Dublin | 25 July, 2019: Avolon, the international aircraft leasing company, announces results for the second quarter of 2019 (‘Q2’).

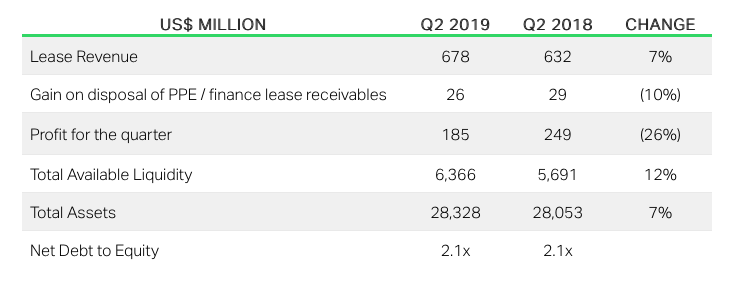

Lease revenue for the quarter was US$678 million;

Generated US$423 million of net cash from operating activities in the quarter;

Delivered US$185 million in profit for the quarter;

Finance expense impacted by US$83 million movement in non-cash gains and charges related to debt facility amendment and refinancing activity;

At 30 June 2019, Avolon had US$16.6 billion future contracted rental cashflows; and

At quarter end, Avolon had US$6.4 billion of available liquidity in unrestricted cash, undrawn revolving credit facilities and undrawn secured and unsecured debt.

2019 Second Quarter | Operating Highlights

Owned and managed fleet of 530 aircraft, with total orders and commitments for 393 new technology aircraft;

Executed a total of 24 lease transactions in the quarter comprising new aircraft leases, follow-on leases and lease extensions;

Delivered a total of 15 new aircraft to 10 customers and transitioned 11 aircraft to follow-on lessees;

Sold 38 aircraft during the quarter including the sale of 34 regional aircraft; and

Total of 149 airline customers operating in 60 countries.

2019 Second Quarter | Strategic Highlights

Closing of a private offering by Avolon of US$2.5 billion, aggregate principal amount, of senior unsecured notes, upsized from an initial target size of US$1.8 billion due to significant investor demand;

Corporate credit rating upgraded to investment grade by Fitch, Moody’s and S&P. Credit ratings at quarter end were:

Fitch BBB- (Stable Outlook)

Moody’s Baa3 (Stable Outlook)

S&P BBB- (Stable Outlook)

Upsized our unsecured revolving credit facility by US$488 million bringing the total facility size to over US$2.8 billion;

Repriced our senior secured Term Loan B facility to LIBOR plus 1.75% in conjunction with the repayment of US$800 million of the facility; and

Ordered 140 CFM LEAP-1A Engines, to power 70 A320neo family aircraft, valued at US$2 billion at list prices announced at 2019 Paris Air Show.

Dómhnal Slattery, Avolon CEO, commented: “The second quarter was headlined by our successful achievement of an Investment Grade rating profile - which was delivered well ahead of the expected timeframe and affirms our long-held view that we have an Investment Grade quality business.”

“We continued our strong financial and trading performance from the previous quarter, delivering total revenues of $682 million, a profit of $185 million and selling 38 aircraft. Our strong cashflow generating capabilities and consistent aircraft trading performance, coupled with our capital raising activities, resulted in Avolon ending the quarter with $6.4 billion of total available liquidity.”