São Paulo, October 1, 2023 – Azul S.A., “Azul”, (B3: AZUL4, NYSE: AZUL) announces that it has completed the contemplated:

(i) restructuring of its obligations with substantially all lessors and OEMs, which the permanent elimination of lease payment obligations that had previously been deferred during the COVID-19 pandemic;

(ii) a permanent reduction in lease payments from original contractual lease rates to agreed-upon current market rates;

(iii) the deferral of certain payments to lessors and OEMs, as well as certain obligations under supplier agreements; and

(iv) other concessions including improved end-of-lease compensation obligations and aircraft return conditions, the elimination of future maintenance reserves payments, and the negotiated early termination of certain aircraft leases.

As part of these agreements, Azul Investments LLP, a subsidiary of Azul, has issued US$370,490,204 principal amount of 7.500% Senior Unsecured Notes due 2030, in satisfaction on a dollar-for-dollar basis of certain payment and other obligations owed to certain lessors and OEMs.

In connection with these agreements, lessors and OEMs also agreed to receive an aggregate of up to US$570 million in Azul’s preferred shares valued at R$36.00 per share. Issuance of all preferred shares pursuant to the relevant agreements shall be made in quarterly installments, commencing in the third quarter of 2024 and scheduled to be completed by the fourth quarter of 2027. Throughout this period, if at the time of measurement the trading price of Azul’s preferred shares is lower than R$36.00, Azul may compensate for the difference by issuing additional preferred shares, or through a cash settlement, or through the issuance of new debt instruments. If the trading price of Azul’s preferred shares is higher than certain thresholds, the number of shares will be capped at these thresholds, and dilution will therefore be lower. Azul will keep investors and the general market updated on the progress of the issuance of the preferred shares.

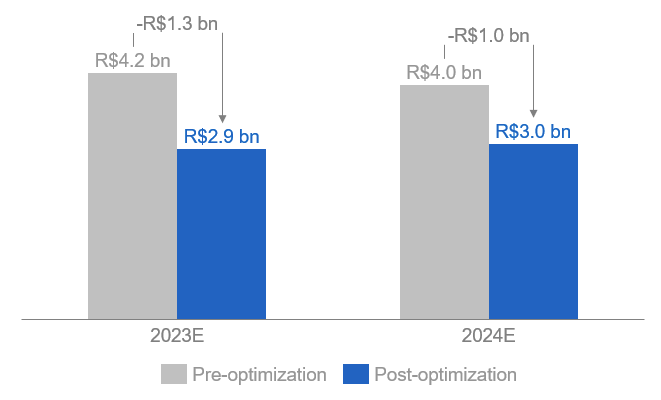

The restructuring described herein significantly decreases Azul’s lease liabilities by reducing its lease payments going forward by over R$1.0 billion per year, as illustrated in the schedule below:

Lease Payments Including Future Deliveries

(R$ billion at R$5.00 per dollar)

“We are happy to communicate the effectiveness of the commercial agreements announced in March. Through these agreements, we have significantly improved our capital structure and cash flows by reducing our lease liabilities and payments, while at the same time honoring our commitment to fully compensate our partners. We also have no significant maturities until the end of 2028 and can now rely on a strong balance sheet and liquidity position, consistent with our superior network, product offering, and cost structure,” said Alex Malfitani, Azul’s CFO.

This communication is for information purposes only, in accordance with current legislation and shall not be interpreted or considered, for all legal purposes and effects, as an offering and/or promotional material for the Notes.