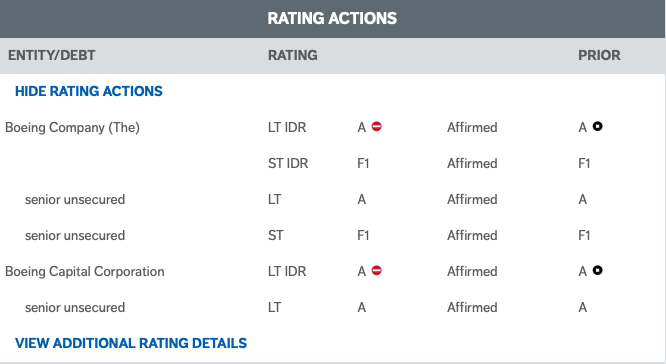

Fitch Ratings has affirmed the Boeing Company's (BA) ratings at 'A'/'F1' and Boeing Capital Corporation's (BCC) ratings at 'A'. Fitch has revised the Rating Outlook to Negative from Stable.

The Outlook revision is based on regulatory uncertainty regarding the timing and global sequencing of the 737 MAX' return-to-service (RTS), the growing logistical challenge of returning parked planes to service and delivering stored post-production aircraft, the substantial financing needed for temporary working capital build-up, and the risk of higher concessions to airlines, especially if the 737 MAX grounding extends into the end-of-year holiday season. The MAX situation also presents significant public relations challenges, and the impact on Boeing's reputation and brand will be a watch item for the next year or more.

Fitch believes the 737 MAX will remain a concern throughout the aviation credit sector into 2020. The 737 MAX situation will reduce much of the financial cushion Boeing has at the current 'A' rating, leaving the company more exposed to other unforeseen events or industry developments. In addition to the 737 MAX, BA has a challenging agenda, including the Embraer S.A. (ERJ, BBB-/Rating Watch Negative) transaction, 777X development, potential New Mid-Market Airplane (NMA) launch, and several planned production rate increases. Fitch also expects there will be a lingering operating margin impact for several years after the 737 MAX returns to service. Other concerns include various lawsuits and investigations.

BA ended 2018 in a net debt position for a second consecutive year, and Fitch expects this trend will continue in 2019, with likely further debt issuances. Including Fitch's assumptions for the ERJ transaction, Fitch estimates consolidated debt for BA and BCC (together, Boeing) could increase almost $10 billion during 2019, ending at nearly $24 billion. Fitch estimates debt could rise above $24 billion before year-end as a result of working capital build up related to the 737 MAX grounding, but this will begin to decline once deliveries resume. Fitch's assumptions for the ERJ transaction include BA funding its $4.2 billion payment to ERJ with new debt and consolidating approximately $3.5 billion of debt attributable to ERJ's commercial aerospace business.

KEY RATING DRIVERS

737 MAX Grounding:

The impact of the $4.9 billion charge for the 737 MAX announced last week is already reflected in Fitch's conservative forecasts, and it is not a key driver of the Outlook revision. There is a risk the potential amount of customer concessions could increase if there are further delays in RTS or difficulties executing the delivery of the large number of parked aircraft. While large, the charge is manageable in the context of BA's revenues, cash generation, and liquidity. Share repurchases remain a significant source of financial flexibility.

Fitch views the MAX situation as largely a temporary issue of timing unless substantial orders are cancelled. International Airlines Group's (IAG) letter of intent to purchase 737 MAX aircraft was a positive development, and Boeing's main competitor has also had challenges with the Airbus A320neo.

Key uncertainties remain in addition to the uncertain timing on RTS. These include pilot training requirements, public perception of the 737 MAX, 737 MAX valuations, and aircraft finance impact. There is also uncertainty surrounding the phasing of RTS throughout the world, although it appears that aviation regulators are working in a more coordinated manner than Fitch initially expected.

Fitch believes the aviation industry is approaching the 737 MAX situation in a balanced manner, as reflected in the IAG announcement. Fitch believes that the aviation sector sees this situation as temporary and is looking at the narratives in the preliminary accident reports. The industry is also considering the 737 MAX's operating history prior to the grounding, which lasted more than a year and a half, completing more than 200,000 flights and carrying more than 30 million passengers by Fitch's estimates.

Watch items include the final reports for the Lion Air and Ethiopian Airlines accidents, the timing of production rate changes, and the Joint Authorities Technical Review (JATR) report.

Ratings Incorporate Periodic Stress: Despite these challenges, Fitch believes Boeing's credit profile can withstand the pressure, driving the affirmation of the ratings. The ratings affirmation incorporates conservative assumptions about the 737 MAX's return to service and related costs. The affirmation is also supported by Boeing's demonstrated ability to withstand challenging periods such as the post-9/11 downturn, the most recent economic recession, and the 787/747-8 development delays.

Fitch believes Boeing's credit profile can support the current 737 MAX stresses due to substantial liquidity, financial flexibility, low leverage, access to the capital markets, and revenue diversification. Aside from the 737 MAX, Boeing's products and markets are healthy. Overall, BA had a strong credit profile for its 'A' rating before the 737 MAX grounding, and Fitch's ratings for the company incorporate the periodic stress periods that arise in the commercial aviation sector.

Strong Underlying Credit Profile: Boeing's ratings reflect its strategic positions in the commercial aerospace and defense sectors, high barriers to entry in its key businesses, a strong liquidity position, substantial cash generation, and $487 billion order backlog. The ratings are also supported by the company's demonstrated ability to withstand challenging periods. Financial flexibility is another key rating strength.

Three large defense contract wins in 2018 could help address the challenges Boeing's defense segment faced over the past several years. Boeing has also earned credit for lowering its risk profile by shifting a substantial number of employees to defined contribution benefit plans, signing long-term labor agreements and successfully executing a significant number of aircraft production rate changes over the past several years.

In addition to the 737 MAX, concerns for Boeing include M&A activity, the potential for delays and cost overruns on development programs, regular and substantial charges, the aging of parts of the company's defense portfolio and the size of the company's pension deficit on a GAAP basis at $15.3 billion at the end of 2018. The company is also susceptible to commercial aerospace industry shocks, such as downturns, terrorism, and disease.

Margin levels remain a bit low for the rating category, but Boeing made progress addressing this concern in the past two years. The company's portfolio is less balanced than it once was, as commercial growth reduced the weight of defense revenue as a percentage of consolidated revenue. Growth of services offerings could improve Boeing's balance, diversification and margins. The intense competitiveness of the commercial airplane industry is also a rating consideration.

BCC: The rating affirmation for BCC primarily reflects the unconditional guarantees provided by BA for the due and punctual payment and performance of all of BCC's outstanding publicly-issued debt. The ratings also remain supported by BCC's role arranging, structuring, and providing financing to support the sale of BA's products; the high level of management and operational integration between the two entities; BA's track record of support for BCC; and the fungibility of funding between the two entities.

BCC has historically exhibited sound operating performance, stable asset quality, and a sufficient liquidity profile, although its standalone credit risk profile would likely be lower than 'A'. The difference is due to cyclicality and residual value risk associated with the aircraft leasing business, the credit risk profile and concentration of BCC's lessors, and its elevated leverage levels relative to standalone aircraft lessors.

BCC's revenues and operating income have remained relatively flat, driven by portfolio run-off and aircraft sales, offset by modest new origination activity. Asset quality has also remained relatively stable over the years, as the company has worked through a number of credit issues within its portfolio and reduced overall risk resulting from a decrease in customer financing. Fitch believes that current loss reserves, the supportive aircraft financing environment, and improved airline credit fundamentals, provide adequate support relative to potential losses on receivables.

DERIVATION SUMMARY

Boeing's most immediate peer is Airbus SE (A-/F2/Stable). Despite some convergence in credit profiles over the past several years, several key credit factors still differentiate the two companies' ratings. Cash flow generation is one of the key differentiators between Airbus and Boeing. Boeing has consistently achieved better FCF and FFO over the past decade, due to better program execution and lower investment needs despite higher dividend payments. Cash generation should continue to grow at both companies, but Boeing's cash flow advantage is likely to persist. Boeing's business profile is also modestly stronger than Airbus' because of a more diverse revenue mix between commercial and defense. Both companies have strong balance sheets and liquidity positions, with Airbus generally operating with a higher net cash position than Boeing. FX exposure is another key differentiator between Boeing and Airbus, with the former having little exposure and the latter have significant exposure, although Airbus has taken actions to lessen the situation.

KEY ASSUMPTIONS

Fitch's Key Assumptions Within Our Rating Case for the Issuer

-

The 737 MAX returns to service in some regions no later than the end of October 2019. Deliveries resume shortly after the plane returns to service;

-

BA builds working capital at a rate of as much as $1.5 billion per month as a result of the 737 MAX deliveries shut-down. This begins to reverse after deliveries resume, with some of the impact recovered during 2019 and the remainder recovered in 2020;

-

Margins are negatively affected by MAX-related costs in 2019 through 2021, but remain solid for the rating;

-

BA moves the 737 production rate from the temporary 42/month level back to 52/month in the first quarter of 2020. The planned 737 rate change to 57/month is achieved in 2020;

-

The Boeing-Embraer commercial joint venture closes at the end of 2019. Boeing finances its $4.2 billion payment to Embraer with debt and also consolidates $3.5 billion of Embraer debt and an equal amount of cash;

-

Debt increases almost $10 billion in 2019 as a result of the Embraer transaction and some additional debt issuance. In 2020 and after Fitch assumes Boeing refinances all debt maturities in addition to issuing some incremental debt;

-

Share repurchases remain suspended through 2019, then resume in mid-2020;

-

Dividends rise steadily through the forecast period;

-

The 777X enters service in 2020, but there is a risk of a slip into 2021;

-

BA launches the NMA in 2020.

RATING SENSITIVITIES

Developments That May, Individually or Collectively, Lead to Positive Rating Action

--Positive rating actions could be driven by an improvement in the company's credit profile from higher commercial aircraft deliveries, debt reduction and pension contributions;

--Several initiatives to boost margins, if successful, could also drive positive rating actions;

--Modifying the cash deployment strategy to have less focus on share repurchases could also lead to positive ratings actions.

Developments That May, Individually or Collectively, Lead to Negative Rating Action

--A negative action could be driven by material delays in returning the 737 MAX to service in some key regions beyond the end of 2019, with substantial order cancellations and related material cost increases;

--There could be a negative rating action if there are material negative developments with any of the company's other major programs leading to delivery delays, order cancellations, large additional costs or inventory write-downs;

--Large acquisitions, particularly combined with a sector downturn, could affect the ratings, as could debt-funded share repurchases;

--Sustained consolidated FFO-adjusted leverage above 2.0x could lead to a negative rating action;

--Sustained free cash flow margins below 5% could lead to a negative rating action.

BCC: BCC's ratings and Rating Outlook are linked to those of its parent. Positive rating actions would be limited to Fitch's view of BA's credit profile. Fitch cannot envisage a scenario where the captive would be rated higher than its parent. Conversely, negative rating actions could be driven by a change in BA's ratings or from a change in the perceived relationship between BCC and BA, most notably including the early termination of the parent guarantee prior to the repayment of BCC's outstanding publicly issued debt.

LIQUIDITY AND DEBT STRUCTURE

Strong Liquidity Position: Boeing had a strong consolidated liquidity position of approximately $10.8 billion as of March 31, 2019, consisting of $7.7 billion in cash and investments and $3.1 billion of revolving credit facility availability. The company upsized its revolving credit facilities by $1.5 billion after the end of the first quarter, enhancing liquidity. The company's strong cash flow and flexibility with share repurchases further support its liquidity profile.

Consolidated debt, as of March 31, 2019, was $14.7 billion ($12.6 billion attributable to BA and $2.1 billion attributable to BCC). Of the amount attributable to BCC, Fitch estimates approximately $500 million consists of debt originally issued by BCC and subsequently guaranteed by BA, with the remainder consisting of intercompany loans from BA to BCC. Short-term debt was $3.4 billion, including $2 billion of CP. Boeing issued $3.5 billion of unsecured notes in the second quarter. Fitch expects further debt to be issued in 2019 to fund the acquisition of Embraer's commercial plane business. The company has several maturities over the next year, averaging about $1.7 billion per year through 2021.

Boeing's strong cash generation contributes to its liquidity position. The company generated $9.6 billion of FCF in 2018, but 2019 FCF may be lower due to working capital build up related to the 737MAX. Fitch expects long-term annual free cash will be at least at 2018 levels, or greater than $9 billion per year. Boeing made $4 billion of discretionary pension contributions in 2017, including a $3.5 billion contribution in the form of company shares. This satisfied most required contributions for the next several years, and Fitch does not expect pension contributions through the projection period.

BCC Treatment: In most cases where an industrial company has a captive finance subsidiary Fitch deconsolidates the subsidiary and then evaluates the parent's financial statements treating the subsidiary as an equity investment. In the case of Boeing, we do not follow this process but instead look at financial metrics primarily on a consolidated basis. Fitch looks at Boeing and BCC on a consolidated basis for several reasons. BCC evolved into a less significant part of Boeing's financials as a result of the successful strategic shift to reduce BCC's emphasis on portfolio growth and increase focus on facilitating third-party financing for customers. BCC's primary strategic mission is not regular lending to Boeing's customers, but only occasionally financing aircraft, with approximately 99% of the company's deliveries typically financed by third parties.

The financial information Fitch has for BCC is not as detailed as is typically the case with industrial finance captives. In early 2013 Boeing fully guaranteed all of BCC's outstanding debt, which is also not typical of the industrial finance captives rated by Fitch. BCC stopped making separate SEC filings. In general, Fitch's approach of consolidating BCC's financial statements is a more conservative approach to the credit analysis of Boeing than if BCC were deconsolidated.

SUMMARY OF FINANCIAL ADJUSTMENTS

Fitch has made no material adjustments that are not disclosed within the company's public filings.