easyJet delivers a strong trading performance in the third quarter.

Full Year Headline profit before tax guidance increased to £550m to £590m

Summary

easyJet has delivered a strong performance in the third quarter with robust customer demand driving outperformance in our passenger and ancillary revenue growth. Disruption across Europe continues to be an industry wide issue and is having an impact on revenue, cost and operational performance, with the main drivers being European industrial action and air traffic restrictions. Despite this increase in disruption easyJet has increased its headline profit before tax guidance for Financial Year 2018 to between £550 million and £590 million.

Revenue

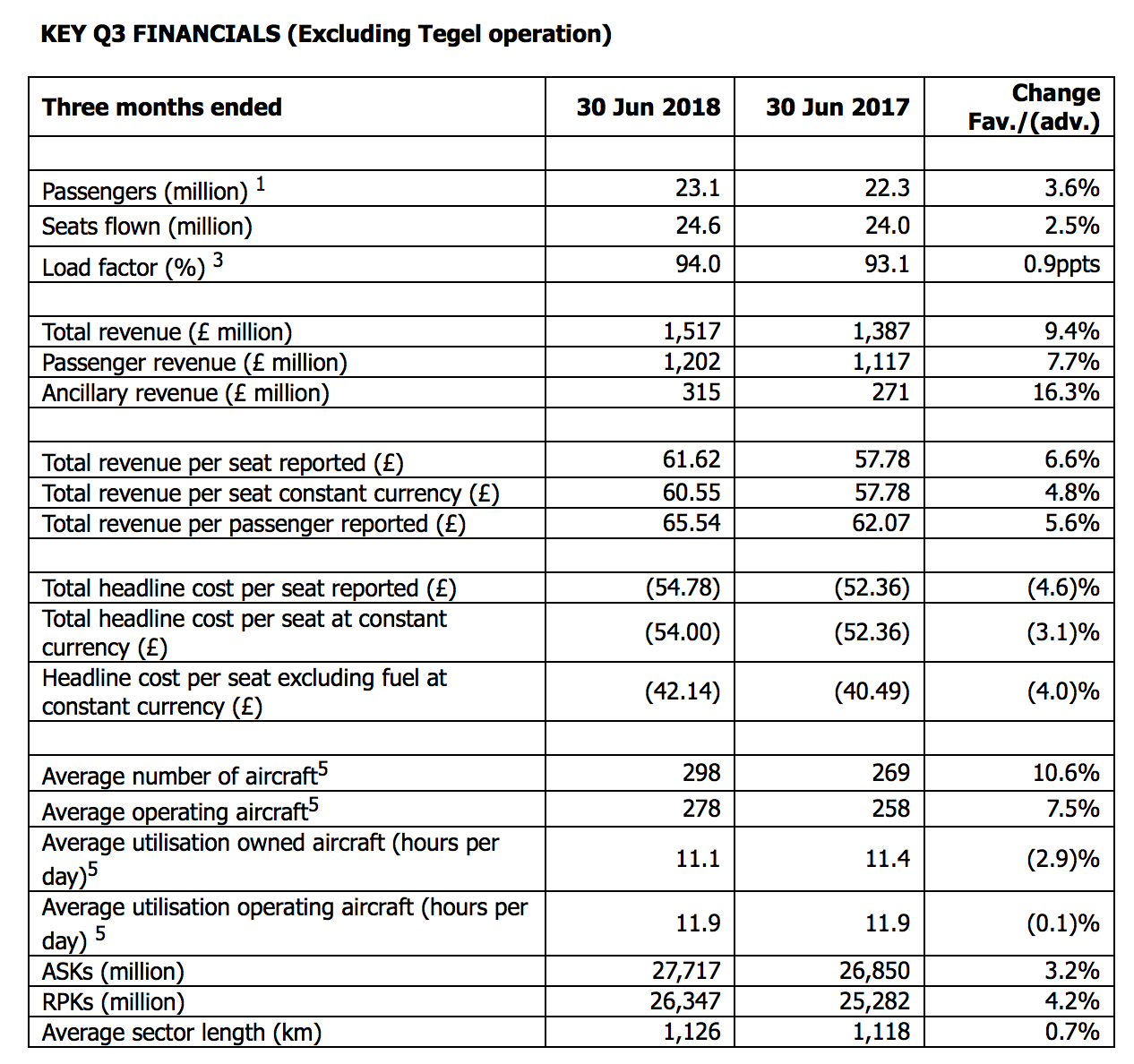

Total revenue in the third quarter to 30 June 2018 increased by 14.0% to £1.6 billion and ancillary revenue increased by 21.1% to £328 million.

Passenger1 numbers in the third quarter increased by 9.3% to 24.4 million, driven by an increase in capacity2 of 8.9% to 26.2 million seats which was lower than originally planned due to disruption. Load factor3 increased by 0.3 percentage points to 93.4%.

Total revenue per seat excluding Tegel operations increased by 4.8% at constant currency. This performance has been driven by:

- A benign competitor environment, with unfilled Monarch capacity and challenges for competitors in France

- Continued positive underlying trading enhanced by a particularly strong May due to the timing of public holidays

- An 11.5% increase in ancillary revenue per seat at constant currency with greater conversion and attachment rates from improved website functionality. More customers are choosing allocated seating and adding bags, helped by attractive pricing and product positioning with the 15kg/23kg split offer

- Offset by a c.£40 million negative impact of Easter moving partially into the first half of the year

easyJet now expects H2 revenue per seat at constant currency to increase by low to mid-single digits. Current data shows that uptake by competitors of overlapping Monarch capacity continues to be lower than expected into Q4, however, some impact on late yields may be expected from continued warm weather.

Operations

Operational performance for the quarter has been significantly impacted by external factors, in particular the regular and sustained ATC industrial action in France as well as the impact of severe weather. easyJet experienced 2,606 cancelled flights in the period (compared to 314 in Q3 2017) of which the significant majority were due to industrial action, ATC restrictions or severe weather. easyJet is continuing to invest in its resilience programme to improve its On Time Performance (OTP) and reduce cost, through initiatives in ground handling such as DHL, data-driven initiatives such as predictive maintenance, and scheduling improvements.

As a result of the disruption, OTP was 73% in Q3 and 78% for the year to 30 June 2018 (vs 78% and 79% respectively in 2017).

Cost (excluding Tegel)

easyJet's underlying cost performance has been solid. Headline cost per seat excluding fuel at constant currency increased by 4.0% in the quarter, higher than expected, reflecting:

- Increased disruption costs in the quarter, up circa £25 million against Q3 last year

- The accrual of expected employee incentive payments due to our strong financial performance, as guided at the first half results

- Costs relating to increased loads, crew costs and underlying inflation

easyJet's cost programme has delivered savings in particular in airport costs, driven by discounts on additional passenger volumes, and fleet up-gauging. Total cost programme savings in the financial year to date are £85 million.

Mainly as a result of the increased disruption in Q3 easyJet now expects full year cost per seat excluding fuel at constant currency to increase by circa 3%.

Berlin Tegel

In this start-up phase easyJet continues to prioritise its operational delivery and build its market presence. Load factors are continuing to increase, are now consistently above 80% and have reached 86% for June, reflecting strong brand traction in Berlin.

Revenue per seat is weaker than previously guided due to recent additional capacity in the Berlin market, which easyJet has been less able to counteract due to prioritising the protection of the slot portfolio and operating an inherited inefficient schedule for the peak summer season. As a result, headline losses for Tegel operations for the year are expected to be circa £125 million for the full year, compared to previous guidance of up to £95 million.

Despite this, easyJet is progressing well with its integration activity at Tegel and now expects to incur £50 million during the year in non-headline costs. This is lower than previous guidance of £60 million, as the fleet has transitioned into operations earlier than expected. At 30 June 10 easyJet aircraft were operating alongside wet leased fleet and easyJet now has 441 Tegel based pilots and cabin crew.

easyJet's total loss for Tegel operations this year is therefore expected to be £175 million (£160m estimated on acquisition), reflecting the revenue environment.

easyJet is committed to capitalising on the strategic opportunity in the Berlin market and targets to reach a break even position in Financial Year 2019 as it optimises its schedule over the next 18-24 months.

Outlook

For the year ending 30 September 2018, excluding Tegel operations, easyJet expects:

- Full Year capacity to grow by c.4.5%

- H2 revenue per seat at constant currency to increase by low to mid-single digits

- Full Year headline cost per seat excluding fuel at constant currency to increase by circa 3% assuming normal levels of disruption in Q4

- Full Year unit fuel bill is likely to be £60 million to £70 million favourable. The total fuel bill is expected to be c.£1.12 billion

- Foreign exchange4 movements will have a c.£20 million positive impact on headline profit before tax

Tegel operations are expected to deliver a Full Year headline loss before tax of circa £125 million and non-headline loss before tax of around £50 million.

Headline profit before tax for the 12 months to 30 September 2018, including the Tegel headline loss, is expected to be between £550 million and £590 million, up from previous guidance of £530 million to £580 million.

Commenting; Johan Lundgren, easyJet Chief Executive said:

"easyJet has delivered a strong performance during our third quarter driven by robust customer demand. The airline continues to go from strength to strength attracting more than 24 million customers in the period who chose to fly with us for our leading network of top European destinations, low fares and outstanding service.

We have also seen the continued growth in ancillary revenues, mainly due to more passengers choosing to buy allocated seating and hold bags.

With easyJet on track for a positive summer trading period during the fourth quarter, we are raising our guidance for full year headline profit before tax for financial year 2018 to between £550 million and £590 million."