Copa Holdings, S.A. (NYSE: CPA), today announced financial results for the third quarter of 2017 (3Q17). The terms "Copa Holdings" and "the Company" refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the third quarter of 2016 (3Q16).

OPERATING AND FINANCIAL HIGHLIGHTS

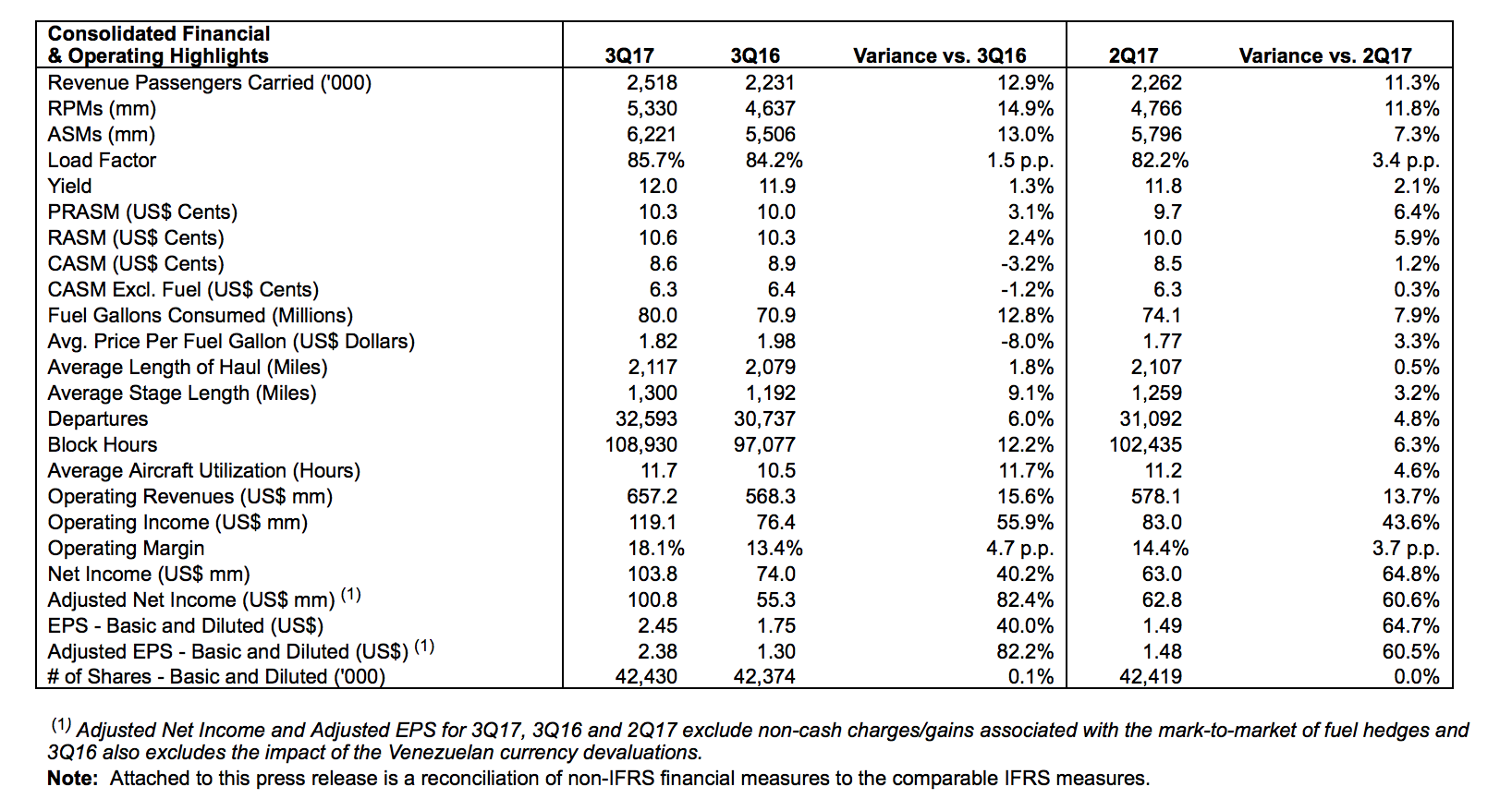

Copa Holdings reported net income of US$103.8 million for 3Q17 or earnings per share (EPS) of US$2.45, compared to net income of US$74.0 million or earnings per share of US$1.75 in 3Q16.

Excluding special items, the Company would have reported an adjusted net income of US$100.8 million, or adjusted EPS of US$2.38, compared to an adjusted net income of US$55.3 million or adjusted EPS of US$1.30 in 3Q16. Special items include a non-cash gain of US$2.9 million in 3Q17 and US$19.2 million in 3Q16 related to the mark-to-market of fuel hedge contracts.

Operating income for 3Q17 came in at US$119.1 million, representing a 56% increase over operating income of US$76.4 million in 3Q16, as a result of 13% additional capacity, a 2.4% increase in unit revenue per available seat mile (RASM), and a 3.2% decrease in unit costs. Operating margin for 3Q17 came in at 18.1%, compared to an operating margin of 13.4% in 3Q16.

Total revenues for 3Q17 increased 15.6% to US$657.2 million. Yield per passenger mile increased 1.3% to 12.0 cents and RASM came in at 10.6 cents, 2.4% above 3Q16.

For 3Q17, consolidated passenger traffic grew 14.9% while consolidated capacity grew 13.0%. As a result, consolidated load factor for the quarter increased 1.5 percentage points to 85.7%.

Operating cost per available seat mile (CASM) decreased 3.2%, from 8.9 cents in 3Q16 to 8.6 cents in 3Q17. CASM excluding fuel costs decreased 1.2%, from 6.4 in 3Q16 to 6.3 cents 3Q17.

Cash, short-term and long-term investments ended 3Q17 at US$971.5 million, representing 40% of the last twelve months' revenues.

Copa Airlines faced several operational challenges during the quarter, including severe weather, natural disasters and other external factors that affected the company´s financial results for the quarter and the operation of its hub in Panama City. These events caused many flight cancelations and delays; as a result, the airline´s Completion Factor and On-Time Performance came in lower than usual, at 98.5% and 82.9%, respectively.

Subsequent Events

Copa Holdings will pay its fourth quarter dividend of US$0.75 per share, on December 15, 2017, on all outstanding Class A and Class B shares, to stockholders of record as of November 30, 2017.

FULL 3Q17 EARNINGS RELEASE AVAILABLE FOR DOWNLOAD AT: http://investor.shareholder.com/copa/results.cfm