Copa Holdings, S.A. (NYSE: CPA), today announced financial results for the second quarter of 2017 (2Q17). The terms "Copa Holdings" and "the Company" refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the second quarter of 2016 (2Q16).

OPERATING AND FINANCIAL HIGHLIGHTS

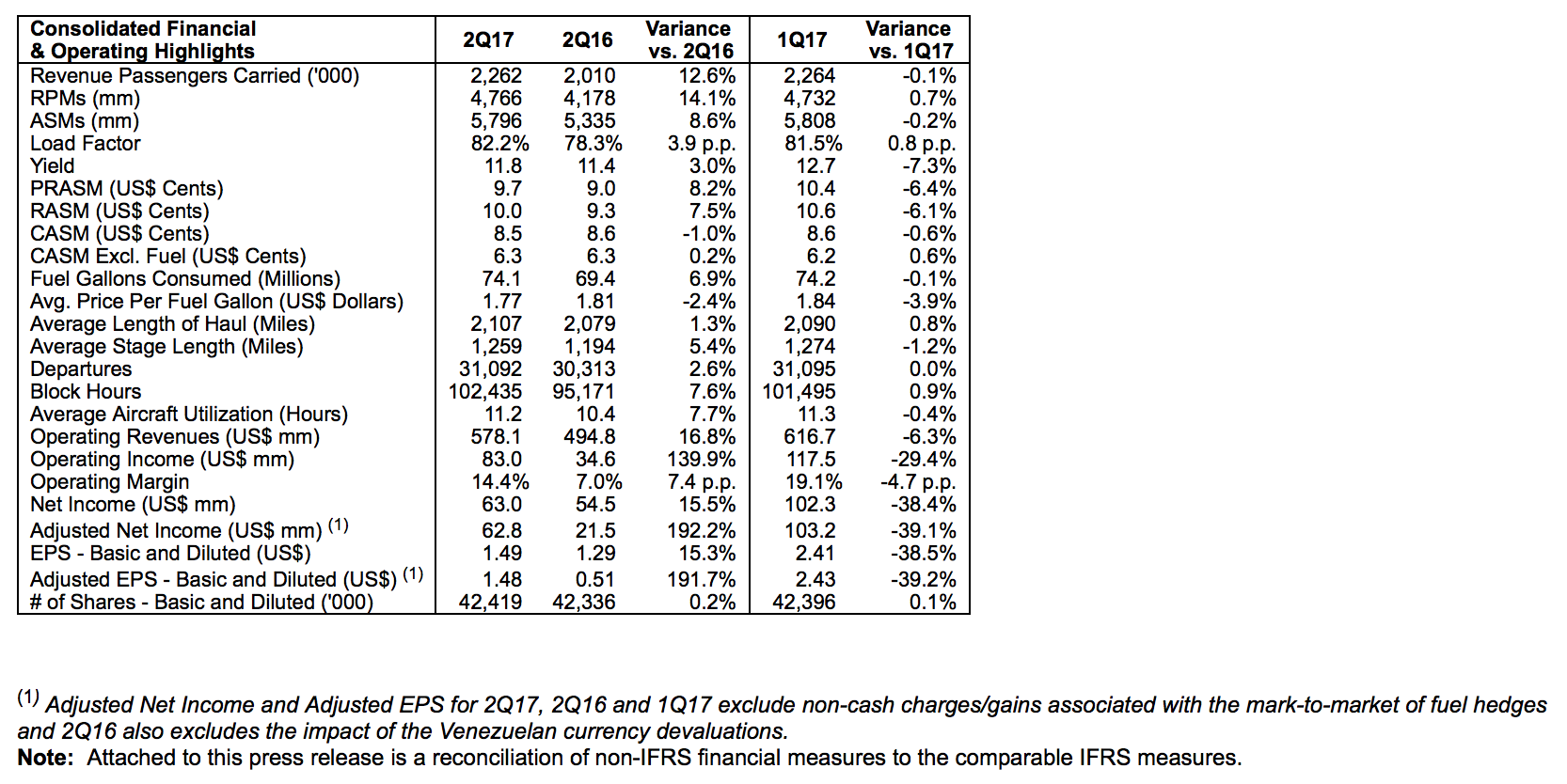

- Copa Holdings reported net income of US$63.0 million for 2Q17 or earnings per share (EPS) of US$1.49, compared to net income of US$54.5 million or earnings per share of US$1.29 in 2Q16.

- Excluding special items, the Company would have reported an adjusted net income of US$62.8 million, or adjusted EPS of US$1.48, compared to an adjusted net income of US$21.5 million or adjusted EPS of US$0.51 in 2Q16. Special items for 2Q17 include a non-cash gain of US$0.2 million associated with the mark-to-market of fuel hedge contracts. Special items for 2Q16 include a US$7.6 million loss related to foreign currency fluctuations and a non-cash gain of US$40.6 million associated with the mark-to-market of fuel hedge contracts.

- Operating income for 2Q17 came in at US$83.0 million, representing a 139.9% increase over operating income of US$34.6 million in 2Q16, as a result of 8.6% additional capacity, a 7.5% increase in unit revenue per available seat mile (RASM), and a 1% decrease in unit costs. Operating margin for 2Q17 came in at 14.4%, compared to an operating margin of 7.0% in 2Q16.

- Total revenues for 2Q17 increased 16.8% to US$578.1 million. Yield per passenger mile increased 3.0% to 11.8 cents and RASM came in at 10 cents, or 7.5% above 2Q16.

- For 2Q17, consolidated passenger traffic grew 14.1% while consolidated capacity grew 8.6%. As a result, consolidated load factor for the quarter increased 3.9 percentage points to 82.2%.

- Operating cost per available seat mile (CASM) decreased 1%, from 8.6 cents in 2Q16 to 8.5 cents in 2Q17. CASM excluding fuel costs remained flat at 6.3 cents in 2Q17 and 2Q16.

- Cash, short-term and long-term investments ended 2Q17 at US$924.6 million, representing 39% of the last twelve months' revenues.

- In June, Copa Airlines announced a new flight to Mendoza, Argentina, starting in November 2017.

During the Paris Airshow in June, Copa Airlines announced the order of 15 Boeing 737 MAX 10 aircraft, to be delivered in 2021 and 2022. The order is a conversion of previously ordered Boeing 737 MAX 8 aircraft. - Copa Airlines reported consolidated on-time performance of 85.1% and a flight-completion factor of 99.7% for 2Q17, maintaining its position among the best in the industry.

Subsequent Events

Given the Company's strong cash position and financial performance, the Board of Directors today approved an increase in dividend payout of more than US$20 million for the second half of 2017, which will represent an additional $0.24 per share, per quarter, for the third and fourth quarters of 2017. As such, the third quarter dividend payment will increase from US$0.51 to US$0.75 per share, payable on September 15, 2017, on all outstanding Class A and Class B shares, to stockholders of record as of August 31, 2017.