 2017, the 84 aircraft were generating annualized rental revenue of approximately $366 million. FLY’s lease utilization factor was 100% for the third quarter of 2017.