August 28, 2019 – Avianca Holdings S.A. (the “Company” or “Avianca”) today announced that it has extended the “Early Participation Deadline” with respect to its pending offer to exchange (the “Exchange Offer”) any and all of its existing 8.375% Senior Notes due 2020 (the “Existing Notes”) for new 8.375% Senior Secured Notes due 2020 (the “Exchange Notes”).

Avianca said that the new “Early Participation Deadline” for the Exchange Offer will be 11:59 p.m., New York City time, on September 11, 2019 and, accordingly, all Existing Notes tendered at or prior to that time will be eligible to receive the Total Exchange Consideration, including the “Early Participation Payment” set forth in the table below.

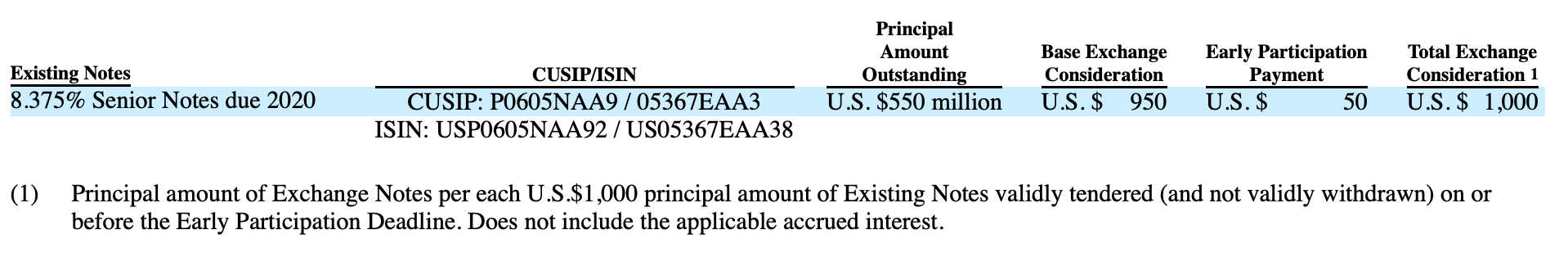

The following table sets forth the Exchange Consideration, Early Participation Payment and Total Exchange Consideration for Existing Notes validly tendered and accepted for exchange in the Exchange Offer and the related consent solicitation for the Existing Notes (the “Consent Solicitation”):

Principal amount of Exchange Notes per each U.S.$1,000 principal amount of Existing Notes validly tendered (and not validly withdrawn) on or before the Early Participation Deadline. Does not include the applicable accrued interest.

The exchange agent for the Exchange Offer has indicated that, as of 11:59 p.m., New York City Time, on August 27, 2019, tenders and consents from holders of a majority in principal amount of outstanding Existing Notes had been validly received and not withdrawn. Accordingly, Avianca and the trustee for the Existing Notes entered into a supplemental indenture to the indenture for the Existing Notes, as described in the Offering Memorandum for the Exchange Offer. The supplemental indenture contains proposed amendments eliminating substantially all covenants and eliminating or waiving certain events of defaults for the Existing Notes, including a waiver of cross-defaults resulting from the deferral of payments under the Company’s ongoing reprofiling program.

As a consequence of receiving majority participation, the minimum condition to the Exchange Offer has been satisfied. However, United Airlines, Inc. and Kingsland Holdings Limited have informed the Company that the participation received to date is not sufficient for them to fund their proposed new investment of up to $250 million in Avianca.

The withdrawal deadline has passed and holders may no longer withdraw Existing Notes tendered in the Exchange Offer. The Exchange Offer will expire at 11:59 p.m., New York City time, on September 11, 2019, unless extended. All other terms and conditions of the Exchange Offer and Consent Solicitation, as previously announced and described in the Offering Memorandum and Supplement (as defined below) and the related letter of transmittal and consent, remain unchanged.

This press release shall not constitute an offer to purchase any securities or a solicitation of an offer to sell, or the solicitation of tenders or consents with respect to, any securities. The Exchange Offer and Consent Solicitation are being made only pursuant to the Offering Memorandum dated August 14, 2019 (the “Offering Memorandum”), the Supplement dated August 23, 2019 (the “Supplement”) and related transmittal documents, and only to such persons and in such jurisdictions as is permitted under applicable law.

The Exchange Offer is being made, and the Secured Notes will be offered and issued, only (a) in the United States to holders of Existing Notes who are “qualified institutional buyers” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) in reliance upon the exemption from the registration requirements of the Securities Act and (b) outside the United States to holders of Existing Notes who are persons other than “U.S. persons” (as defined in Rule 902 under the Securities Act) in reliance upon Regulation S under the Securities Act (collectively, “Eligible Holders”).

Documents relating to the Exchange Offer will only be distributed to Eligible Holders who properly complete and return a letter of eligibility confirming that they are within the category of Eligible Holders for this Exchange Offer. Eligible Holders who desire a copy of the letter of eligibility should contact D.F. King & Co., Inc., the information agent for the Exchange Offer, at telephone: (866) 796-1291 (U.S. toll-free) or (212) 269-5550 (collect), email: avianca@dfking.com or access the letter of eligibility at www.dfking.com/avianca.