Avolon, the international aircraft leasing company, announces results for the second quarter of 2020 (‘Q2’).

2020 SECOND QUARTER | FINANCIAL HIGHLIGHTS

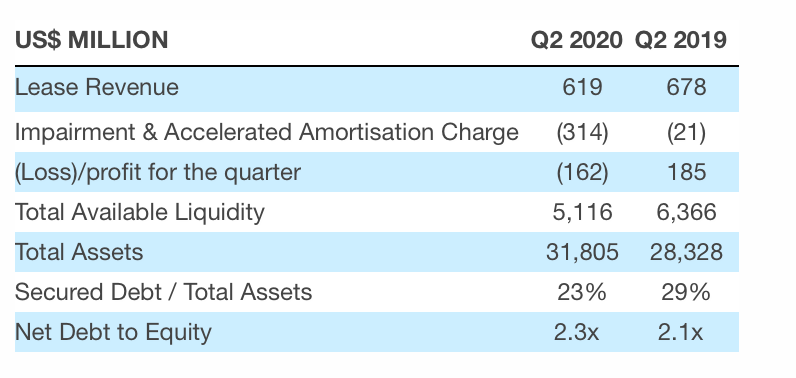

- Lease revenue for the three months to 30 June was US$619 million;

- Adjusted profit of US$152 million for the quarter, when adjusted for non-cash impairment charges and accelerated amortisation related to airline restructurings, with a net loss of US$162m for the quarter;

- Strong liquidity position at quarter end, with total liquidity in excess of US$5.1 billion;

- Avolon’s capital strength was further enhanced in Q2 with a 34% reduction in near-term capital commitments to the end of 2021, resulting in a year to date cumulative 52% reduction in capital commitments in the 2020-2023 timeframe;

- Buyback of US$639 million of Avolon senior unsecured notes maturing between 2021-2024, at a discount to par, realizing a net gain of $61m and further reducing near-term debt maturities;

- As at 30 June, many of our customers had entered into short-term rental deferral arrangements or were in arrears on their rental obligations. As a result, Avolon’s aggregate increase in trade receivables and deferred revenue asset implied a lease revenue collection rate during the first half of 2020 of 68%, with two thirds of the collection shortfall related to deferral arrangements;

- During Q2, 12 of Avolon’s customers were due to start repayments at the scheduled expiry of their deferral arrangements, 7 of these customers made payments in full and 5 customers have fallen into arrears or sought an extension to their short-term rental deferral arrangement for some or all of their rental obligations.

2020 SECOND QUARTER | OPERATIONAL HIGHLIGHTS

- Cancelled commitments to acquire 27 B737MAX aircraft in the 2020-2022 timeframe, in addition to the 75 B737MAX aircraft cancelled in Q1;

- Removed commitment to acquire 1 A330neo aircraft due to deliver in 2022 and deferred 3 A320neo family aircraft from 2020/21 to 2022;

- Delivered 3 new aircraft and transitioned 4 aircraft to follow-on lessees;

- Sold 10 aircraft during the quarter including 1 managed aircraft; 5 of these aircraft were sold to the Sapphire 2020-1 vehicle;

- Executed a total of 16 lease transactions in the quarter comprising new aircraft leases, follow-on leases and lease extensions;

- Owned and managed fleet of 547 aircraft at the end of Q2, with total orders and commitments for 277 new technology aircraft; and,

- Total of 145 airline customers in 62 countries.

Dómhnal Slattery, Avolon CEO, commented: “The second quarter was undoubtably a challenging period for the aviation sector, and our results clearly show the impact of this crisis. The lockdown of the global economy caused severe disruption to the demand for air travel and uncertainty remains around the pace and timing of a recovery.

Based on our experience, we have taken decisive action since the start of the year, we have removed US$7.9 billion of near-term capital commitments and bought back US$639 million of our unsecured bonds at a discount to par, all while maintaining over US$5 billion of total liquidity.

These actions enhanced our capital strength and provide a strong foundation to support our customers in this critical period and to manage our business through the recovery.

While at an early stage, we have seen traffic trends in certain markets that suggest that the structure and quality of our portfolio leaves us well positioned to take advantage of the recovery when it does take hold.”