Avolon, the international aircraft leasing company, issues an update for the first quarter of 2019 (‘Q1’).

AVOLON FLEET METRICS | Q1 2019

Q1 FLEET METRICS & BUSINESS HIGHLIGHTS

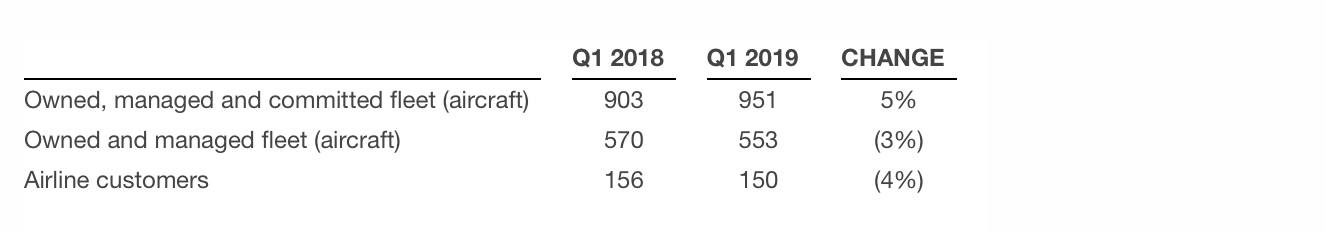

Owned and managed fleet of 553 aircraft at end Q1, with total orders and commitments for 398 new technology aircraft;

Executed a total of 8 lease transactions in the quarter comprising new aircraft leases, follow-on leases and lease extensions;

Delivered a total of 12 new aircraft to 9 customers and transitioned 4 aircraft to follow-on lessees;

Sold 20 aircraft during the quarter including the sale of 10 regional aircraft; and

Total of 150 airline customers operating in 61 countries.

Q1 STRATEGIC & FINANCIAL HIGHLIGHTS

Closing of a private offering by Avolon of US$1.1 billion, aggregate principal amount, of senior unsecured notes, upsized from an initial target size of US$750 million due to significant investor demand;

Closing of Avolon’s inaugural US$500 million three-year unsecured term loan facility which was upsized by over 60% based on the original launch size of US$300 million;

Upsized our unsecured revolving credit facility by US$125 million bringing the total facility size to over US$2.3 billion;

Continued progress towards our strategic objective of achieving an investment grade credit rating with receipt of positive updates from 3 rating agencies:

S&P upgrade of its rating on Avolon’s senior unsecured notes to BB+;

Fitch upgrade of Avolon’s corporate credit rating to BB+ with a Positive Outlook; and

Moody’s update of its outlook on Avolon’s corporate credit rating to Ba1 with a Positive Outlook.

Issued our 2019 Industry Forecast Paper providing a review of 2018 and offering some predictions for the industry in 2019.