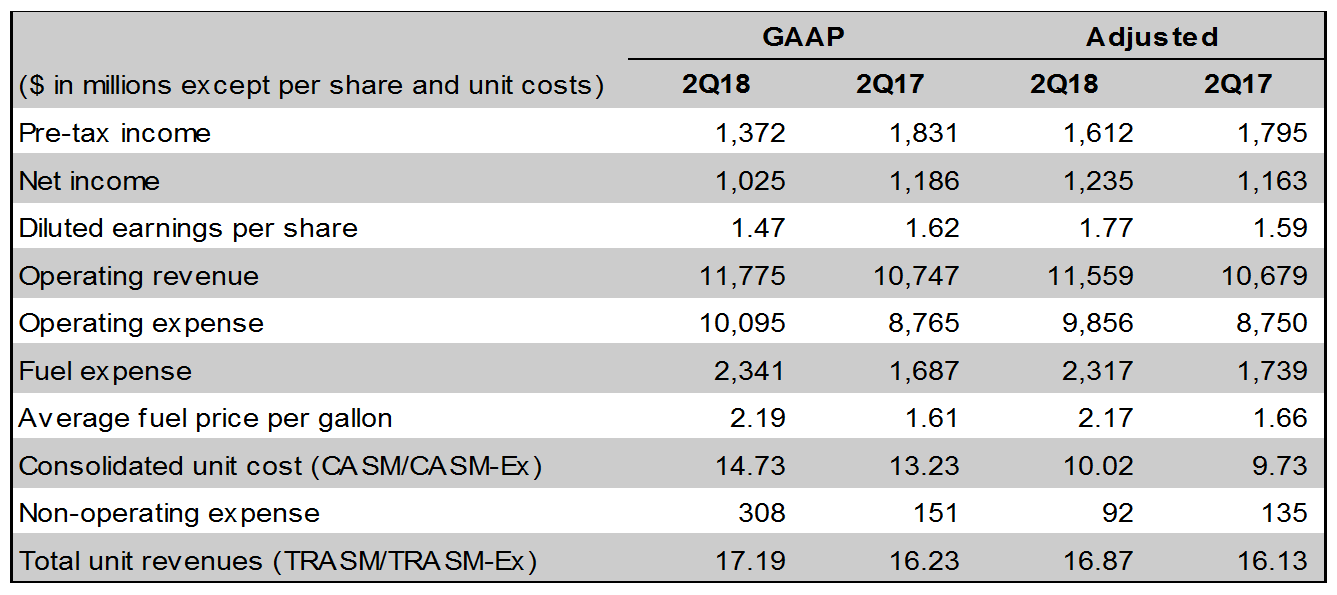

Delta Air Lines today reported financial results for the June quarter 2018. Highlights of those results, including both GAAP and adjusted metrics, are below and incorporated here.

Adjusted pre-tax income for the June quarter 2018 was $1.6 billion, a $183 million decrease from the June 2017 quarter, as record revenues partially offset the approximately $600 million impact of higher fuel prices.

“With an expected $2 billion higher fuel bill for 2018, we are now forecasting our full-year earnings to be $5.35 to $5.70 per share. We have seen early success in addressing the fuel cost increase and offset two-thirds of the impact in the June quarter,” said Ed Bastian, Delta’s Chief Executive Officer. “With strong revenue momentum, an improving cost trajectory, and a reduction of 50-100 bps of underperforming capacity from our fall schedule, we have positioned Delta to return to margin expansion by year end.”

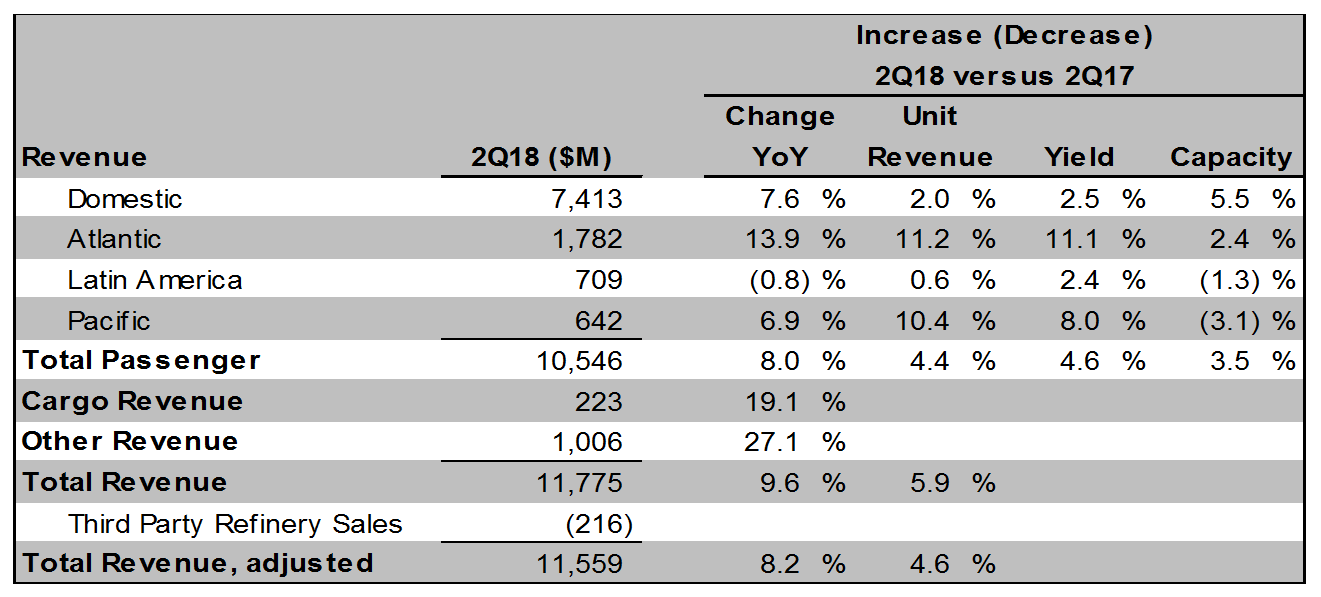

Revenue Environment

Delta’s adjusted operating revenue of $11.6 billion for the June quarter improved 8 percent, or $880 million versus the prior year. This quarterly revenue result marks a record for the company, driven by improvements across Delta’s business, including double-digit increases in both cargo and loyalty revenue.

Total unit revenues excluding refinery sales (TRASM) increased 4.6 percent during the period driven by strong demand across all entities and improving yields. Foreign exchange drove a nearly one point benefit to the quarter.

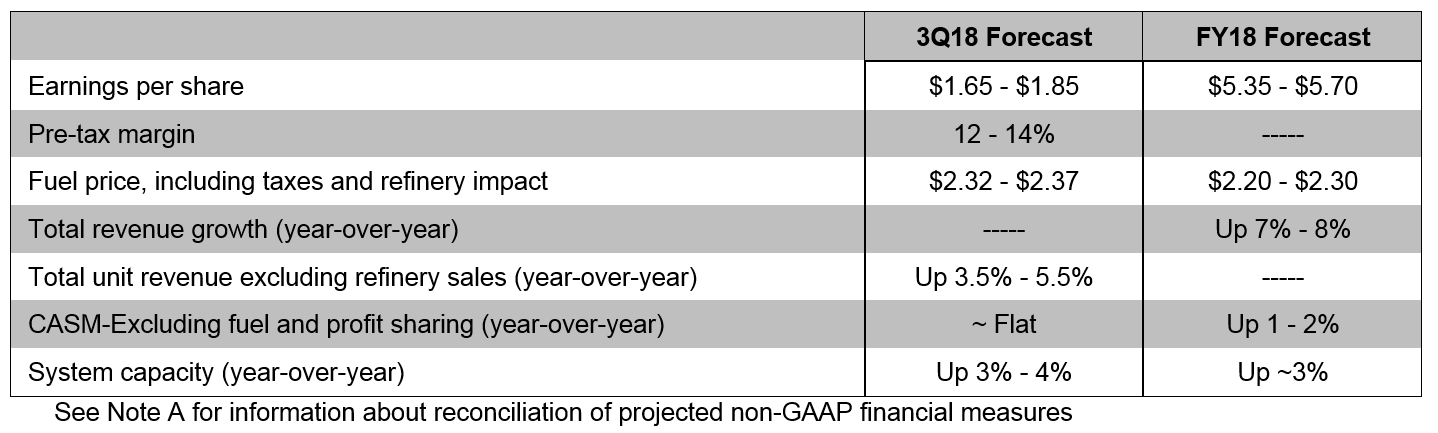

“The great service of the Delta people, strong demand for our product, and momentum across our business allowed Delta to deliver the highest quarterly revenue in our history and increase our revenue premium to the industry,” said Glen Hauenstein, Delta’s President. “While we are pleased with our revenue performance in the quarter, accelerating the recapture of the recent fuel price increases is the number one focus for our commercial team. We expect total unit revenue growth of 3.5 to 5.5 percent for the September quarter as we benefit from our commercial initiatives and recapture higher fuel costs.”

September 2018 Quarter and Full Year Guidance

Delta expects solid top-line growth, an improving cost trajectory, and a return to margin expansion.

Cost Performance

Total adjusted operating expenses for the June quarter increased $1.1 billion versus the prior year quarter, with more than half of the increase driven by higher fuel prices.

Adjusted fuel expense increased $578 million, or 33 percent, relative to June quarter 2017. Delta’s adjusted fuel price per gallon for the June quarter was $2.17, which includes $45 million of benefit from the refinery.

CASM-Ex increased 2.9 percent for the June 2018 quarter compared to the prior year period, a one point improvement from the March quarter. Cost pressures were driven by higher revenue-related costs and increased aircraft rent and depreciation associated with Delta’s fleet initiatives.

“We expect the sequential improvement in cost trends to continue in the second half of the year as we see additional benefits from our fleet restructuring, our One Delta initiatives, and annualization of accelerated depreciation as well as prior investments in our product,” said Paul Jacobson, Delta’s Chief Financial Officer. “Our cost structure is an essential component of sustainable performance, and by keeping our cost growth below 2 percent for the year, we are positioning the company to expand margins by year end.”

Adjusted non-operating expense improved by $43 million versus the prior year, driven primarily by pension expense favorability. Adjusted tax expense declined $255 million for the June quarter primarily due to the reduction in Delta’s book tax rate from 34 percent to 23 percent.

Cash Flow and Shareholder Returns

Delta generated $2.8 billion of operating cash flow and $1.4 billion of free cash flow during the quarter, after the investment of $1.4 billion into the business primarily for aircraft purchases and improvements.

For the June quarter, Delta returned $813 million to shareholders, comprised of $600 million of share repurchases and $213 million in dividends.

The Board of Directors declared a quarterly dividend of $0.35 per share, an increase of 15 percent over previous levels. This change will bring the total annualized dividend commitment to approximately $950 million, consistent with the company’s target of returning 20 to 25 percent of free cash flow to owners over the long-term. The September quarter dividend will be payable to shareholders of record as of the close of business on July 26, 2018, to be paid on August 16, 2018.

Strategic Highlights

In the June quarter, Delta achieved a number of milestones across its five key strategic pillars.

Culture and People

Accrued an additional $400 million in profit sharing and paid out $23 million in Shared Rewards as a testament to the outstanding performance made possible by Delta’s more than 80,000 employees around the world.

Ranked No. 1 corporate blood donor by the American Red Cross for the most recent year at 11,085 units of blood from 214 Delta sponsored blood drives.

Became a National Signature Partner of Junior Achievement’s 3DE program with a $2 million contribution over the next five years.

Operational Reliability

Delivered 58 days of zero system cancellations on a year-to-date basis, up 23 days from 2017.

Achieved mainline on-time performance (A0) of 71.7 percent year-to-date, up 1.4 percent from the prior year.

Network and Partnerships

Launched a joint venture with Korean Air on May 1, expanded reciprocal codeshare flying to more than 50 Korean Air-operated markets and 400 Delta-operated markets, and announced new service from Seattle to Osaka and Minneapolis/St. Paul to Seoul in partnership with Korean Air to begin in 2019.

Continued Delta’s global expansion with the launch of new service including Los Angeles to Paris and Amsterdam; Indianapolis to Paris; and Atlanta to Lisbon. Delta also announced plans to begin nonstop flights between the United States and Mumbai, India, in 2019.

Customer Experience and Loyalty

Debuted the first refreshed 777-200ER aircraft featuring the award-winning Delta One suite, the popular Delta Premium Select cabin and 9-abreast seating in the Main Cabin in addition to all new interior features and in-flight entertainment.

Launched new uniforms for 64,000 Delta employees worldwide, created by acclaimed designer Zac Posen and built with Lands' End quality. The designs embrace innovative fit, form and function, and carry Delta into the future in style.

Opened the newly renovated Delta Sky Club at Ronald Reagan Washington National Airport (DCA) with an additional 1,800 square feet of space for guests to enjoy.

Investment Grade Balance Sheet

Completed a $1.6 billion unsecured debt offering through a mix of three-, five-, and 10-year notes at a blended yield of 3.85 percent. The proceeds from this offering were used to refinance secured debt and will lower Delta's overall interest expense by $20 million annually on a run-rate basis.

Increased revolver capacity by $635 million, to a total of $3.1 billion in undrawn revolving credit facilities.

June Quarter Results

Special items for the quarter consist primarily of mark-to-market adjustments on refinery fuel hedges and unrealized gains/losses on investments.