Dublin | 9 April, 2018: Avolon, the international aircraft leasing company, issues an update for the first quarter of 2018 (‘Q1’).

Q1 Fleet Metrics & Business Highlights

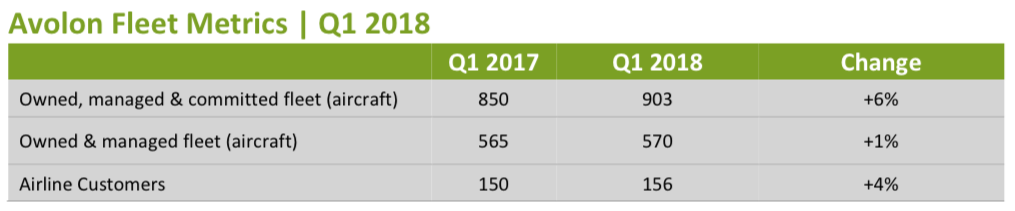

- Owned and managed fleet of 570 aircraft at end Q1, with total orders and commitments for 333 new technology aircraft;

- Delivered a total of 6 new aircraft, transitioned 13 aircraft to secondary leases and sold 5 aircraft during the quarter;

- Completed a total of 21 lease transactions in the quarter comprising new aircraft leases, second leases and lease extensions;

- Average owned fleet age of 5.3 years with an average remaining lease term of 6.6 years at end of Q1 (not including the impact of 41 mid-life aircraft contracted to be sold to Sapphire Aviation Finance);

- Total customer base of 156 airlines in 64 countries;

- All 9 aircraft repossessed from Air Berlin successfully redeployed and revenue generating; and

- Continued strong progress on placement of new order pipeline; 82% placed through to the end of 2019.

Q1 Strategic & Financial Highlights

- Launched the Sapphire Aviation Finance platform with the issuance of US$768 million of senior secured notes and a majority equity investment from a third party investor;

- Contracted to sell 41 mid-life aircraft to Sapphire Aviation Finance including 6 B737-700, 14 B737-800, 4 A319-100, 8 A320-200, 1 A321-100, 5 A330-200, 1 A330-300, and 2 B767-300;

- Enhanced noteholder protections for all existing senior unsecured note issuances through the following amendments to existing indentures:

- Addition of incremental guarantees from Avolon Aerospace Leasing Limited and Hong Kong Aviation Capital; and,

- Implementation of a mandatory redemption covenant relating to Shareholder Payments and Affiliate Investments.

- Successfully closed a private offering of US$500 million senior unsecured notes;

- Corporate credit ratings affirmed from four rating agencies which, at 31 March 2018, were Fitch Ratings (BB), KBRA (BBB+), Moody’s Investor Service (Ba2) and S&P Global Ratings (BB+), all with stable outlook;

- Raised incremental new debt of US$640 million, including a US$150m upsize of Avolon’s revolving Warehouse Facility; and,

- Declared and paid a dividend of US$250 million in Q1 2018 as previously disclosed in our 2017 Full Year results.