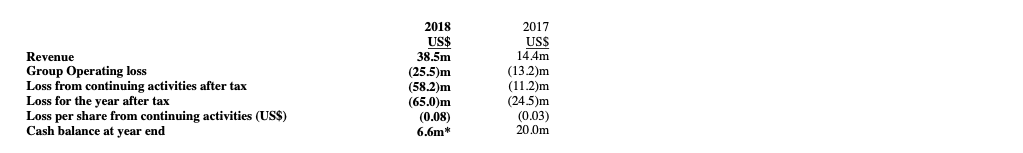

fastjet, the low-fare African airline, announces its audited final results for the year ended 31 December 2018. The table below summarises the financial performance of the fastjet Group's (the "Group") continuing activities.

*Cash balance at 25 June 2019 US$2.6m (of which US$ 0.4m restricted in Zimbabwe).

Strategic highlights

· Completion of shareholding acquisition in Federal Airlines in October 2018.

· Exit from Tanzania following regulatory challenges and uneconomic pricing by competitors.

· US$12.0m loan facility agreement with Solenta Aviation Holdings Limited ("SAHL") to fund the exercise of the Company's option over the purchase of the three ATR72 aircraft with the balance to be used for general working capital purposes.

· US$2.0m loan facility from SSCG for general working capital purposes across the Group on an interest-bearing loan at 6% fixed per annum, for an initial period of six months - $1.25m of this amount has been repaid post year-end.

· fastjet Zimbabwe deposited RTGS$5.0m of its restricted bank balances held in Zimbabwe with Annunaki on an interest-bearing deposit at 4% fixed per annum, for an initial period of six months. This deposit has been refunded in full post year-end.

· Fundraising of US$ 10 million in July 2018 and additional refinancing of US$ 40 million in December 2018.

Financial and Operational highlights

· Group revenue from continuing operations increased by 167% to US$38.5m (2017: US$14.4m). This was driven by an increase in passenger numbers of 45% in Zimbabwe and 575% in Mozambique (as Mozambique only operated for two months in 2017), and an overall increase in yields of 33%.

· Zimbabwe revenue increased 102% year on year to US$26.0m (2017: US$12.9m). This was achieved by an increase in available capacity of 30%, an increase in passengers of 45%, which included the start of Harare - Bulawayo route, a significant increase in yield of 40% and a further 5% increase in average load factors.

· Mozambique revenue increased 642% year on year to US$8.9m (2017:US$1.2m). This was achieved by an increase in available capacity of 613%, an increase in passengers of 575% (based on full year of operations), an increase in yield of 10% and a 5% decrease in average load factors.

· Costs from continuing operations before exceptional items increased by 132% to US$64.1m (2017: US$27.6m). This increase in costs is driven largely by the above-mentioned increase in capacity in both markets adding US$36.5m additional costs in the 2018 financial year.

· Exceptional items of $ 22.1m impacting the increase in costs for the year included:

o US$11.3m release of shares in lock-up transactions after the December 2018 capital raise and following the acquisition of the E145 aircraft on lease;

o the exercise of the option to purchase FedAir, requiring a purchase price allocation and valuation of FedAir to be performed, which resulted in a write down of US$4.6m;

o the impairment of goodwill of US$1.5m;

o the impairment of Air Operations Certificate of US$3.0m;

o the impairment of brands US$1.3m; and

o US$0.4m other costs.

· The loss after tax for the year from continuing operations, excluding US$22.1m exceptional items mentioned above, and the Zimbabwe related exchange loss of US$8.5m was US$27.6m (2017: US$11.2m);

· Total costs increased by 278% year on year to US$96.4m (2017: US$25.5m) of which exceptional items were US$22.1m (2017: US$ nil).

Discontinued Operations

The Group discontinued operations in Tanzania and reported a loss from discontinued activities net of tax and exchange differences on translation of US$6.9m (2017: US$13.3m) which related to:

· a US$8.9m trading loss of Tanzania CGU;

· US$16.9m gain on net liabilities no longer consolidated;

· US$5.5m reclassification of foreign currency translation loss;

· US$14.6m loss on disposal of the three ATR 72-600 aircraft acquired specifically for the Tanzanian business; and

· US$0.3m relating to expenses accrued for forward sales liabilities for Tanzania.

Outlook

The encouraging performance of our continuing operations in the final quarter of 2018 is expected to continue into 2019, with a near break-even Group operating result in quarter 1 of 2019 (seasonally the weakest quarter of the year) supporting the Board's expectation of the Group achieving an operating profit for the 2019 financial year excluding the significant foreign exchange losses triggered in Zimbabwe specifically.

The Directors continue to adopt the going concern basis, notwithstanding the expected need for further funding and assumed the ability to extract hard currency funds from Zimbabwe in the foreseeable future.

fastjet, with a restructured balance sheet and optimised organisational structure, a refined operating model and having diversified its geographic revenue streams over the past two years is now better positioned to strategically deliver sustainable growth.

Nico Bezuidenhout, fastjet Chief Executive Officer, commented:

"2018 saw the successful completion of the stabilization process we embarked upon in 2016. It was a year during which substantial changes were implemented which will have long-lasting, structural benefits for fastjet. Most notably, fastjet withdrew from Tanzania - a market that had been consistently loss-making over a number of years - as well as completing its fleet transition, further reducing overhead costs, substantially reducing long-term debt, and replacing and enhancing our financial and management information core systems. 2018 also saw a strong performance from fastjet's first full year of operations in Mozambique, the exercise of a purchase option that allows the Group entry into the South African market through the acquisition of a shareholding in a profitable business in this country, and increased seat occupancy rates and revenue levels in our Zimbabwean business. These efforts required commitment from all our stakeholders and significant time, effort and financial resource for which the Management and Board of fastjet is thankful to our employees, investors, suppliers and customers.

"The fastjet of today is a fundamentally different business to that of eighteen months ago, as evidenced by the Group achieving operational profitability in two of its three markets for the last quarter of 2018. We remain focused on managing the macro-economic challenges confronting the business and on improving fastjet's performance still further."