- Top priority is protecting the health and safety of customers and employees

- In response to demand declines, company will remove 15 points of system capacity

- Undertaking cost reduction and cash flow enhancing initiatives to protect financial position

In addition to the significant efforts under way to protect the health and safety of its customers and employees, Delta Air Lines is announcing additional steps to address the financial impact of the COVID-19 (coronavirus) outbreak.

“In the weeks since COVID-19 emerged, Delta people have risen to the challenge, taking every possible action to take care of and protect our customers during a stressful time,” said Delta CEO Ed Bastian. “As the virus has spread, we have seen a decline in demand across all entities, and we are taking decisive action to also protect Delta’s financial position. As a result, we have made the difficult, but necessary decision to immediately reduce capacity and are implementing cost reductions and cash flow initiatives across the organization.”

Bastian added, “Over the last 10 years, we’ve transformed Delta by strengthening the balance sheet, diversifying our revenue streams and enhancing operational and financial flexibility. The environment is fluid and trends are changing quickly, but we are well positioned to manage this challenge and are taking actions to ensure that Delta maintains its leadership position and strong financial foundation.”

Capacity

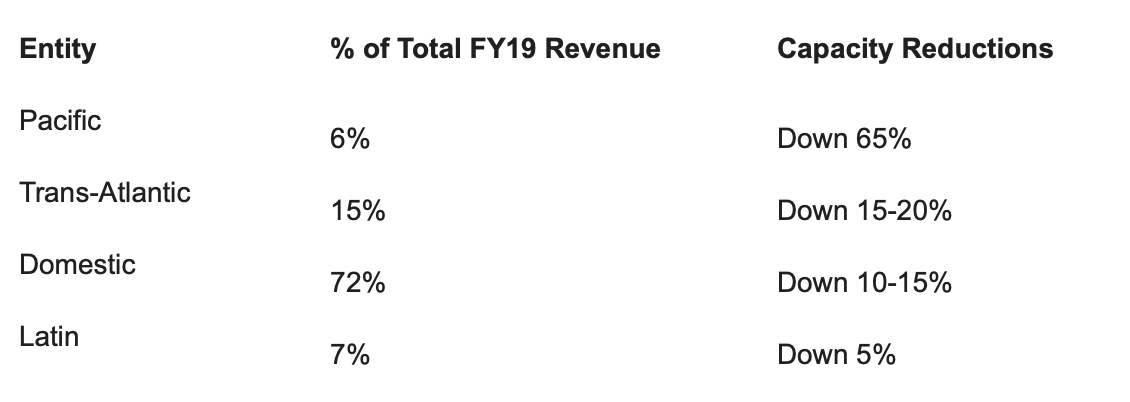

To align capacity with expected demand, Delta is reducing system capacity by 15 points versus its plan, with international capacity reduced by 20-25 percent, and domestic capacity reduced by 10-15 percent. The company will continue to make adjustments to planned capacity as demand trends change.

By region, reductions include:

Expenses

Delta is undertaking cost reduction initiatives, including:

- Instituting a company-wide hiring freeze and offering voluntary leave options

- Parking aircraft, and evaluating early retirements of older aircraft

In addition, the recent fuel price decline provides approximately $2 billion of full-year expense benefit.

Balance Sheet and Cash Flow

Delta has also made the following cash flow decisions:

- Deferring $500 million in capital expenditures

- Delaying $500 million of voluntary pension funding

- Suspending share repurchases

Delta has an investment-grade balance sheet, providing ready access to capital markets and bank financing. The company recently announced the issuance of $1 billion of secured aircraft debt at a blended rate of 2.09 percent and intends to use the proceeds to fund $1 billion of scheduled debt maturities in March.

Delta’s leverage ratio is at the low-end of its targeted range of 1.5 to 2.5 times adjusted debt to EBITDAR. Liquidity is strong and expected to be at least $5 billion at the end of the March quarter. In addition, Delta has approximately $20 billion of unencumbered assets, including $12 billion in aircraft.