Dublin, Ireland, February 27, 2020 – Fly Leasing Limited (NYSE: FLY) (“FLY”), a global leader in aircraft leasing, today announced its financial results for the fourthquarter and full year of 2019.

Fourth Quarter 2019 Highlights

· Net income of $75.2 million, $2.43 per share

· Adjusted Net Income of $77.0 million, $2.49 per share

· Return on equity of 35.9%, Adjusted return on equity of 36.7%

· Sold ten aircraft for an economic gain of $62.7 million, a 31% premium to book value

· Purchased seven aircraft for $217.0 million

2019 Full Year Highlights

- Net income of $225.9 million, $7.12 per share

· Adjusted Net Income of $245.9 million, $7.75 per share

· Return on equity of 29.2%, Adjusted return on equity of 31.8%

· Sold 35 aircraft for an economic gain of $149.1 million, an 18% premium to book value

· $28.42 book value per share at year end, a 32% increase since December 31, 2018

· Net debt to equity ratio of 2.3x

"FLY is reporting record financial outcomes for the fourth quarter and full year 2019 along with adjusted returns on equity of more than 30% in both the quarter and full year," said Colm Barrington, FLY's Chief Executive Officer. "At year end, our book value per share was $28.42, which was a 32% increase in the year. Our leverage was reduced to 2.3x at year end, down from 4.0x at the beginning of the year.”

“Our aircraft sales in 2019 demonstrated the value in our balance sheet, reduced lesseeconcentration, generated cash and reduced our leverage,” added Barrington. “In the year we sold 35 aircraft with an average age of over 10 years, generating an economic gain of nearly $150 million, which was an 18% premium to book value."

“FLY remains well positioned for a period of fleet enhancement as we continue to take delivery of our committed pipeline of new, fuel-efficient and low polluting Airbus A320neo family aircraft and pursue other opportunities to acquire attractive aircraft,” said Barrington. “FLY has a strong balance sheet and ample financial capacity to support the acquisition of both our committed deliveries and additional aircraft that we expect to acquire this year.”

Financial Results

FLY is reporting net income of $75.2 million, or $2.43 per share, for the fourth quarter of2019. This compares to net income of $31.0 million, or $0.95 per share, for the same period in 2018.

Net income for the year ended December 31, 2019 was $225.9 million, or $7.12 per share, compared to net income of $85.7 million, or $2.88 per share, for the year endedDecember 31, 2018.

Adjusted Net Income

Adjusted Net Income was $77.0 million for the fourth quarter of 2019, compared to$30.8 million for the same period in the previous year. On a per share basis, Adjusted Net Income was $2.49 in the fourth quarter of 2019, compared to $0.94 for the fourthquarter of 2018.

For the year ended December 31, 2019, Adjusted Net Income was $245.9 million, or$7.75 per share, compared to $91.2 million, or $3.06 per share, for the same period last year.

A reconciliation of Adjusted Net Income to net income determined in accordance with GAAP is shown below.

Share Repurchases

During the year ended December 31, 2019, FLY repurchased 2.0 million shares at an average price of $16.29 per share, for a total cost of $32.8 million. As of December 31, 2019, FLY had 30.9 million shares outstanding and had $50.0 million remaining under its share repurchase authorization.

Financial Position

At December 31, 2019, FLY’s total assets were $3.7 billion, including investment in flight equipment totaling $3.2 billion. Total cash at December 31, 2019 was $338.3 million, of which $285.6 million was unrestricted. The book value per share at December 31, 2019 was $28.42, a 32% increase since December 31, 2018. At December 31, 2019, FLY's net debt to equity ratio was 2.3x, reduced from 4.0x at December 31, 2018.

Aircraft Portfolio

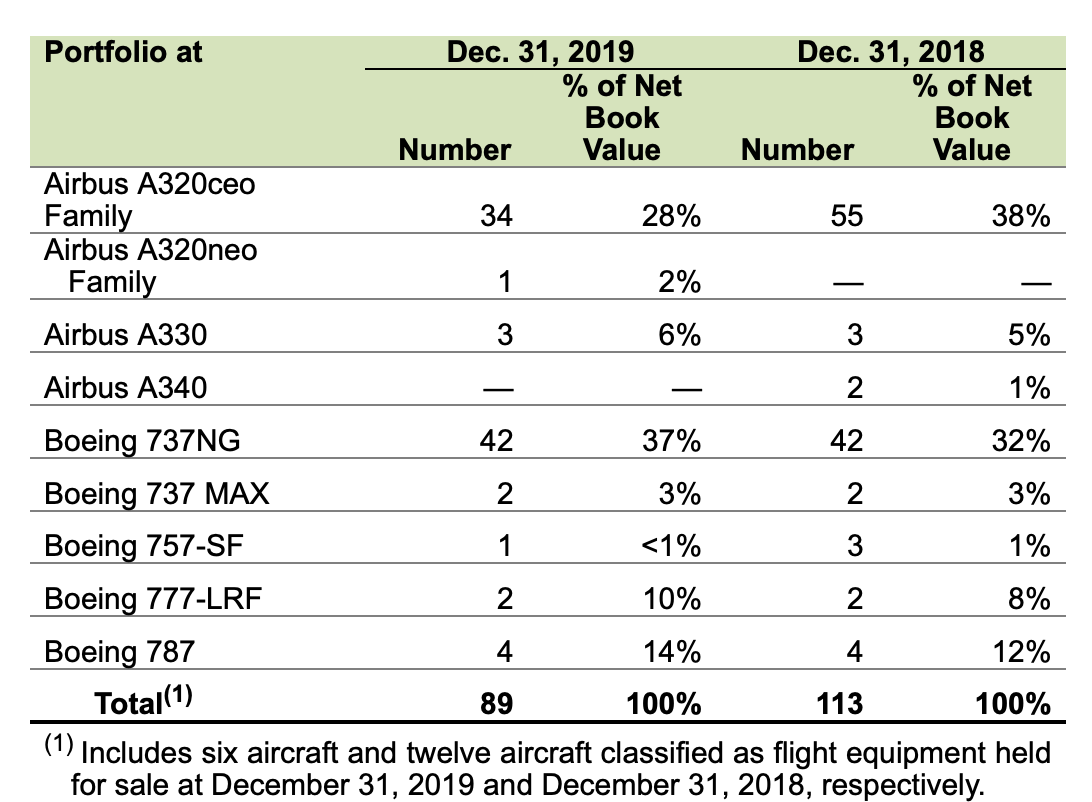

At December 31, 2019, FLY's portfolio consisted of 89 aircraft, six of which were classified as flight equipment held for sale, and seven engines. FLY's aircraft and engines were on lease to 41 airlines in 24 countries. The table below does not include engines.

At December 31, 2019, the average age of the portfolio, weighted by net book value of each aircraft and engine, was 7.6 years. The average remaining lease term was 5.3years, also weighted by net book value. At December 31, 2019, FLY's portfolio, excluding aircraft held for sale, was generating annualized rental revenue of approximately $332 million.