Ends year with US$5 billion of liquidity

Dublin, 22 February, 2018 | Avolon, the international aircraft leasing company, announces results for the 2017 full year. The year was headlined by the acquisition and integration of CIT’s aircraft leasing business. Avolon’s owned, managed and committed fleet grew 109% in 2017 to 908 aircraft by year-end and full year profit after tax increased 59% to US$550 million.

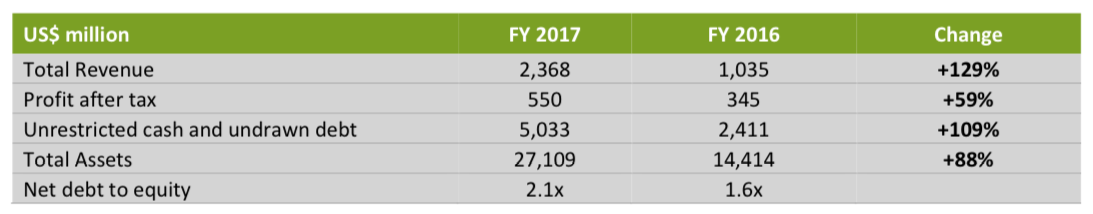

2017 Financial Highlights

- Total revenue for the year was US$2.4 billion, an increase of 129% year on year;

- Annualized lease rate of 11.5%, an increase from 10.3% in 2016;

- Delivered US$550 million in profit after tax for the full year, an increase of 59% year-on-year;

- At year end, Avolon had US$15.7 billion future contracted rental cashflows; and

- Avolon ended 2017 with US$5 billion of available liquidity in unrestricted cash, undrawn revolving credit facilities and undrawn secured debt.

2017 Operating Highlights

- 107 aircraft deliveries, transitions and sales, including the delivery of 45 new aircraft;

- Sold 44 aircraft, including 29 owned aircraft and 15 managed aircraft, across the combined platform in 2017; Owned, managed and committed fleet increased by 109% year-on-year to 908 aircraft at the end of 2017;

- Average age of owned fleet of 5.3 years, and average remaining lease term of delivered fleet of 6.6 years; and Fleet utilisation for the year was 99.4%.

2017 Full Year Strategic Highlights

- Completed the US$10.4 billion acquisition and integration of CIT’s aircraft leasing business creating the 3rd largest aircraft lessor;

- Raised US$14.9 billion total debt and equity capital in 2017, including US$9.75 billion of debt raised in the public capital markets:

- US$2.4 billion of incremental equity raised, US$5.5 billion TLB issuance and US$4.25 billion unsecured bond issuances;

- Repriced US$5.0 billion TLB-2 from LIBOR plus 2.75% with a LIBOR floor of 0.75% to LIBOR plus 2.25% with a LIBOR floor of 0.75%;

- Repriced and partially repaid TLB-1 from LIBOR plus 2.25% with a LIBOR floor of 0% to LIBOR plus 1.75% with a LIBOR floor of 0%; and

- Raised US$2.8 billion of new commercial debt, export credit debt, and private placement debt from 28 lenders during the year, including the upsizing of warehouse facilities and other revolving credit facilities by a combined total of US$1.1 billion.

- Received corporate credit ratings from four rating agencies which, at 31 December 2017, were: Fitch Ratings (BB), KBRA (BBB+), Moody’s Investor Service (Ba2, upgraded from Ba3) and S&P Global Ratings (BB+), all with stable outlook;

- Announced a series of corporate transactions including:

- Firm order for 75 Boeing 737 MAX aircraft including 55 MAX 8s and 20 MAX 10s with options for a

further 20 MAX 8 aircraft; and - Acquired all non-controlling interests in the consolidated Avolon group.

- Firm order for 75 Boeing 737 MAX aircraft including 55 MAX 8s and 20 MAX 10s with options for a

Dómhnal Slattery, Avolon CEO, commented: “Avolon delivered a strong performance in 2017 in what was a transformative year for our business. We more than doubled revenue to US$2.4 billion and reported record net profit of US$550 million.

As we look forward to 2018, we are confident in our business and our growth objectives. We are a stronger and more strategically relevant business than at any time in our history. We have the team, the balance sheet and the aircraft order book to deliver for our customers and all our stakeholders in 2018 and beyond.”