São Paulo, January 28, 2020 – Azul S.A., “Azul”, (B3: AZUL4, NYSE: AZUL), the largest airline in Brazil by number of cities served and flight departures, announces today it expects to sublease 53 of its Embraer E195 aircraft (“E195”), to LOT, Poland’s flag carrier, and Breeze Aviation Group, a U.S based start-up airline. The announcement follows Azul’s strategy to accelerate the replacement of its entire domestic fleet of E195 jets with larger, next-generation E2 aircraft that are more fuel efficient due to new engine technology.

“For the past 11 years, the E195 has been the foundation of Azul’s business model and will continue to deliver a great experience to LOT and Breeze customers. Now that we have built the broadest network in Brazil we are ready to add larger, more fuel-efficient E2 aircraft to our fleet. Fuel in Brazil is about 35% more expensive than other parts of the world so it particularly beneficial to Azul to move to next-generation aircraft as quickly as possible,” says John Rodgerson, CEO of Azul.

“The ability of the E195 to perform well with low-utilization and shorter-haul flying makes it a perfect complement to the Airbus A220-300, which will perform well in higher-utilization and longer-haul flights. We believe there is significant charter potential and peak season demand in the United States for an airplane of this seat count and cost structure. With no middle seats, the E195 has ranked high in guest comfort and satisfaction and we look forward to the introduction of the airplane into our fleet,” said Lukas Johnson, Chief Commercial Officer of Breeze Aviation Group.

“The E195 jets are the core of our short-haul fleet. Beloved by our passengers, they have already proved their reliability and cost efficiency over the past few years and this is what we aim for while developing the flight network from our bases in Warsaw and Budapest. Thanks to that, in 2021 LOT will be the biggest Embraer operator in Europe and among the biggest in the world”, says Rafał Milczarski, CEO of LOT Polish Airlines.

Azul and LOT have signed a letter of intent for the sublease of 18 firm aircraft and up to 14 options subject to LOT corporate approvals. LOT had previously acquired seven E195s from Azul. Breeze, which was founded by our controlling shareholder, is expected to sublease up to 28 aircraft, subject to Azul shareholders’ approval, as determined by the Company’s bylaws. All E195s are expected to be phased out by the end of 2022 and will be subleased at least until the end of the original operating lease term.

Aircraft replacement creates value for Azul shareholders

Azul conducted a comprehensive financial analysis of the benefits of replacing E195s with more fuel-efficient next-generation aircraft. The Embraer E2 has a trip cost that is 14% lower and a unit cost that is 26% lower compared to the E195, and it has 18 additional seats. This significant cost reduction is mostly driven by the E2s fuel efficiency, lower ownership cost, as well as reduced maintenance costs as detailed below. As a result of the lower cost per seat of the E2, the Company expects to fly these aircraft with a utilization rate of more than 13 hours per day, further increasing the profitability of this aircraft type.

Considering that the remaining contractual lease term of Azul’s current fleet of E195s is 4.7 years, the Company believes that the acceleration of its fleet transformation will generate an incremental operating cash flow of approximately R$2.9 billion between 2020 and 2027. Specifically, the Company expects that the better economics of the E2s combined with the sublease revenue will more than offset the incremental cost of accelerating the replacement of all E195s by 2022.

In addition, the replacement of Azul’s entire E195 fleet is expected to generate R$4.8 billion of incremental EBITDA between 2020 and 2027 or approximately R$16 million per E195 replaced on an annualized basis.

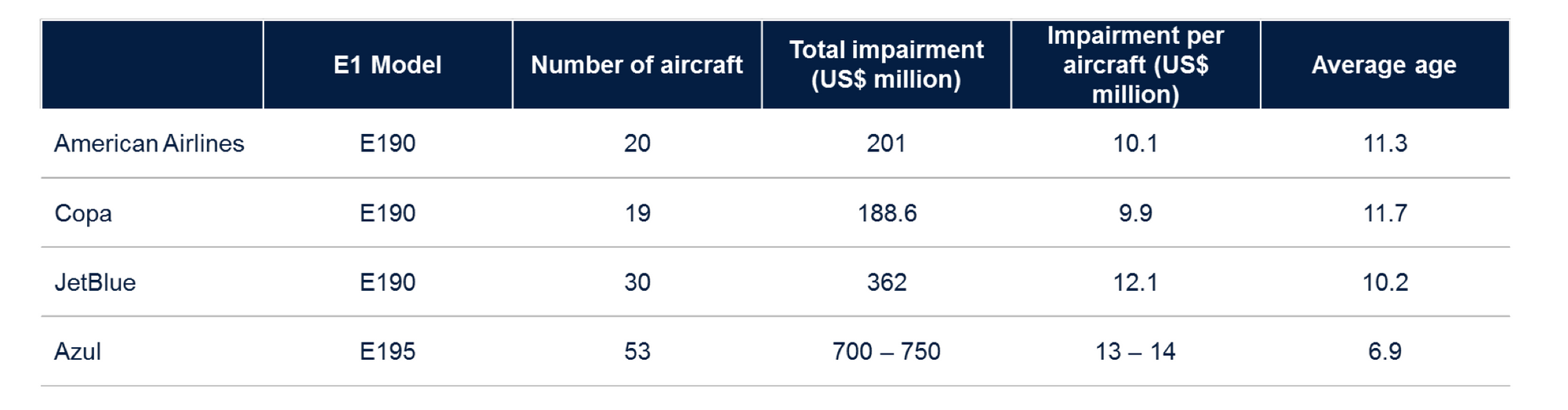

Due to the difference between the accounting book value of the E195 leases and the estimated recoverable amount, the Company expects to recognize a non-cash write-off charge of up to US$750 million to be reflected in the Company’s fourth quarter financial results as detailed below.

Related party transaction contract with Breeze

The sublease of up to 28 E195s to Breeze was approved by our corporate governance committee and board of directors, and has been submitted for approval to Azul shareholders. This approval is necessary for Azul to receive the significant economic benefits described above.

The transaction with Breeze was conducted at arm’s length and its commercial terms provide substantially comparable economic benefits when compared to the LOT sublease contract. Azorra Aviation LLC, an independent aircraft lessor and advisor that specializes in the Embraer market and whose principals have more than 30 years of experience in the aviation sector, verified the Company’s analysis of the equivalence between the LOT and Breeze transactions. Ernest & Young, an independent audit firm, performed Agreed Upon Procedures to verify specific inputs used on the Company’s analysis.

Azul’s general shareholders’ meeting is scheduled to take place on March 2nd. To access the meeting materials visit www.voeazul.com.br/ir.