AIRCRAFT MARKET SUMMARY

The Current Market

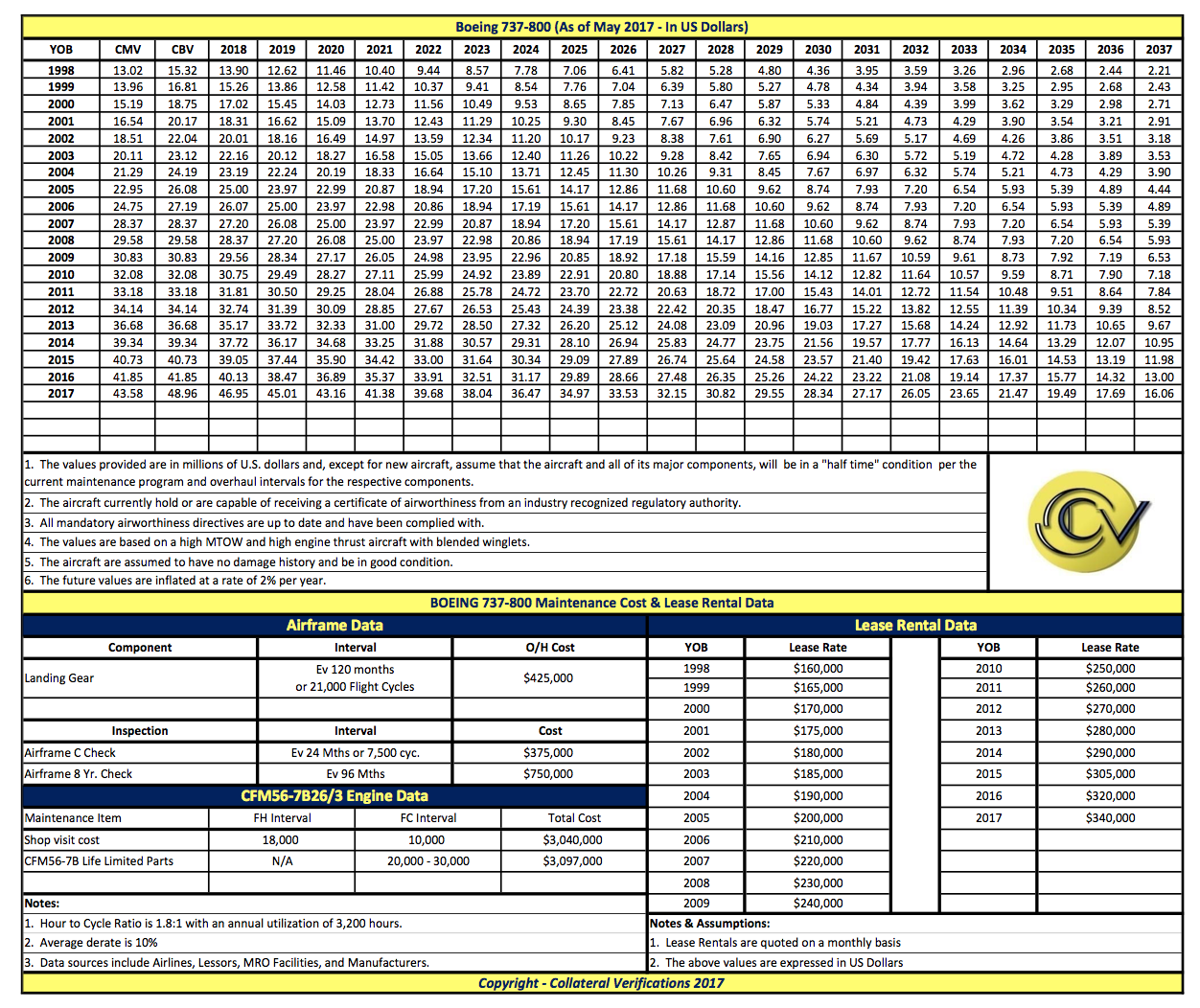

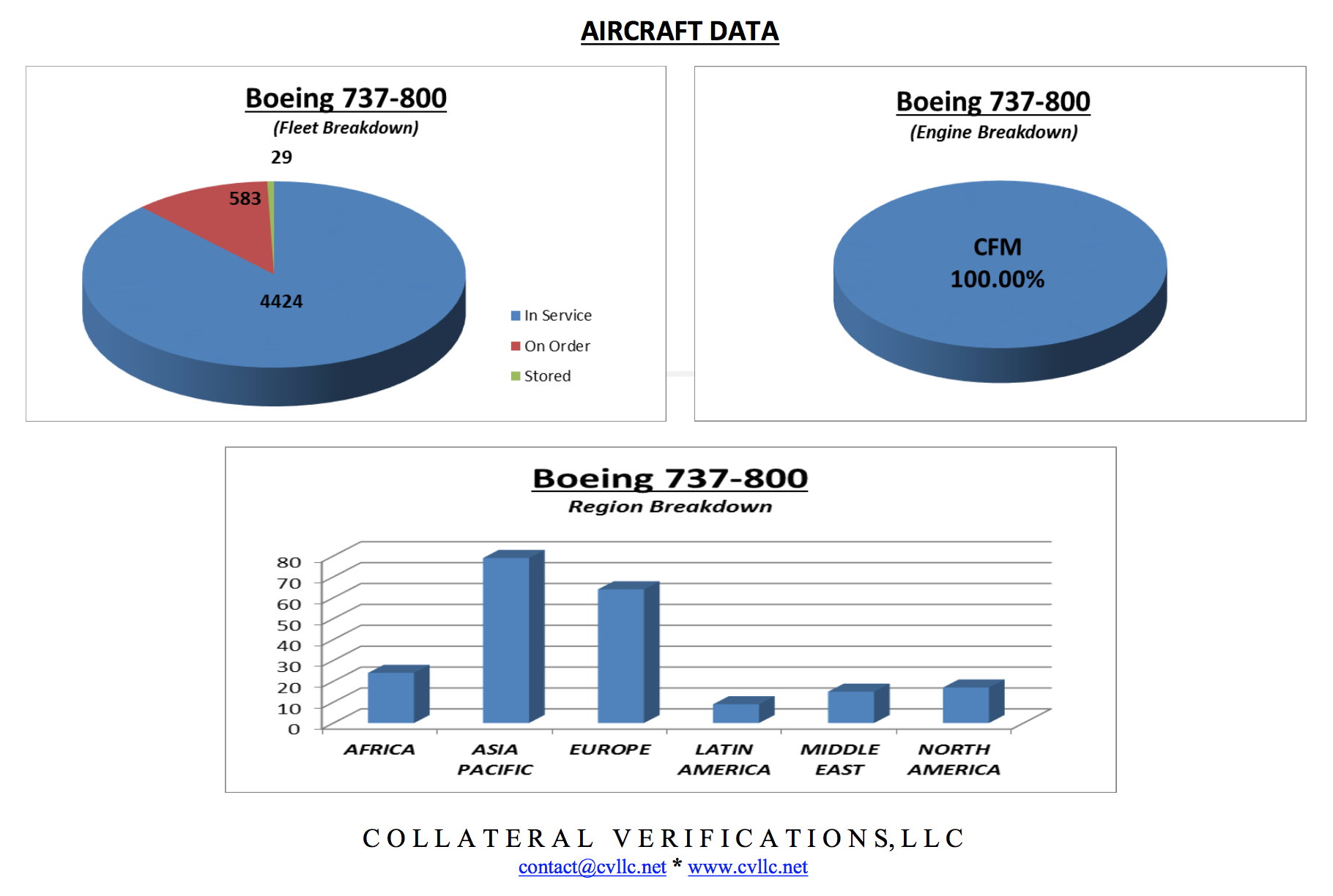

The 737-800 market availability continues to be limited due to the strong demand for the aircraft in recent years. The Boeing 737-800 has continued to fare well in the current environment as this aircraft is still viewed as one of the most desirable single-aisle aircraft for operators and investors alike. CV is currently aware of 25 737-800 available for sale and/or lease worldwide, and 39 aircraft that are currently in storage. These numbers are out of a total of 4,424 737-800 aircraft currently in service. It is CV’s opinion that this percentage is very low for a narrowbody aircraft that has been in production for almost 20 years.

The current trends for the aircraft have shown continued stability in its market value and lease rates, especially for new aircraft. Monthly lease rates of new aircraft can be seen around US$340,000 per month for operating leases of new aircraft. Older aircraft values have shown stability in the last 6 months as well due to the lower price of fuel which has made used aircraft more attractive to operators. These trends, not dissimilar to the last downturn, are expected to continue throughout 2017. The increase in the production rate of this aircraft by Boeing is a bit of a concern as it does provide more availability to the market and has started to soften the values and lease rates of some older aircraft types. The 2017 value trends should continue to remain stable as demand will remain strong in the near term. Overall, CV feels that the long-term viability of this aircraft remains very good. The diversified operator base, current order backlog, and ease of marketability should ensure that this aircraft remain desirable in the marketplace for many years to come.

The Competition

The 189 seat 737-800 has now replaced the 737-400 and competes directly with the A320, with the advantage of several extra seats. Both manufacturers claim advantages for their type over the opposition as one would expect - Airbus promotes the wider cabin, containerized cargo, flight deck commonality up to its widebody A380, and competitive choices of engines. Boeing highlights the reliability and easy to maintain features of the 737 family, allied to low operating costs and with better range and higher cruise capability of the 737-800 over the A320. In reality, both types are popular with the world’s leading airlines and look set to gain equal shares of the single-aisle sector in the coming years. With the introduction of the 737MAX which is due to start delivering later this year, we expect that there to be some further impact to residual values once the MAX reaches a mature production rate.

VALUE DEFINITIONS

Current Market Value (CMV):

The Current Market Value (CMV) of an aircraft is the appraiser’s opinion of the most likely trading price that may be generated for an aircraft under the market circumstances that are perceived to exist at the time in question, according to the International Society of Transport Aircraft Trading (ISTAT). The current market value assumes that the aircraft is valued for its highest and best use, that the parties to the hypothetical sales transaction are willing, able, prudent and knowledgeable, and under no unusual pressure for a prompt sale, and that the transaction would be negotiated in an open and unrestricted market on an arm’s length basis, for cash equivalent consideration, and given an adequate amount of time for effective market exposure to perspective buyers.

Base Value (BV):

Base value is the appraiser’s opinion of the underlying economic value of an aircraft in an open, unrestricted, stable market environment with a reasonable balance of supply and demand, and assumes full consideration of its “highest and best use”. An aircraft’s base value is founded in the historical trend of values and in the projection of future value trends and presumes an arm’s length, cash transaction between willing, able and knowledge parties acting prudently, with an absence of duress and with a reasonable period of time available for marketing.

Current Market Value (CMV):

To determine current market values of aircraft, CV uses, as our main source of data, any and all known reported market values. These values are extracted from numerous aviation industry sources and from CV’s proprietary and confidential transaction database.

As a secondary consideration, CV also analyses and gathers data on factors that influence the market value of an aircraft, such as its age, condition, configuration, fleet composition of such aircraft, similar aircraft available to the market, number of aircraft stored, operating economics, new aircraft prices, and the current state of the environment for the aviation industry.

This information is then entered into CV’s own proprietary transaction database and analyzed to determine a current market value based on a single sale transaction and using the assumptions as outlined in each aircraft valuation report at the time specified on the report.

Base Value (BV):

To determine its Base and Future values, CV first analyses any and all transaction information within its own proprietary database. This analysis allows CV to then establish the new price of an aircraft at a specific point in time. Historical data is then analyzed to determine the average depreciation rates of aircraft based on various conditions. This analysis is also broken down by aircraft type, mission, and in or out of production status. The result of these analyses is a depreciation factor which can then be applied to the various aircraft valuation models which CV utilizes for its valuation services and publications. Based on each valuation model, CV then creates base value curves for each aircraft which provide the base and future values for the aircraft which are reflected in the Turbine Aircraft Guide.

Lease Rentals:

The Lease Rentals provided in each valuation report represent CV’s opinion of aircraft lease rates in today’s operating lease environment. These lease rates are derived from CV’s own proprietary transactions database which contains a wide range of lease transactions received from numerous sources within the industry. This data is then compiled to produce the lease rentals provided in each aircraft valuation report.

Maintenance Cost Data:

The maintenance cost data provided in the Turbine Aircraft Guide is information that has been collected from various industry sources such as maintenance publications, conferences, MRO facilities, manufacturers, and financial institutions. The data represents the current estimated maintenance costs for such aircraft based on the assumptions and conditions provided.

Statement of Independence:

The aircraft valuation reports provided in the Turbine Aircraft Guide represent the opinion of Collateral Verifications and are intended to be advisory in nature. Therefore, CV assumes no responsibility or legal liability for actions taken or not taken by the purchaser of the Turbine Aircraft Guide or any other party with regard to the data provided in each report. By accepting these reports, the purchaser agrees that CV shall bear no responsibility or legal liability regarding these reports. CV also states that these valuation reports have been independently prepared and fairly represents the aircraft and CV’s opinion of its values.