Dublin | 4 October 2018: Avolon, the international aircraft leasing company, issues an update for the third quarter of 2018 (‘Q3’).

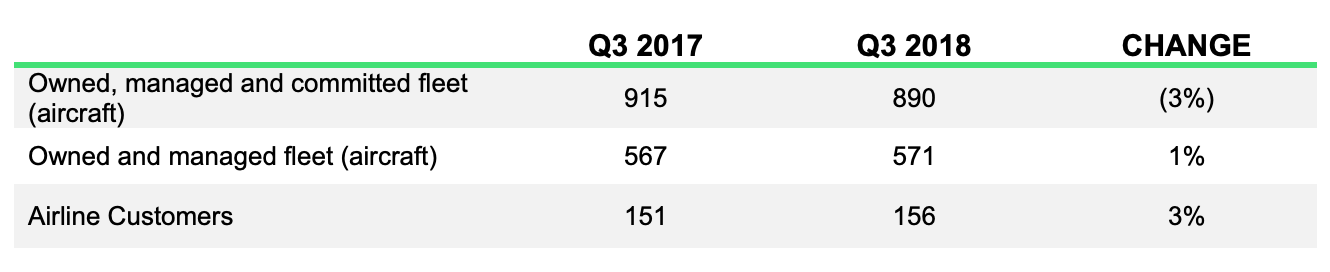

AVOLON FLEET METRICS | END Q3 2018

Q3 FLEET METRICS & BUSINESS HIGHLIGHTS

-

Owned and managed fleet of 571 aircraft at end Q3, with total orders and commitments for 319 new technology aircraft;

-

Executed a total of 39 lease transactions, comprising new aircraft leases, second leases and lease extensions;

-

Delivered a total of 14 aircraft to 8 customers, including 2 transitions;

-

Sold 16 aircraft, including the sale of 4 aircraft to Jade Aviation, Avolon’s joint venture with Cinda;

-

Fleet utilization for the quarter was 100%;

-

Average owned fleet age of 5.1 years with average lease term remaining of 6.8 years at end of Q3; and

-

Total customer base of 156 airlines in 64 countries at the end of the quarter.

Q3 STRATEGIC & FINANCIAL HIGHLIGHTS

ORIX Corporation (“ORIX”), through its wholly owned subsidiary ORIX Aviation Systems (“ORIX Aviation”), entered into an agreement to acquire a 30% stake in Avolon from Bohai Capital for US$2.2 billion, based on 31 March 2018 NAV, implying an Avolon enterprise value of US$23.7 billion. This acquisition, scheduled to complete in Q4 2018, will:

· Diversify and strengthen the financial profile of Avolon's shareholder base;

· Accelerate Avolon’s path to Investment Grade, with Fitch and Moody’s having placed Avolon on positive outlook and under review for upgrade respectively; and

· Implement a governance structure with enhanced protections for the minority shareholder and indirectly for debt investors.

Paid a previously announced dividend of US$240 million in Q3 2018, to facilitate the repayment of all outstanding intercompany loans between Avolon and its parent Bohai, as part of the pre-closing sequence for ORIX’s acquisition of a 30% minority interest in Avolon;

Raised incremental new debt capital of US$2.1 billion during the quarter, including:

· The upsizing of Avolon’s unsecured revolving credit facility by US$350 million to US$1.8 billion; and

· The successful closing of a private offering of US$1 billion senior unsecured notes, which was upsized from US$750 million due to significant investor demand.

Repaid US$365 million TLB-1, which had a maturity of April 2020, as part of a publicly stated objective to increase the level of unencumbered assets within the Avolon portfolio.