IBA, the new winner of the Airline Economics’ ‘Appraiser of the Year ‘award, presented its latest market update on Jan 17th. While comprehensive details are available at www.iba.aero, the key themes are summarised below by Dr Stuart Hatcher, Chief Intelligence Officer, Mike Yeomans, Head Analyst – Commercial Aircraft & Leasing, and Paul Lyons, Head of Advisory.

The team also takes a closer look at the 1,300 returns and extensions planned for 2018 and considers whether this year will be another year of extensions.

Traffic growth forecasts across passenger and freight markets remain strong for 2018, despite downgrades from 2017 levels. While emerging markets drive demand, IBA remains cautious about the “burgeoning middle class play” in India and other lower-income countries.

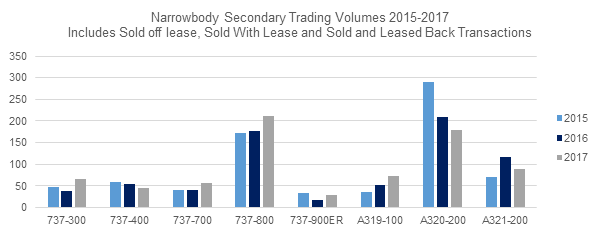

Search for yield will be found elsewhere as the narrowbody market tightens. Whether that is a shift to older aircraft and lower tier operators/higher risk destinations, or further capital in the engine and freighter sectors. IBA’s analysis of 2017 transaction volumes suggests a tightening of supply of the most highly favoured assets. A decline in on-lease trading levels of more popular A320 and A321 models is contrasted by an increase in trades of leased A319s and 737-700s.

IBA expects to see more consolidation in the lessor space, with European airlines, and in the MRO/ aftermarket sector, with fragmentation and

economies of scale the key drivers.

Costs challenges will loom large for some operators. Competition is heating up, there are a great many aircraft to deliver and pressure on routes/fares,

combined with rising DOCs, will expose those that have been operating on fumes for the past year. The mooted privatisation of some national carriers might shift their risk profile.

China will be a mixed bag for 2018. It will continue to see the similar high recent growth in aircraft leasing and finance, both from an internal and

outbound point of view, especially from Chinese lessors. The demand for aviation will still be strong domestically but there is a cautious mood prevailing for outbound deals as government policies will tend to dampen the supercharged growth, especially with some previously active groups.

The mooted GECAS sale will readdress lessor league table and possibly see the emergence of another serious investor in the space. If not won by

an already-established large lessor, IBA expects to see a strong Far-Eastern push should the sale go ahead. Liquidity concerns in China, if borne out, could drive secondary market activity, making life harder for others divesting assets.

Oil price will contribute to the reestablishment of lease premiums for new generation aircraft.

Further activity in the capital markets is expected, especially looking at the mid-life/poorer credit space as higher returns are sought.

OEMs face a thought provoking year. Despite competing with its own product range, we expect the CSeries to do well if Airbus can address the pricing and tariff issues. While great news for Airbus, the Emirates A380 order will do little to assuage concerns around its secondary market, or residual risk. The situation on the Boeing MoM/797 has been quiet of late – IBA wonder if this will continue in 2018?

Embraer faces challenges selling its E2 model into the US with scope clause restrictions and sales have switched back to the E1 as the backlog contracted year-on-year. IBA expects a further decline in Embraer deliveries in 2018. ATR production has already reduced as the OEM delivers aircraft into an oversupplied market. Will 2018 see a rebound in demand on the back of higher oil prices?

Entry-into-service issues for the MAX and neo will subside once engine OEMs manage to get on top of spare engine supply. IBA still expects a delay in the roll-out of upgrades, SBs and ADs to plague CFM, Pratt and Rolls Royce (for the 787), but the operational reliability will be tackled to reduce the number of cancellations.

IBA’s pipeline would suggest there is still plenty of appetite for leasing, both through new platforms and entrants, and through capital markets. Given the challenges of some tier 1 airlines last year, IBA expects the risk appetite from Japan and Korea to diversify.

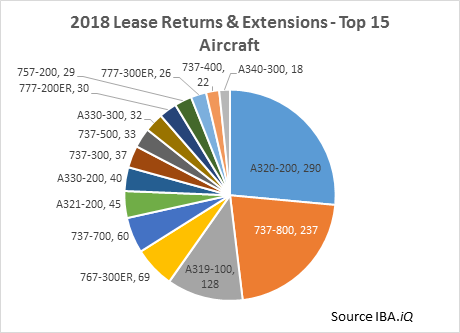

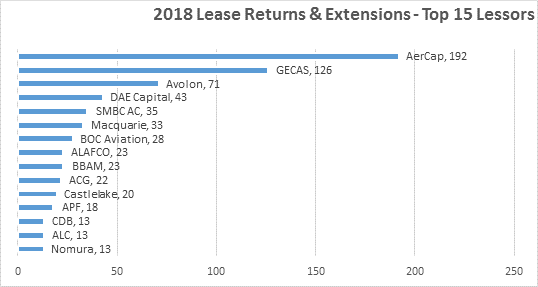

2018 looks to be a busy year for the lessors. IBA.iQ, the new fleets and values data platform from IBA, has identified a total of 1,300 lease returns and extensions for the market to address. Overleaf it analyses that activity by aircraft type, lessor and lessee.

Naturally the A320-200 and 737-800 take the crown, accounting for almost half of all transitions, whilst the 767-300ER and A330-200 lead the pack for the widebodies.

The market will remain particularly interested in the 777-300ERs, and the few A380s that are expected to transition that did not quite make the chart. Younger A320s, 737-800s and A321s should stay where they are.

If fuel remains static then a handful of the widebodies may well stay where they are too.

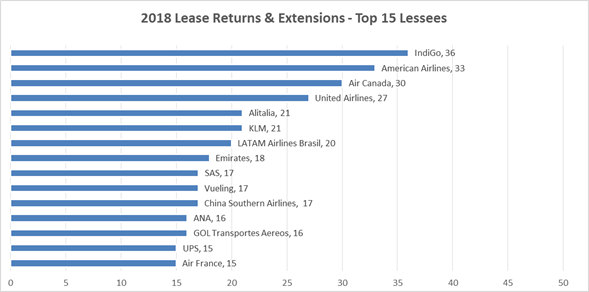

From the lessee perspective, IndiGo, AA, Air Canada, United and Alitalia are highlighted as the top five. There are many here that we expect to see selling to the operator or remain for another period, but a good number will return.

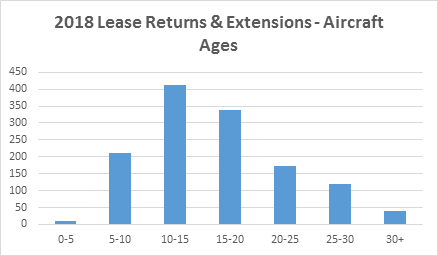

The bulk of the returns or extensions will come from mid-life aircraft – the 10-20 year olds, whilst only around 200 aircraft below 10 years old will be available. IBA suggests some of the oldest will head for retirement, whilst a number of the mid-life narrowbodies may find their way into a conversion program.

Overall IBA expects to see the majority of leases reaching term in 2018 to be ‘extended’ rather than returned, with pricing and values remaining robust – assuming no significant change to oil pricing, interest rates and other market forces. We would advise Lessors to plan and resource ahead to meet the transitions head on, and off course, there is the opportunity to review and possibly re-negotiated lease terms.

Footnote: IBA won the coveted ‘Appraiser of the Year’ award at last night’s gala ceremony hosted by Airline Economics in Dublin. The firm was voted for by industry peers in the aviation banking, leasing and brokerage sectors in recognition of IBA’s independent valuation expertise and significant depth of experience. IBA provides appraisals and advisory services to 49 of the top 50 lessors and has recently launched a new fleets and values data platform - IBA.iQ