LINK TO FITCH RATINGS' REPORT(S):

AASET 2020-1 Trust (US ABS)

AASET 2020-1 Trust -- Appendix

AASET 2020-1 - ESG Navigator

Fitch Ratings - New York - 29 January 2020:

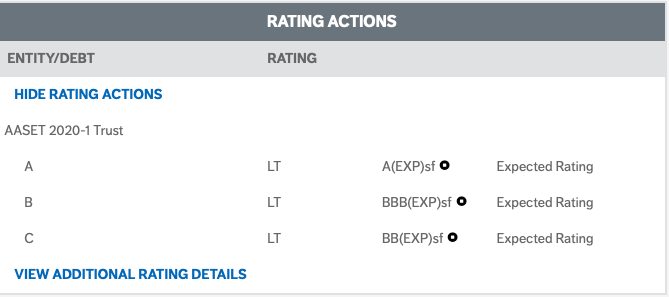

Fitch Ratings has assigned expected ratings to AASET 2020-1 Trust.

TRANSACTION SUMMARY

Fitch expects to rate the aircraft operating lease ABS secured notes issued by AASET 2020-1 Trust (2020-1). AASET 2020-1 expects to use proceeds of the initial notes to acquire all the aircraft-owning entity (AOE) series A, B and C notes (initial series A, B and C AOE notes) issued by AASET 2020-1 US Ltd. (AASET US) and AASET 2020-1 International Ltd. (AASET International), collectively, the AOE issuers.

The notes will be secured by lease payments and disposition proceeds on a pool of 28 mid- to end-of-life aircraft purchased from certain funds (the SASOF Funds), managed by subsidiaries of Carlyle Aviation Partners Ltd. (CAP) collectively with its affiliates (Carlyle Aviation). Carlyle Aviation Management Limited (CAML), an indirect subsidiary of CAP, will be the servicer. This is the sixth public, Fitch-rated AASET transaction, and the ninth issued since 2014 and serviced by CAML. Fitch does not rate CAP or CAML.

The timeframe of remedial actions for the liquidity facility is longer than outlined in Fitch's counterparty criteria, but this is deemed to be immaterial under primary scenarios.

KEY RATING DRIVERS

Stable Asset Quality — Mostly Liquid Narrowbody: The pool comprises mostly narrowbody aircraft (85.0%), including 10 B737-800 (32.8%) and six A320-200s (25.5%). The weighted average (WA) age is 15.2 years, which is at the older end of the range for recent peer transactions, but consistent with 2019-1 (15.8 years) and older than 2019-2 (11.9 years). Widebody aircraft total 15.0%, in line with 2019-2 (15.7%) and lower than 2019-1 (29.4%).

Lease Term and Maturity Schedule — Neutral: The WA remaining lease term is 3.4 years, in line with prior AASET transactions. One lease matures in 2020 (5.3%), 10 in 2021 (31.4%), six in 2022 (21.1%), and two in 2023 (7.5%). From 2020-2023, 19 leases mature (65.4%), which is lower than 2019-2 but in line with 2019-1, during the first four-year period after closing.

Asset Value and Lease Rate Volatility: Fitch derives assumed initial aircraft values from various appraisal sources and employs future aircraft value and disposition stresses in its analysis. These take into account aircraft age and marketability to simulate the decline in values and lease rates expected to occur over the course of multiple aviation market downturns.

Operational and Servicing Risk — Adequate Servicing Capability: Fitch believes Carlyle Aviation Partners (parent: The Carlyle Group is rated BBB+/Stable) has the ability to collect lease payments, remarket and repossess aircraft in an event of lessee default and procure maintenance to retain values and ensure stable performance. This is evidenced by the experience of their team, the servicing of their managed fleet, and prior securitization performance.

Lessee Credit Risk — Weak Credits: Fitch's 'CCC' assumed lessee concentration totals 60.4%, significantly higher relative to 2019-2 and 2019-1 (14.5% and 47.5%, respectively). Most of the 18 lessees are either unrated or speculative-grade credits, typical of aircraft ABS. Unrated or speculative airlines are assumed to perform consistent with either a 'B' or 'CCC' Issuer Default Rating (IDR) to reflect default risk in the pool. Ratings were further stressed during future assumed recessions and once an aircraft reaches Tier 3 classification.

Country Credit Risk — Diversified: The largest country concentration is the U.S. (IDR of AAA/Stable) with seven aircraft (15.5%), followed by India (10.6%) and then Thailand (9.1%). The top five countries total 49.0%, down from 2019-2 (64.4%) and 2019-1 (59.6%), with 15.5% of lessees concentrated in Developed North America. There is a higher concentration in Emerging APAC (34.3%) versus 2019-2 (25.5%) and 2019-1 (3.6%); however, this reflects the industry's growth in the region in recent years.

Transaction Structure — Consistent: Credit enhancement (CE) comprises overcollateralization (OC), a liquidity facility and a cash reserve. The initial loan to value (LTV) ratios for series A, B and C notes are 66.5%, 78.0% and 83.5%, respectively, based on the average of the maintenance-adjusted base values (MABVs). These levels are consistent with prior AASET transactions.

Adequate Structural Protections: Each series of notes makes full payment of interest and principal in the primary scenarios, commensurate with their ratings after applying Fitch's stressed asset and liability assumptions. Fitch has also created multiple alternative cash flows to evaluate the structural sensitivity to different scenarios, as detailed in the Rating Sensitivities section.

Aviation Market Cyclicality: The commercial aviation has exhibited significant cyclicality tied to the health of the overall global economy. This cyclicality can produce increased lessee defaults, lower demand for off-lease aircraft, and deterioration in lease rates and asset values. Fitch stresses asset values, utilization levels, lease rates and default probability during assumed market down cycles to account for this risk.

Rating Cap of 'Asf': Fitch limits aircraft operating lease ratings to a maximum cap of 'Asf' due to the factors discussed above and the potential volatility they produce. For more details, refer to Fitch's "Global Structured Finance Rating Criteria" (May 2019) and "Aircraft Operating Lease ABS Rating Criteria" (March 2019), available at www.fitchratings.com.