Dublin, Ireland, August 10, 2017 – Fly Leasing Limited (NYSE: FLY) (“FLY”), a global lessor of modern, fuel-efficient commercial jet aircraft, today announced its financial results for the second quarter of 2017.

Second Quarter 2017 Highlights

- Net income of $2.9 million, nine cents per share

- Adjusted Net Income of $9.7 million, 31 cents per share

- Repurchased nearly two million shares at an average price of $13.07 per share

- Acquired five aircraft, four of which were new deliveries from manufacturers

- Upsized Term Loan by $50 million

- Repriced Term Loan, saving approximately $2 million in annual interest

“We grew our fleet by investing $290 million in five aircraft in the second quarter, including four new aircraft purchased from the manufacturers,” said Colm Barrington, CEO of FLY. “The five aircraft are on leases with an average term of 11 years, further enhancing the overall quality of our fleet. We expect to see improved earnings from these aircraft, and others in our pipeline, as the year progresses.”

“FLY continues to aggressively repurchase its shares,” added Barrington. “In the second quarter, we bought back nearly two million shares for a total of $25.9 million. At quarter end, we repurchased approximately 6.5 percent of the shares outstanding at the beginning of the year. Our average repurchase price of just over $13 per share has helped increase our net book value per share this year to $19.08.”

“We are focused on growth and have a strong pipeline of attractive aircraft investments that we expect to announce in the coming months,” said Barrington. “We expect to meet our $750 million acquisition target in 2017 – and we have the financial resources to acquire an additional $2 billion of aircraft.”

Financial Results

FLY is reporting net income of $2.9 million, or $0.09 per diluted share, for the second quarter of 2017. This compares to net income of $4.7 million, or $0.14 per share, for the same period in 2016.

Net income for the six months ended June 30, 2017 was $7.9 million, or $0.25 per share. For the same six month period in 2016, net income was $11.8 million, or $0.35 per share.

Adjusted Net Income

Adjusted Net Income was $9.7 million for the second quarter of 2017, compared to $15.0 million for the same period in the previous year. On a per share basis, Adjusted Net Income was $0.31 in the second quarter of 2017, compared to $0.45 for the second quarter of 2016. For the six months ended June 30, 2017, Adjusted Net Income was $20.8 million, or $0.65 per share, compared to $31.4 million, or $0.93 per share, for the same six month period in 2016.

A reconciliation of Adjusted Net Income to net income determined in accordance with GAAP is shown below.

Share Repurchases

During the first six months of 2017, FLY repurchased 2.1 million shares for approximately $27.2 million at an average price of $13.06 per share. At June 30, 2017, approximately $39.4 million remained under the share repurchase authorization. Subsequent to quarter end, FLY repurchased 740,957 shares at an average price of $13.77 per share through August 9, 2017. As of August 9, 2017, approximately $29 million remained under the share repurchase authorization.

Financial Position

At June 30, 2017, FLY’s total assets were $3.5 billion, including investment in flight equipment totaling $3.0 billion. Total cash at June 30, 2017 was $455.2 million, of which $335.5 was unrestricted. The book value per share at June 30, 2017 was $19.08.

Aircraft Portfolio

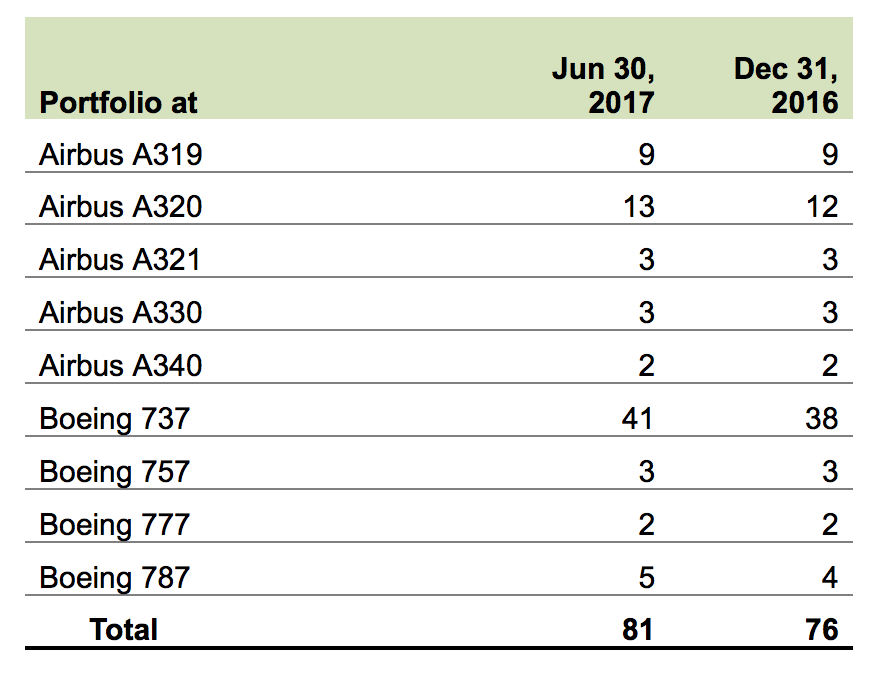

At June 30, 2017, FLY’s 81 aircraft were on lease to 45 airlines in 29 countries. The table below does not show the two B767 aircraft owned by a joint venture in which FLY has a 57% interest.

At June 30, 2017, the average age of the portfolio, weighted by net book value of each aircraft, was 6.1 years. The average remaining lease term was 6.8 years, also weighted by net book value. At June 30, 2017, the 81 aircraft were generating annualized rental revenue of approximately $352 million. FLY’s lease utilization factor was 100% for the second quarter of 2017.

Conference Call and Webcast

FLY’s senior management will host a conference call and webcast to discuss these results at 9:00 a.m. U.S. Eastern Time on Thursday, August 10, 2017. Participants should call +1-253-237-1145 (International) or 800-535-7056 (North America) and enter confirmation code 44952823. A live webcast with slide presentation will be available on the Events page in the Investor Relations section of FLY’s website at www.flyleasing.com. A webcast replay will be available on the company’s website for one year.